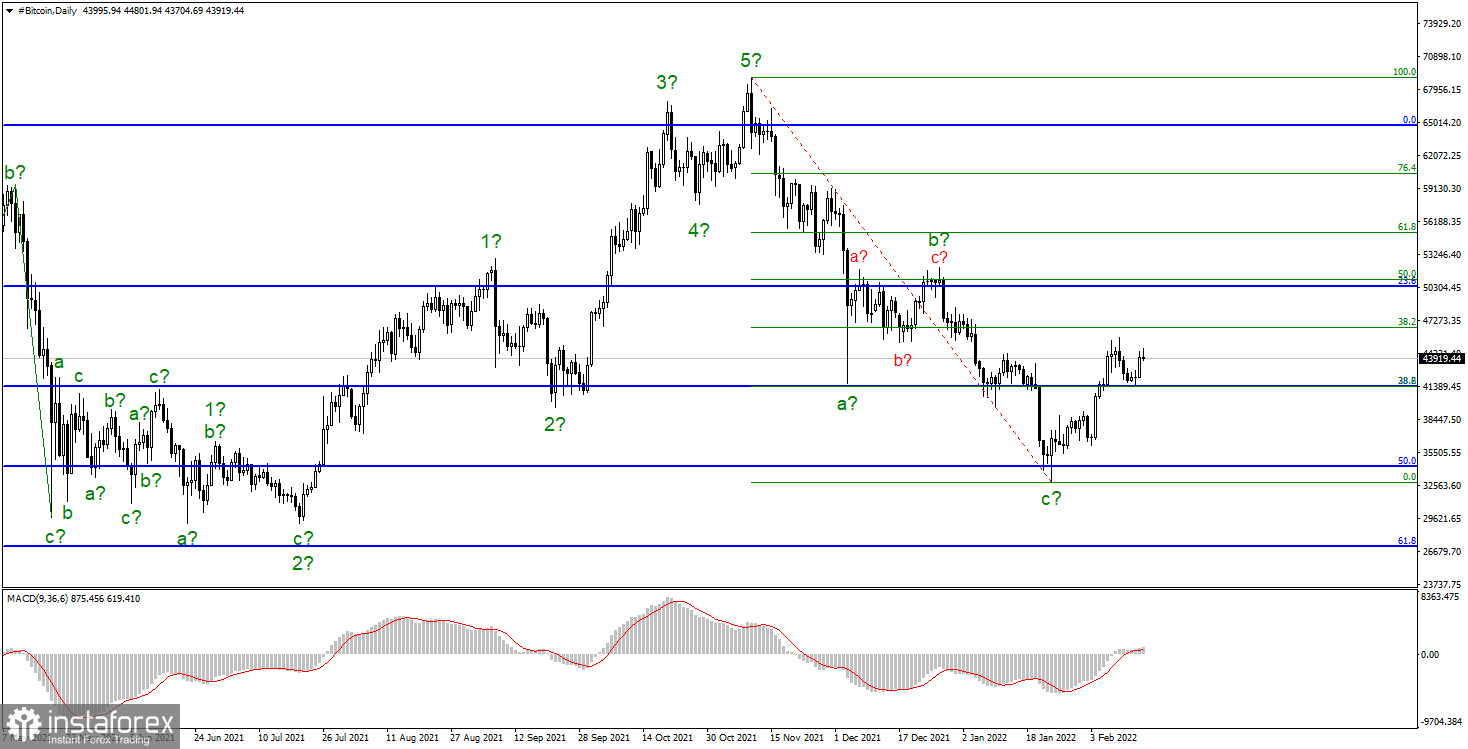

On Monday, Bitcoin attempted to further recover again after declining to the level of $32,000. A failed attempt to break through $41,529, corresponding to 38.2% on the upper Fibonacci grid, indicates that the market is not yet ready for new sales. Therefore, Bitcoin's price may rise a little more. However, the new upward wave that is recently being built is currently almost identical to the expected wave b (in size), and the entire downward trend section can still be transformed into a five-wave one. In this case, wave e will be formed. However, it is not clear at the moment whether the formation of the downward trend is done. Buyers are not in a rush to mass purchase the first cryptocurrency, as they are very much afraid of the news background. It can be recalled that the key topics for the market remain the theme of the Fed's interest rate hike, as well as geopolitical tensions in Europe. Until there is a concrete and clear outcome on these topics, the market can behave cautiously without escalating events.

- Nicholas Merten said that Bitcoin's last decline was not a downward trend

As usual, a huge number of various rumors, opinions, and forecasts have accumulated around the cryptocurrency market, which contradicts each other in most cases. For example, the famous trader Nicholas Merten believes that Bitcoin's last decline cannot be called a downward trend. He stated that during each downward trend, Bitcoin lost more than 70% of its value. Now, he thinks that the cryptocurrency is in the phase of accumulation of volumes.

"Don't let the sideways consolidation fool you into thinking that Bitcoin is in a bearish trend. A new rally is just around the corner," Merten said.

He also added that the main digital asset could rise to $ 200,000 by the end of this year, and its capitalization will exceed $ 4 trillion. However, we have already seen a huge number of such forecasts. The most common one was talking about that the first cryptocurrency will rise to $100,000 before the end of 2021, which did not happen. Thus, it is difficult to say right now how will Bitcoin rise to $200,000 with the current negative news background.

- Michael van de Poppe believes that Bitcoin needs to hold above $41,000.

Trader Michael van de Poppe shared an opposite opinion. He noted that Bitcoin, like the entire cryptocurrency market, could survive another wave of decline. To avoid this, the instrument needs to hold above the key support level of $41,000. If this level does not hold, then a new downward wave may begin to form, and we can forget about the upward trend for a few more months. It is worth noting that Poppe also expects strong growth in cryptocurrencies in the longer term, but traders do not say when exactly this will happen. Currently, the capitalization of Bitcoin is less than $1 trillion.

The downward trend section continues to form. A failed attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, allowed the quotes to start leaving the lows reached. However, it is still too early to talk about the end of the downward section of the trend. It can take a five-wave form and continue its construction with targets near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci within wave e. So far, the wave marking does not imply the construction of a new downward wave. There is not a single signal for this, and the corrective set of waves a - b - c looks quite complete, so the option of building a new upward trend section from the current levels can also be considered. There is a 30% probability for this, but a news background is needed. To sell Bitcoin, new downward signals are needed – unsuccessful attempts to break through levels located above the current rate, or a reversal of the MACD indicator. In general, any signs that the upward wave that is currently being built is already done.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română