The price of oil on Tuesday falls from a seven-year high due to reports that some Russian troops stationed near the border with Ukraine are returning to bases. This news indicates the easing of tension between Russia and Western European countries.

According to the Ministry of Defense, on the morning of February 15, Russia began to return the military of the Southern and Western military districts. Later, the press service of the Southern Military District reported that their servicemen were returning to permanent locations in Dagestan and North Ossetia from exercises in the Crimea. The Western Military District, in turn, reported that their military were being sent to a permanent deployment point in the Nizhny Novgorod region. In support of its words, the Ministry of Defense distributed a video where columns of military equipment, including tanks, infantry fighting vehicles, self-propelled artillery units, are loaded onto echelons.

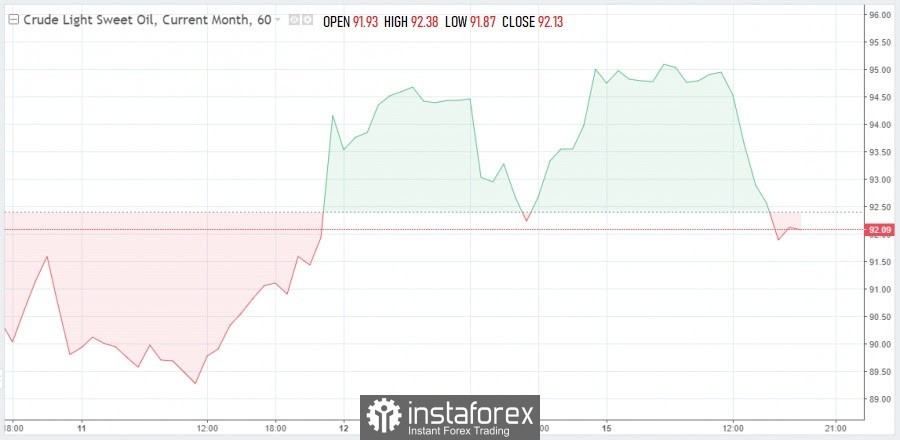

Brent crude instantly reacted to this news by reducing the price by about $2.35 (or 2.4%). By the time the review was prepared, the reference grade was estimated at $93.82 per barrel. American WTI oil also fell in price - by $2.00 or 2.1%. The chart shows the price level at the time of writing - $92.13.

It is obvious that the Russian-Ukrainian conflict has created a high wariness of the energy and raw materials market, which expected a shortage of supplies of hydrocarbon raw materials to the world market. The alleged war would definitely provoke major disruptions in the supply of energy resources from Russia, the world's main exporter of oil and petroleum products, natural gas and coal. Oil production in the country is approximately 11.2 million barrels per day, Trading Economics reminds. Analysts warn that possible interruptions in the supply of black gold from Russia can raise prices for this fuel to $100 per barrel and even higher. Therefore, news about the de-escalation of the Russian-Ukrainian conflict deprives oil of a geopolitical margin.

Brent and WTI black gold reached its highest level since September 2014 this Monday. So, Brent was valued at $96.78, and WTI - at $95.82. The price of Brent oil rose by 50% in 2021, helped by limited supply amid the COVID-19 pandemic.

At the same time, OPEC+ countries still cannot increase oil production to the agreed levels. Last week, experts of the International Energy Agency announced the level of undersupply of oil to the global market from the expanded alliance – 900,000 barrels per day.

Negotiations between the United States and Iran on the resumption of the Iranian government's nuclear deal with world powers are also of great importance for quotes. The new flow of oil to the world market is able to significantly increase the supply and, accordingly, reduce the cost of this raw material.

Russian Foreign Minister Sergey Lavrov on Monday, after talking with his Iranian counterpart Hossein Amir-Abdollahian, noted that significant progress has finally been made on the issue of reviving the nuclear deal with Iran.

In addition, the first weekly report on black gold reserves in the United States is expected to be released today. If the report shows a decrease in crude oil reserves, it will mean a discrepancy between the levels of supply and demand.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română