After the Federal Reserve announced an emergency meeting of the Federal Open Market Committee, investors were essentially waiting for only one outcome - an increase in the refinancing rate. In part, this circumstance contributed to the gradual growth of the dollar, which began last Thursday. When the emergency meeting was announced. Confidence in such an outcome was given by the fact that the interest rate invariably changed according to the results of all previous emergency meetings. But the results of yesterday's meeting turned out to be quite strange. The US central bank decided not to divulge, limiting itself only to a short press release. Without any comments and observations. However, the content of this very press release provides answers to many questions. The central bank focused on reducing the share of overdue loans, which hints at the inevitability of an increase in the refinancing rate. It is quite possible that in such a peculiar way the Fed is preparing the market to raise the refinancing rate by 0.50% at once. From the current 0.25% to 0.75%. In any case, the results of the meeting somewhat surprised the market, and in the end it stood still.

Judging by the data that are being published today, the market will continue to stand still. And although the growth rate of average wages in the UK should slow down from 3.8% to 3.6%, employment itself may grow by 75,000, and the number of applications for unemployment benefits is likely to decrease by 27,000. That is, wages seem to be declining, but employment itself is growing, which is quite a normal combination. The unemployment rate itself is likely to remain unchanged.

Unemployment Rate (UK):

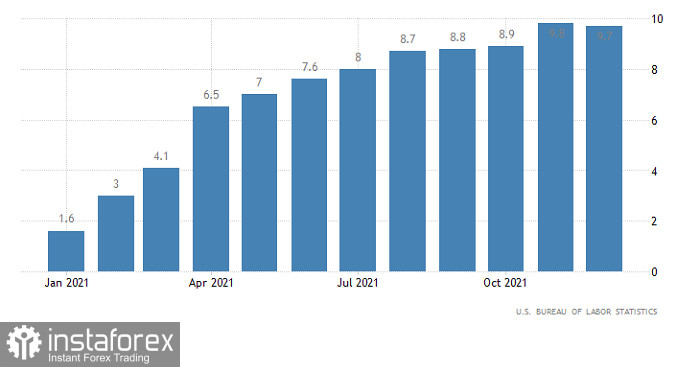

Data on producer prices will be published in the United States, the growth rate of which may accelerate from 9.7% to 10.0%. But this is of little interest to anyone, since judging by the results of yesterday's meeting, the issue of raising the refinancing rate has already been resolved. So the increase in the producer price index will not affect anything.

Producer Price Index (United States):

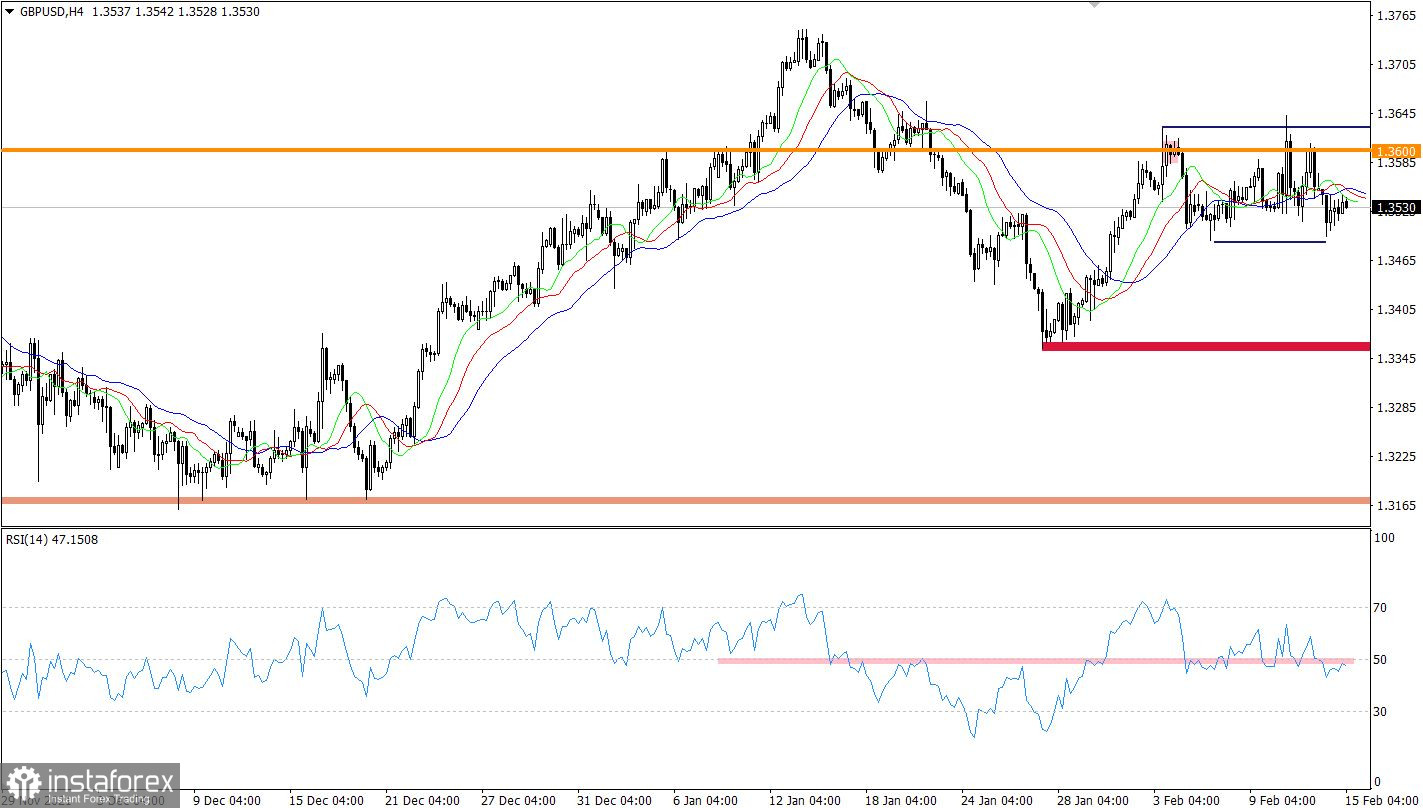

The GBPUSD currency pair did not manage to leave the long-playing horizontal channel at 1.3500/1.3600. The quote is still moving within its boundaries. This price movement indicates the market participants' indecisiveness to the subsequent movement.

The technical instrument RSI in H4 and D1 is moving within the deviation of the middle line, confirming the stage of stagnation.

The Alligator indicator in a four-hour period has a weave between the moving MA lines, which indicates a stagnation in the market.

On the chart of the daily period, the stagnation looks like a consolidation of doji-type candles. This once again confirms the signal about the characteristic uncertainty among market participants.

Expectations and prospects:

In this situation, price movement in a sideways range indicates the process of accumulation of trading forces, where working inside its boundaries is considered a less attractive tactic than working on a breakdown.

The following values serve as signal levels: 1.3630, when considering buy positions and 1.3480, in case of transition to the stage of descending interest recovery.

Complex indicator analysis has a variable signal in short-term and intraday periods due to the lateral price movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română