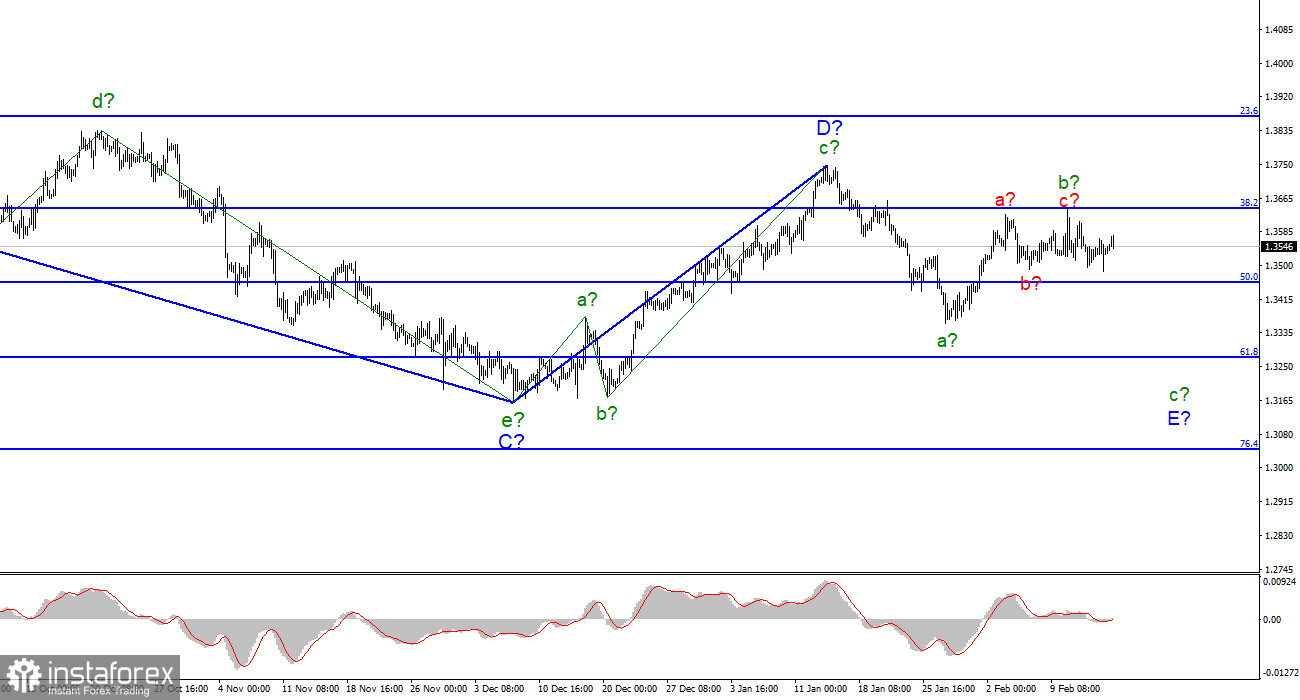

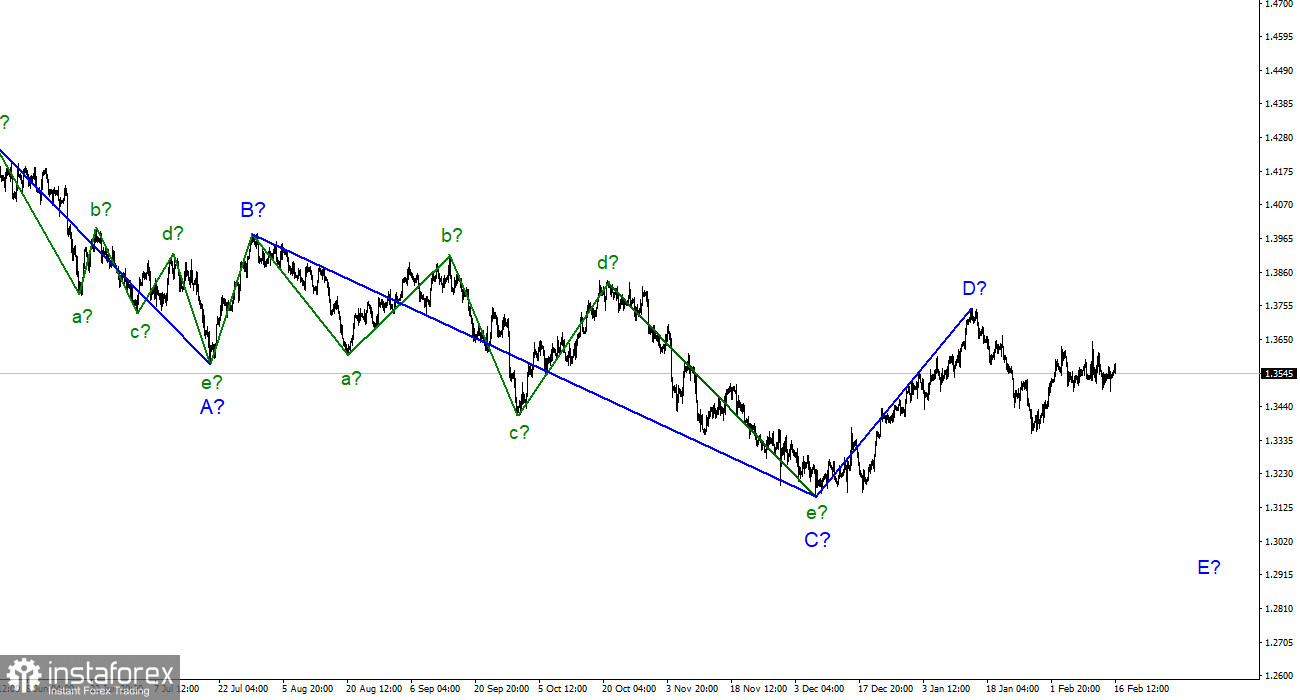

For the pound/dollar instrument, the wave markup continues to look very convincing, but in the near future, it may become somewhat more complicated. The increase in quotes last week complicates the expected wave b and it turns out to be longer than wave a. Since three internal waves are already being viewed inside wave b, this wave must be completed. However, it does not end, and the decline of the instrument does not begin. Based on this, I assume that wave b can take an even more extended form, a five-wave one, and more waves d and e will be built. However, there are no internal waves visible in wave a-E, so this complication of wave b looks strange. At the same time, a three-wave structure is visible inside wave D, so it cannot be the first impulse wave of a new upward trend segment. And the entire downward section of the trend, which originates on June 1, 2021, can be either three-wave or five-wave. Thus, the wave picture is ambiguous now, but I am still inclined to believe that another descending wave E will be built.

Important statistics did not interest the market.

The exchange rate of the pound/dollar instrument increased by 35 basis points during February 16 but decreased by the same amount in the afternoon. The amplitude of the instrument on Wednesday was very low, it can be assumed that the market is waiting for the FOMC evening protocol for the last meeting. However, during the day, both in Britain and in the USA there were quite important statistics that could not but be taken into account by the market. In the UK, an important inflation report for January was released, which showed that prices continue to rise and increased by 5.5% compared to January last year. This value turned out to be higher than traders' expectations. The retail price index rose by 7.8% (also higher than expected). The purchasing price index increased by 13.6%, the selling price index - by 9.9%, and the housing price index - by 10.8%. All indices reflecting inflation rose more than expected. Such statistics could support the demand for the British or at least cause an increase in market activity. But neither the first nor the second happened. In America, an important report on retail trade was also released today, which grew in volumes by 3.8% m/m with market expectations of +2.1%. As you can see, the excess of the forecast was about 2 times. However, this report did not cause a market reaction either. As I said, the total amplitude of the instrument today was less than 20 points. Thus, I conclude that at this time the market is not risk-averse and pays a lot of attention to geopolitical factors. There is no news on geopolitics right now, so market participants are just waiting for the situation to resolve. They want to get certainty on the issue of the conflict in Ukraine, but there is little news about this at the moment.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of wave E. The construction of the proposed wave b is completed or this wave is not b. The instrument made an unsuccessful attempt to break through the 1.3645 mark, and wave b acquired a three-wave appearance. But there was no continuation of the increase in quotes, so now I believe that a wave c-E will be built. Therefore, I advise now selling with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci, until a successful attempt to break through the 1.3644 mark.

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română