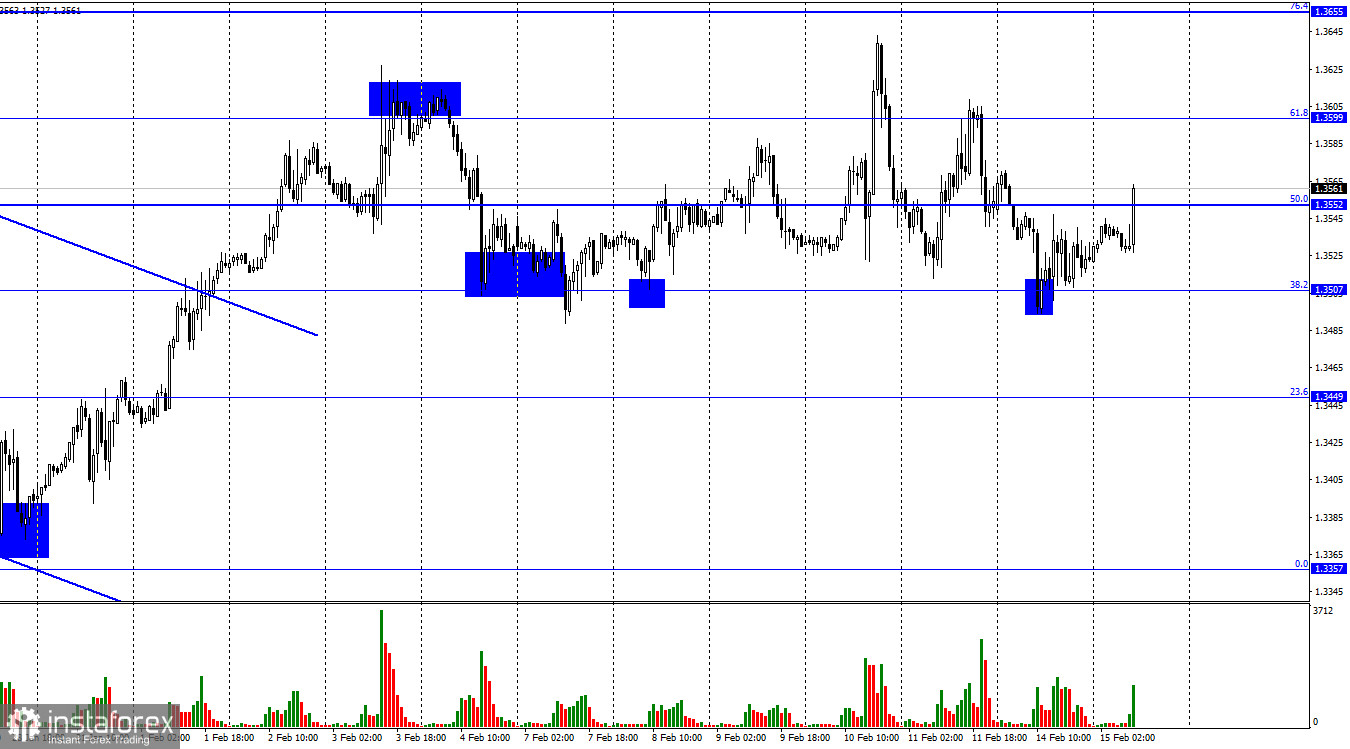

On Monday, GBP/USD fell to the retracement level of 38.2% - 1.3507 on the H1 chart. A pullback from this level supported the British pound and initiated growth. Today, bulls have gained ground amid strong economic data from the UK. Consolidation above 50.0% - 1.3552 will facilitate further growth towards the next Fibonacci level of 61.8% - 1.3599. Indeed, the UK macroeconomic data turned out to be rather strong. Unemployment remained unchanged at 4.1%, but this rate is considered the minimum one in many countries (for example, the US has the same unemployment rate). The number of jobless claims fell by 32,000, broadly in line with traders' expectations. Average wages rose by 4.3% in December against expectations of +3.8%. However, these data has had a slight effect on the market, and here is why. This morning, it was reported that units of Russia's southern and military district started to pull to their base.

The Russian ruble immediately recovered amid this news, while the US dollar faced a risk of a sell-off wave as it is widely used as a safe-haven asset in times of political uncertainty. Thus, when tensions ease, the greenback weakens. Therefore, it seems that today traders have largely reacted to the news about Russian troops pulling back from the Ukrainian border even though it was only a small part of them. Nevertheless, this can be a signal of de-escalation, and there is hope that diplomats will eventually reach an agreement. Either way, this is good news. No more important economic events are expected today, but there may be news regarding the Russia-Ukraine conflict.

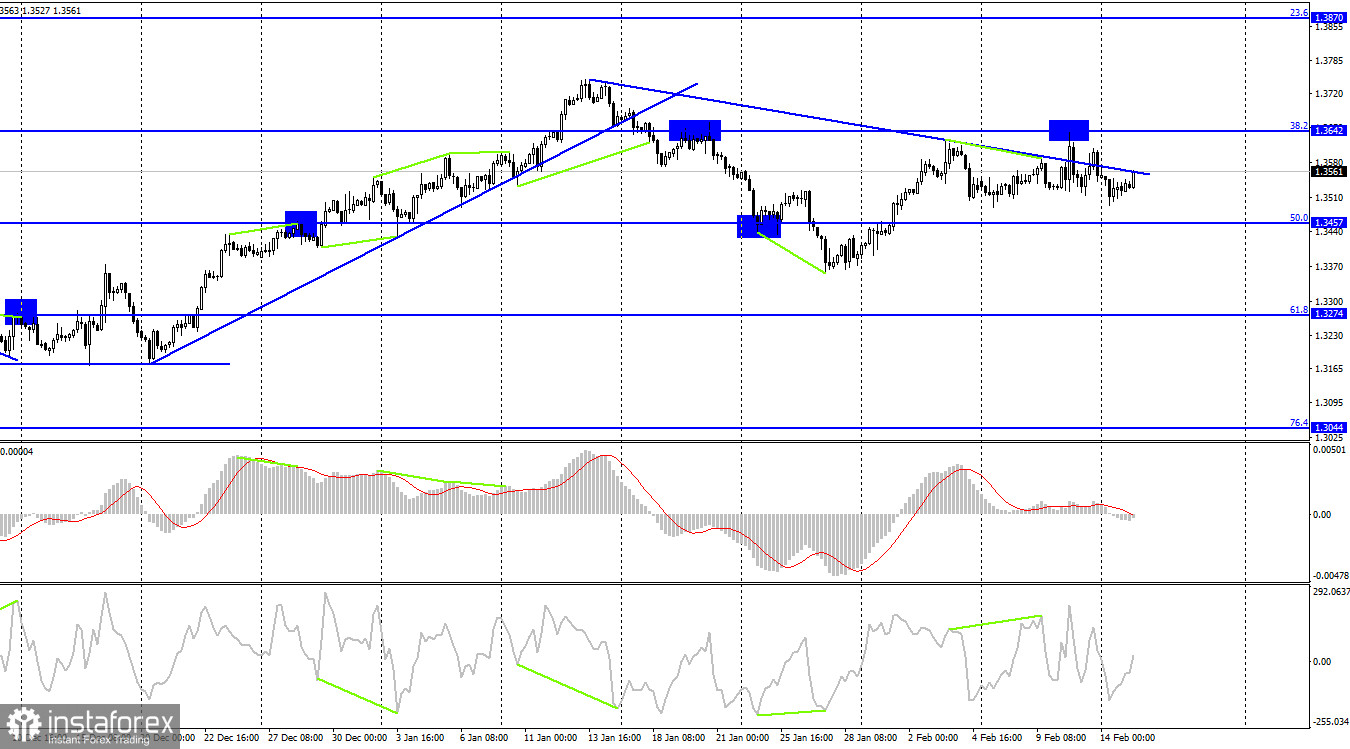

On Friday, the pair consolidated twice above the descending trendline on the 4-hour chart. However, GBP failed to develop further growth. Today, the quotes have again returned to this line in an attempt to consolidate above it for the third time. If this attempt turns out to be successful, the price may continue to grow towards the retracement level of 38.2% - 1.3642. There are no emerging divergences in any of the indicators today.

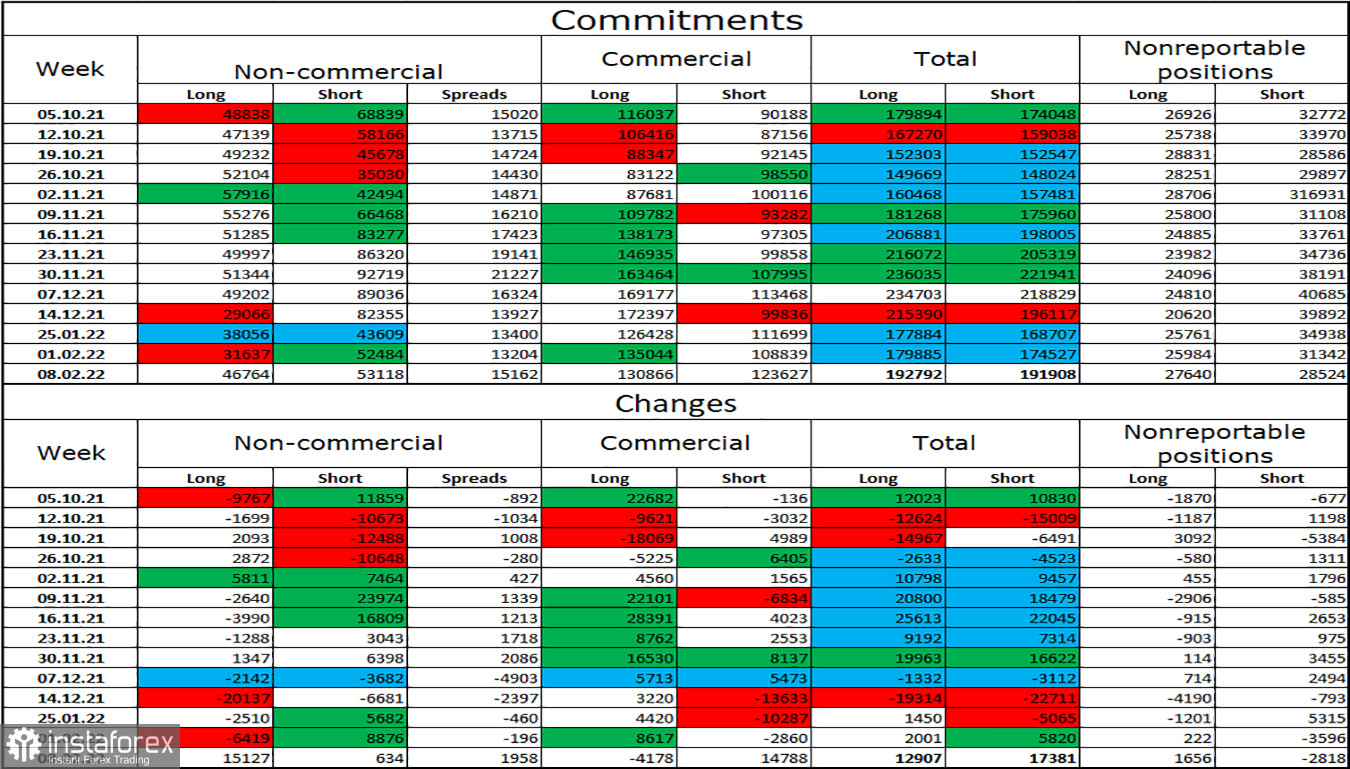

COT report:

The sentiment of the non-commercial group of traders has changed dramatically over the last reporting week. A week earlier, speculators increased the number of short contracts. Today, on the contrary, they are adding more long positions, the number of which has increased by 15,127. This is a vivid example of how quickly the sentiment of major players is changing. The overall mood of speculators can now be called bearish as they have more short contracts opened. But, as I said, the mood of traders is changing too quickly, and the current information background may contribute to these changes.

Economic calendar for US and UK:

UK – Claimant Count Change (07-00 UTC).

UK – Employment Change (07-00 UTC).

UK – Average Earnings Change (07-00 UTC).

US – Producer Price Index (13-30 UTC).

On Tuesday, all scheduled reports in the UK have already been published. The data on producer prices in the US is unlikely to influence the market today. For the rest of the day, the information background will remain weak.

Outlook for GBP/USD and trading tips:

I would recommend selling the pound now although there are no sell signals on the 4-hour chart. At the same time, there are plenty of sell and buy signals on the 1-hour chart. Traders are still nervous, so the price movements can be very rapid and strong.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română