S&P500

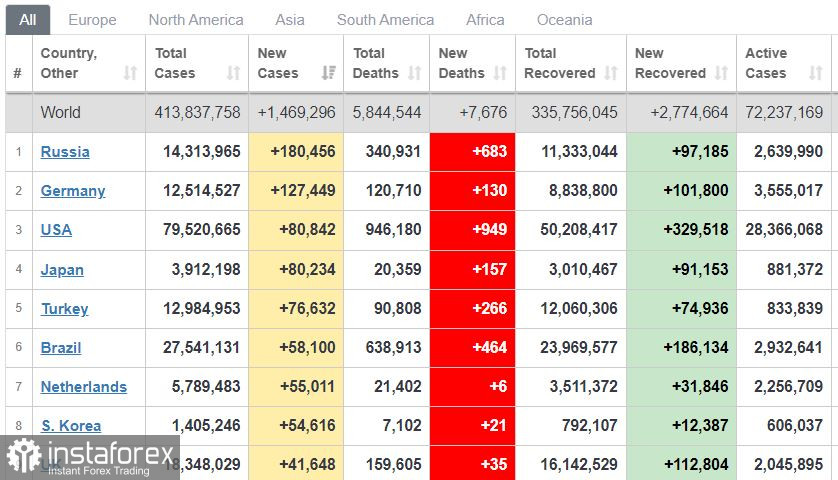

COVID-19 statistics as of early February 15

The US stock market closed in negative territory on Monday. Major indexes suffered slight losses: the Dow Jones lost 0.5%, the S&P 500 retreated by 0.15%, and the NASDAQ changed negligibly.

Asian markets were mixed early on Tuesday, with the Nikkei 225 declining by 0.8% and the Shanghai Composite adding 0.8%.

Oil prices have surged to their highest level since 2014. The price of Brent crude has reached $96 per barrel.

German Economy Minister Robert Habeck spoke in favor of building a LNG terminal to reduce the country's dependence on Russian natural gas.

The S&P 500 is trading at 4,401 and is expected to be in the 4,360 - 4,440 range.

On Monday, the US stock market extended its downtrend, which had begun on Friday. The sell-off was triggered by soaring inflation in the United States, which reached 7.5% YoY in January, as well as market expectations of an interest rate increase by 0.5% or more. Tensions in Eastern Europe put pressure on the market as well. Today, the US State Department urged American citizens to leave Ukraine, Belarus and the breakaway region of Transnistria due to the threat of imminent Russian military action. On Monday, the Fed conducted a closed meeting, without releasing any details to the public. It is likely that the issues of inflation and raising the interest rate were on the agenda. With no clear information, the market reaction to the meeting was very muted. Tomorrow, the FOMC January meeting minutes will be released, but its relevance has fallen in the light of recent inflation data. US PPI data is due today - economists expect producer prices to rise by 0.5% month-over-month or 6% year-over-year.

The number of Omicron cases worldwide is on the decline. About 1.5 million new infections were reported yesterday. This number is more than 2 times lower compared to the high of January 21, when 3.8 million infections were reported. In the US, about 80,000 cases were registered, compared to 700,000 at the peak of the Omicron wave. Most new infections are reported in Eastern European countries. 180,000 infections were registered in Russia, where the pandemic is also slowing down. Germany reported 130,000 Omicron cases.

Microsoft is winding down distance working, telling its workers to prepare for returning to offices. Soaring inflation has led to a split among the ranks of Democrats in the US Congress - Democrat senator Manchin called for sharp interest rate hike, which would obstruct Biden's $2 trillion economic assistance plan and weigh down on economic growth. The current party breakdown in the Senate, where the Democrats have only 50 senators and the Vice President against 50 Republicans, is complicating matters for Biden.

USDX is trading at 96.20 and is expected to be in the 95.90-96.50 range. The index made very slight gains, adding 0.2 points yesterday on market expectations of the Fed rate hike and war in Eastern Europe.

USD/CAD is trading at 1.2740 and is expected to be in the 1.2680-1.2780 range. Rising oil prices are likely to push the pair down.

The US market could rally when geopolitical tensions ease. At this point, war between Russia and Ukraine seems unlikely.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română