S&P500

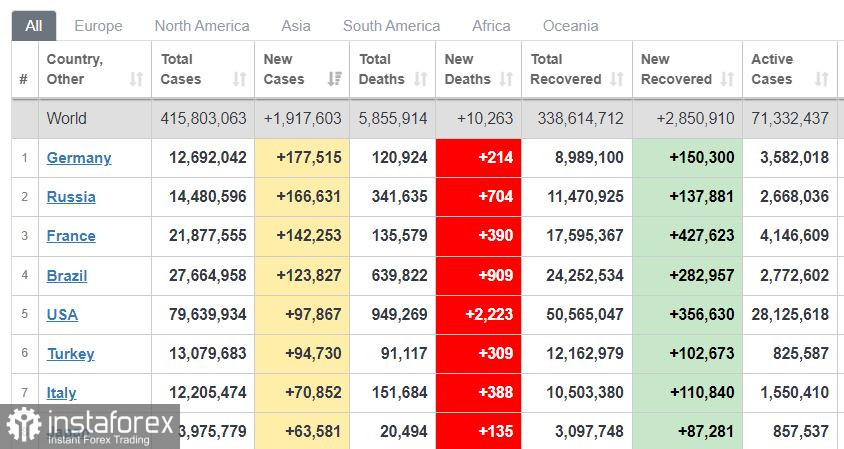

The epidemiological situation in the world in the morning of February 16.

Markets show strong growth after tensions around Ukraine reduced.

US indices showed strong gains on Tuesday. The Dow Jones index increased by 1.2%, the NASDAQ index jumped by 2.5%, the S&P 500 index rose by 1.6%.

Among Asian indices on Wednesday morning, the Japanese index climbed by 2.3%, and the Chinese index increased by 0.3%.

The Russian market showed strong growth on the reduction of invasion risks. The MOEX Russia index added 3.4%, the RTS jumped by 5%, the ruble strengthened against the dollar and euro.

Energy market. Oil, on the other hand, declined yesterday by $2. Brent fell to $93 from $95 on falling tensions as risks of supply shortages from Russia have fallen.

Gas prices in Europe, which were at $1,000 again amid growing tensions between Russia and Ukraine, yesterday plummeted to $800-$860 per 1,000 cubic meters on the ICE exchange.

The S&P 500 index is trading at 4471 within the trading range between 4440 and 4500.

The US market did not react to the new weak data on inflation against the backdrop of the war cancellation. Yesterday the producer price index report was released, according to which wholesale prices rose in January by 1%, well above the forecast of 0.5% growth. This may push the Fed to raise the rate more aggressively. One of the voting members of the Fed, Bullard, has urged a rate hike to 1% by July. However, a rate hike in March is expected by 0.5%.

Important retail sales report for January will be released today. Forecasts show a sharp increase in sales by 2% after a decline in December. This may become another argument in favor of a rate hike. Later in the evening, the Fed minutes will be released. The market will see the details of the March hike being prepared.

Yesterday, US President Joe Biden said that Russian aggression against Ukraine is still possible. Biden endorsed a signal from the Kremlin that he was ready to negotiate but insisted that the US and NATO would not abandon their principles.

At the same time yesterday, the Russian State Duma voted for the draft appeal to the Russian President to recognize the DNR and LNR in the part of Donbas outside of Ukraine's control as independent entities. Putin responded that such recognition is possible if the West does not go along with guarantees that Ukraine will not be admitted to NATO. Thus, a new wave of tensions and sanctions is possible.

The epidemiological situation in the world mostly eases. Yesterday, there were 1.9 million cases, which is more than the previous value, however, it was still a decline. Germany had 177,000 cases, Russia had 166,000 cases yesterday. The death cases are not rising, a high death toll was seen in the US, 2,200 deaths. This was the aftermath of a huge wave of 700,000 cases per day about two weeks ago in the US.

USDX is trading at 95.90 within the range of 95.60 - 96.20. The dollar index declined markedly yesterday on the background of new data on rising inflation. The market is not yet ready for a strong rise in the dollar.

USD/CAD is trading at 1.2710 within the range of 1.2600 - 1.2800. The pair lost its upward momentum after the US dollar stopped growing.

In conclusion, the US market is ready to continue rising, but the Fed's rate hike is putting a lot of pressure on investors.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română