Geopolitics is the answer to the question of why, despite a strong US dollar and a surge in Treasury yields, gold climbed to 8-month highs and then crashed down like a stone. The growing risks of Russia's invasion of Ukraine have created increased volatility in the financial markets, which has a positive effect on safe-haven assets, which include the precious metal. As soon as good news began to arrive from Eastern Europe in the form of the return of part of the Russian troops to the bases, the "bulls" on XAUUSD began to hastily close long positions. As a result, the pair had its worst daily crash in two weeks.

Despite the fact that derivatives markets regularly raised their forecast for the federal funds rate amid the hawkish rhetoric of FOMC officials, which contributed to the growth of Treasury yields and the strengthening of the US dollar, gold managed to gain 4.2% from the levels of January lows. The main driver of its value increase was the understanding by investors that high inflation is likely to last longer than expected. We are talking about the return of the inflationary regime of the 1970s. And this is a completely different story.

In the early 1980s, Paul Volcker, then at the helm of the Fed, began aggressively tightening monetary policy, which eventually led to a recession. Markets do not exclude the possibility of repeating the scenario of 40 years ago. Moreover, rates on 2-year Treasury bonds are rising faster than on 10-year bonds, which increases the risks of yield curve inversion. This signals the approaching recession in the US economy.

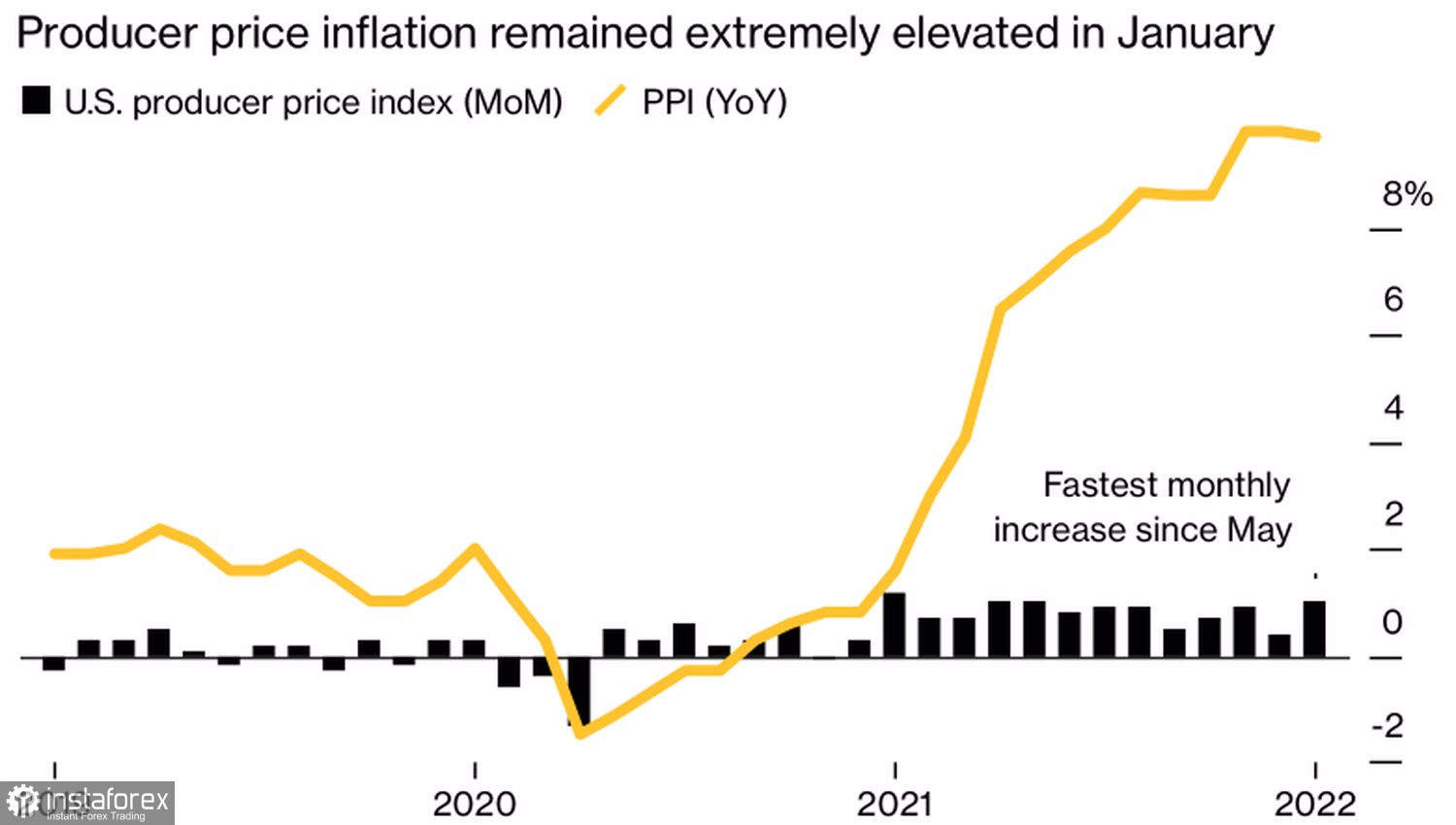

Consumer prices in the US have really skyrocketed to their highest level since 1982, and the acceleration of producer prices makes investors expect 6-7 acts of monetary restriction by the Fed in 2022. It seems that the risks of a recession are not in vain looming on the horizon.

US Producer Price Trends

Russia's invasion of Ukraine could exacerbate the problems of the global economy. JP Morgan predicted that due to supply restrictions from one of the three largest oil producers, Brent quotes will soar to $150 per barrel, and global inflation to 7%. And while central banks usually ignore energy prices when making decisions about making changes to monetary policy, this time could be different. Excessive tightening of monetary policy could have backfired into another recession and the rise of gold in the direction of $2,000 an ounce.

Fortunately for the global economy and unfortunately for the XAUUSD bulls, signs of a de-escalation of the conflict began to appear in Eastern Europe. Russia announced that part of the troops were returning to their bases, which was accepted with approval by the leaders of the Western countries. The end of the confrontation is fraught with a further fall of the precious metal.

Technically, the strategy of buying gold on the breakout of the resistance at $1,835 in the direction of $1,880 per ounce won back 100%. The formation of the Three Indians pattern on the daily chart indicates an increase in the risks of a rollback. Let's return to longs in case of rebound from the support at $1,845 and we will sell the precious metal in case prices consolidate below this level.

Gold, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română