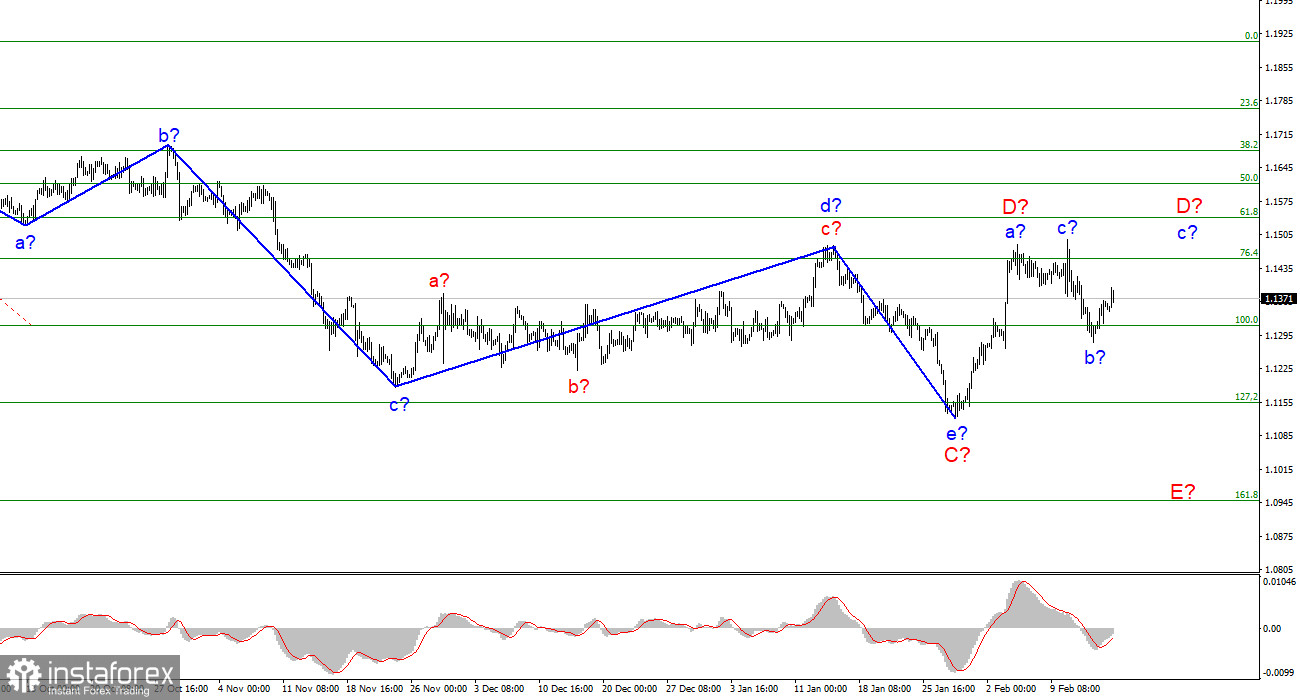

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Last week, there was a decline in quotes, which may be a wave E, or it may be a wave b-D. I believe that wave D is complete, as the news background openly supports the rise of the US currency. Moreover, there are no clear internal waves inside wave C. Thus, they may not be inside wave D either. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that wave D will take a more complex form, a three-wave one, but even in this case, it may already be completed. There is also a backup option with the completion of the construction of a downward trend section. In this case, on January 28, the construction of a new upward trend section began. But the same news background now does not give any reason to expect that an upward section of the trend will be built. A successful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci, will indicate that the market is ready for new sales of the European.

The market is confused and in no hurry to actively trade.

The euro/dollar instrument continued to trade with a small amplitude on Wednesday. On Monday, the amplitude was 45 basis points, on Tuesday - 27, on Wednesday - about the same. The US currency is declining, but this may be only a temporary phenomenon. I want to say that now there is a situation where geopolitical events are of great importance for the whole world, but so far they do not find a specific display on the charts of currency instruments. The news background of the economic plan is present, but the market does not always pay attention to it at all. Thus, the situation is a bit confusing. The wave marking seems to indicate a further decline in the instrument, but everything can change very quickly.

At this time, the whole world breathed a sigh of relief, because, on February 16, the Russian offensive on Ukraine did not begin, as Western media and journalists predicted. February 16 was a kind of day when everything should be decided. However, nothing happened at all that day. No invasion, no de-escalation. Russian troops are in the same place where they have been in recent weeks. There is no progress in negotiations between the West, Europe, Ukraine, and the Russian Federation. And even new meetings of world leaders have already stopped being announced to resolve the current crisis. It seems that no one had any plans for February 17. At the same time, NATO Secretary-General Jens Stoltenberg said that he did not observe any withdrawal of Russian troops from the Ukrainian border and the conflict could flare up with renewed vigor at any moment. He called on the Russian Federation to withdraw its troops and follow the path of diplomacy to resolve the current situation. According to Stoltenberg, the conflict has now gone into suspended animation, but it can come out of it at any second.

General conclusions.

Based on the analysis, I conclude that the construction of the descending wave C is completed. However, wave D can already be completed too. If so, now is a good time to sell the European currency with targets located around the 1.1153 mark, which corresponds to 127.2% Fibonacci, for each MACD signal "down". Another upward wave may be built inside wave D, but for now, this option is a backup. A successful breakout attempt of 1.1314 will indicate that the market is ready for new sales of the instrument.

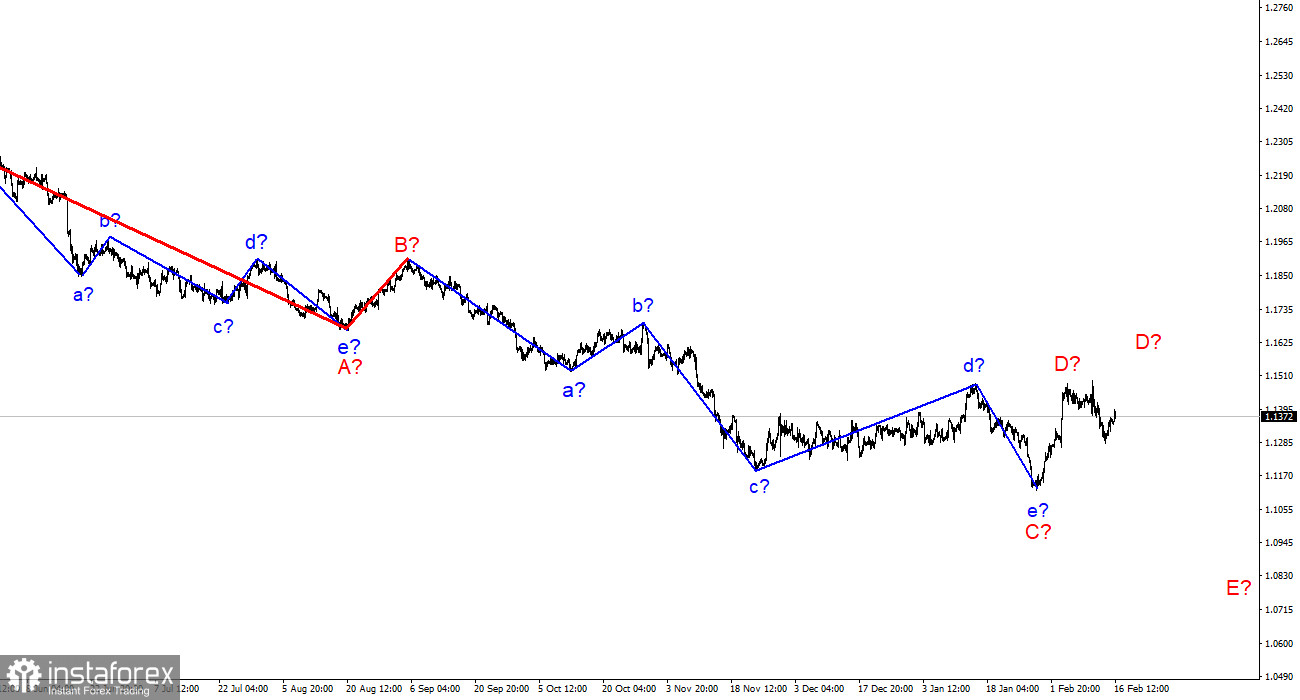

On a larger scale, it can be seen that the construction of the proposed wave D has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is reason to assume that wave D has already been completed. Then the construction of wave E began.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română