It seems that the understanding in the investor community about the geopolitical tension around Ukraine and the possible sharp increase in the Fed's interest rates at the March meeting have taken their toll. Global stock indices received significant support, while in turn, the US dollar was under pressure. All of this was happening despite a new surge in US government bond yields.

The slight decrease in geopolitical tensions still had an impact on global financial markets. After the unsuccessful end of the previous week and the beginning of the current one, stock indices received significant support yesterday. On this wave, crude oil prices made a downward correction, and the US dollar came under significant pressure.

Considering that there will be no military action against Ukraine, the market's attention is shifting to the publication of important economic data from China. New inflation figures came out today, which turned out to be slightly better than the consensus forecast. Here, the consumer price index in January sharply declined from 1.5% to 0.9% in annual terms, and the production value corrected from the level of 10.3% to 9.1%. This is a good signal, and, interestingly, it fell from 3.8% to 3.7% amid the NBK's interest rate cut at the end of the last meeting. We can say that measures to stimulate local producers by reducing the cost of borrowing do not support the growth of inflation in the national economy.

The Chinese stock market reacted to this news with the growth of the local stock market, which was already trying to recover yesterday's optimism on world markets.

Ahead of the opening of European trading, there is a continued weakening of the US dollar and an increase in futures for European stock indices. American futures for the three main stock indexes are still in the negative zone, but it is likely to move into the positive zone when the US trading session opens.

Now, let's return to the important economic data coming out today. The publication of retail sales data can be singled out. It is expected that the core retail sales index in January will grow by 0.8% against a fall of 2.3% in December. In addition, strong growth in retail sales is expected from a negative value of minus 1.9% in December to an increase of 2.0% in January. There will also be data on the volume of industrial production, which should show an increase of 0.4% in January against a decrease of 0.1% a month earlier.

If the US data does not disappoint or even show slightly better values, we can expect a continuation of yesterday's growth in the local stock market, which will undoubtedly spread to other global trading floors, supporting the possibility of a continued, limited rally.

Forecast for the day:

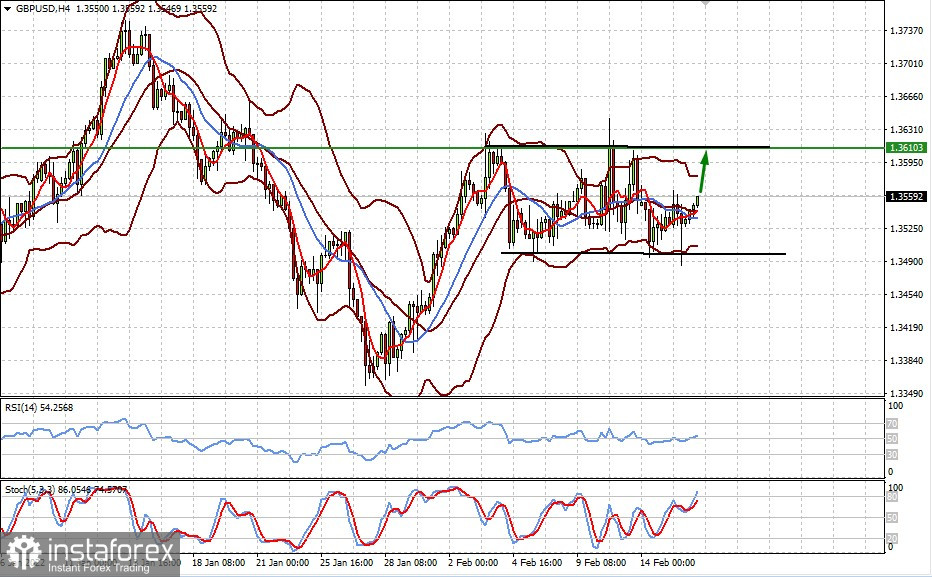

The GBP/USD pair is receiving support amid the local weakening of the US dollar and the publication of the UK's consumer inflation data, which may further stimulate an active increase in interest rates by the Bank of England.

The USD/CAD pair is trading in a range of 1.2635. The reduction of tension in the world, as well as the resumption of growth in crude oil prices and the publication of Canada's inflation data, may put pressure on the pair, which may decline to the level of 1.2635.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română