The US stock market was quite calm on Monday, although the news background remained potentially very strong – all the world's media wrote in the morning that the Fed had decided to hold an unscheduled meeting and this news could already excite the markets. However, this did not happen, as the markets still decided to wait for the official results, and only then make decisions. But amid this event, all the prices of the US stock indices and many stocks slightly declined.

At the same time, the topic of geopolitical tensions in Eastern Europe can also be noted. The conflict has so far been put on a cease as all participants are negotiating. We want to believe that there will be no conflict in the end, but the issue that the participants face is very complex and difficult to resolve. So far, no positive shift is visible in the negotiations. Thus, the markets are now waiting for war. If a war breaks out in Europe, even the US stock market could be hit hard, even though America is far from the potential war zone.

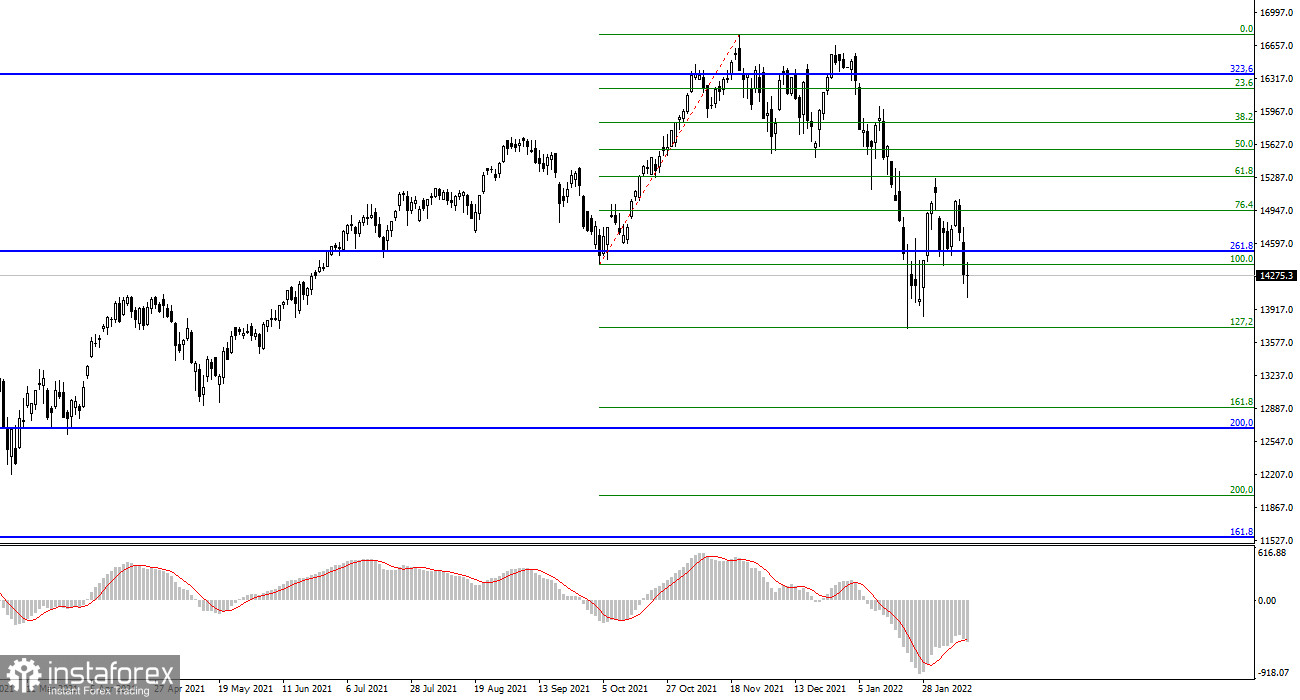

NASDAQ Composite Index

On Monday, the NASDAQ Composite index fell by 4 points and was 14275 points at the close of trading. There are minimal losses, but they are still there. A successful attempt to break through the level of 14525, which corresponds to 261.8% Fibonacci, indicates the willingness of investors to continue selling shares included in the index. The nearest downward target is the level of 13724 – the previous local low.

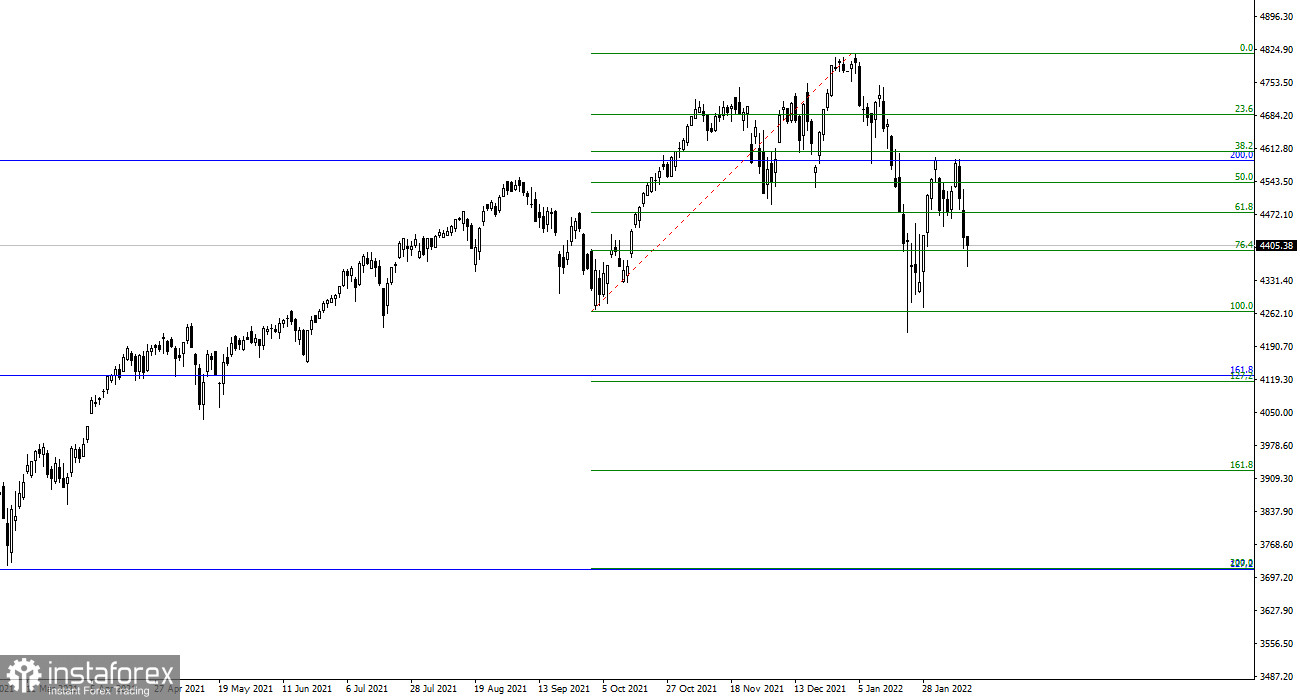

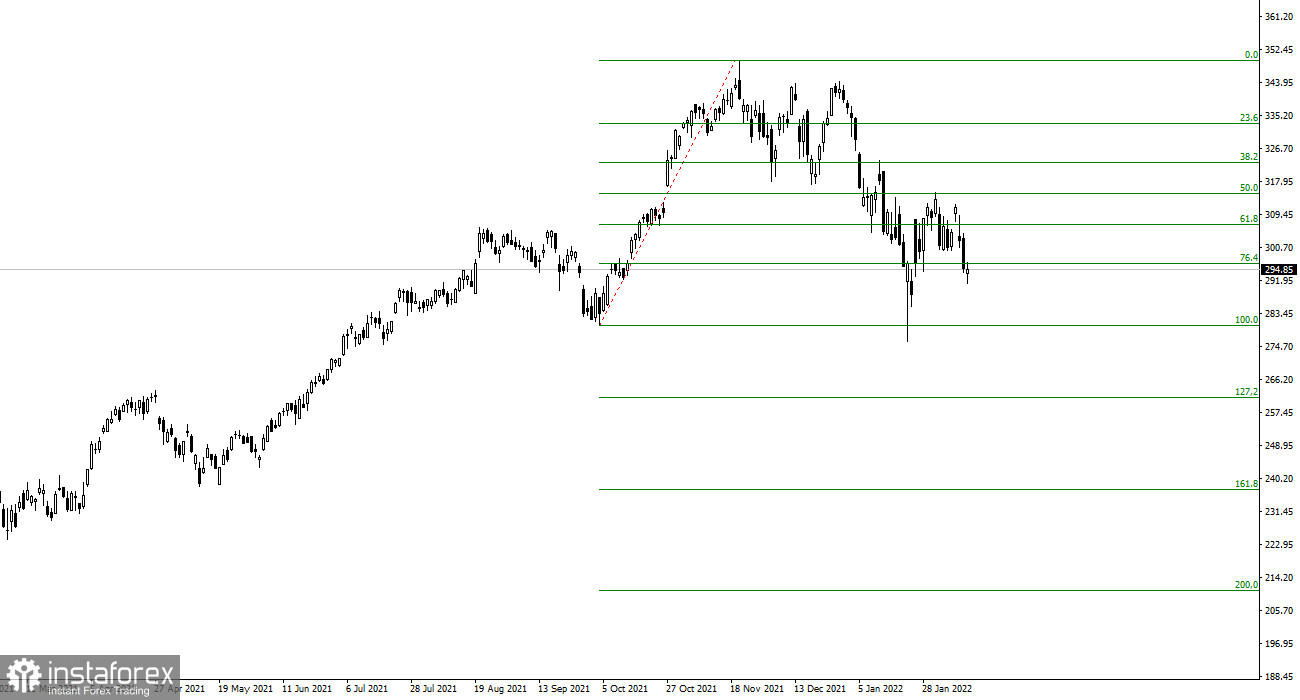

Standard & Poor's 500 index

The Standard & Poor's 500 also dropped by 17 points and closed at 4405. Two failed attempts to break through the level of 4586, which corresponds to 200.0% on the upper Fibonacci grid, led to new sales of the instrument. The news background has a huge impact on investors' sentiment, which is more negative than positive. In most cases, wave counting also indicates the formation of a descending set of waves.

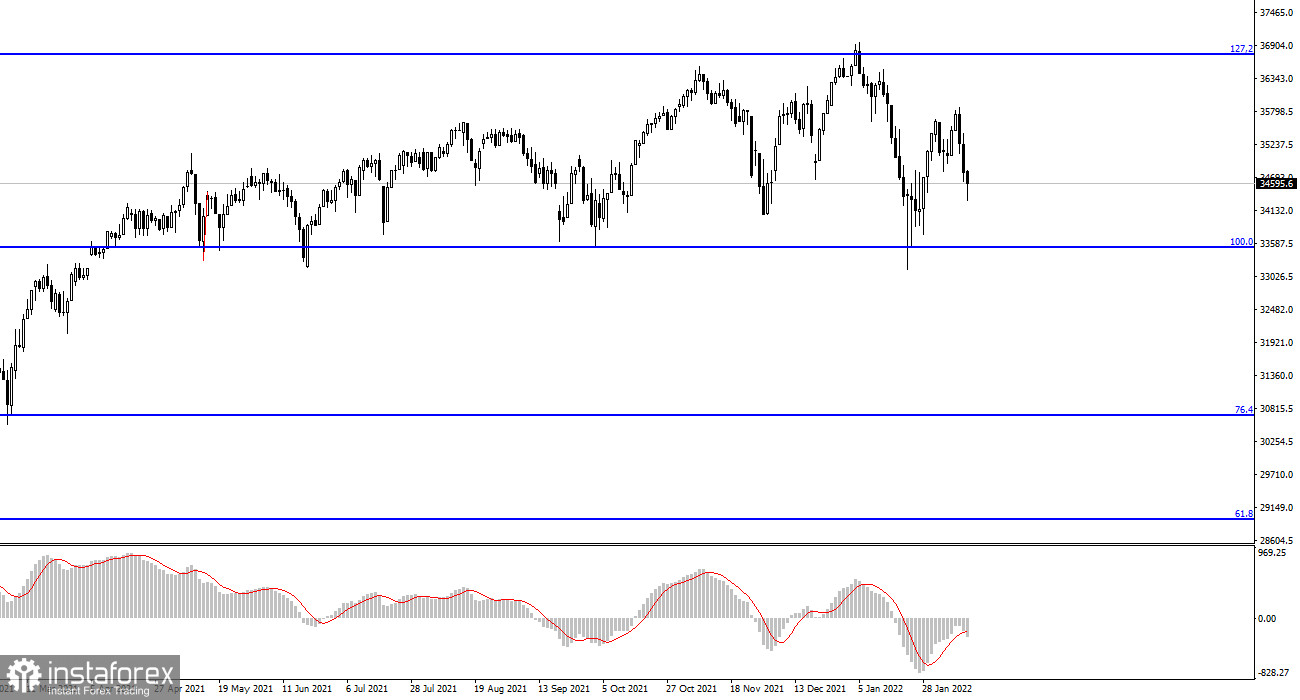

Dow Jones index

The Dow Jones index suffers the least from geopolitical upheavals and strengthening panic around the Fed's interest rate hike. On Monday, they plunged by 184 points, but the picture shows that its correction waves are the smallest in comparison with other instruments.

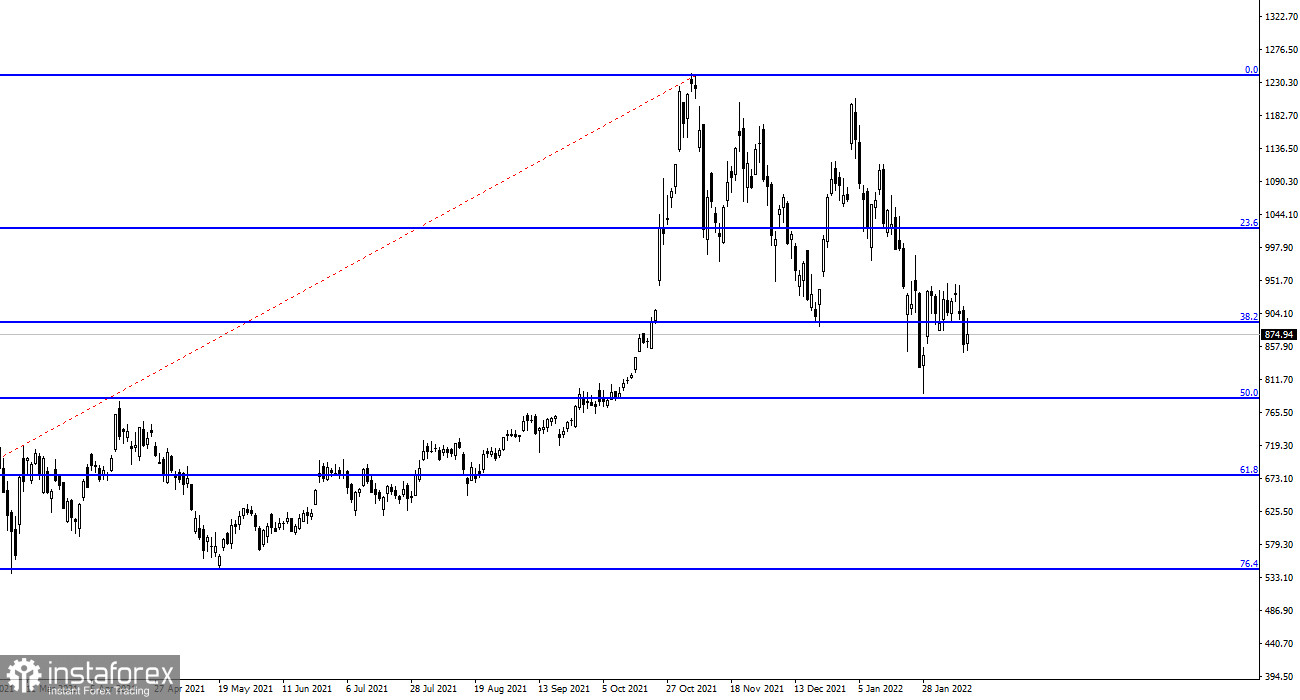

Tesla

Tesla shares rose by $13. However, a successful attempt to break through the $891 mark indicates that the market is ready for new sales of shares of the automaker with a target set near the level of $783, which corresponds to 50.0% Fibonacci. Tech companies weren't feeling the pressure on themselves on Monday.

Microsoft

Microsoft stock may also continue to decline after failing to break through the level of $314, which equates to 50.0% Fibonacci. The nearest target is $280. If it is reached, it will mean that the company's shares have fallen in price by almost $100 in just a few months. Yesterday, the decline in quotes was small.

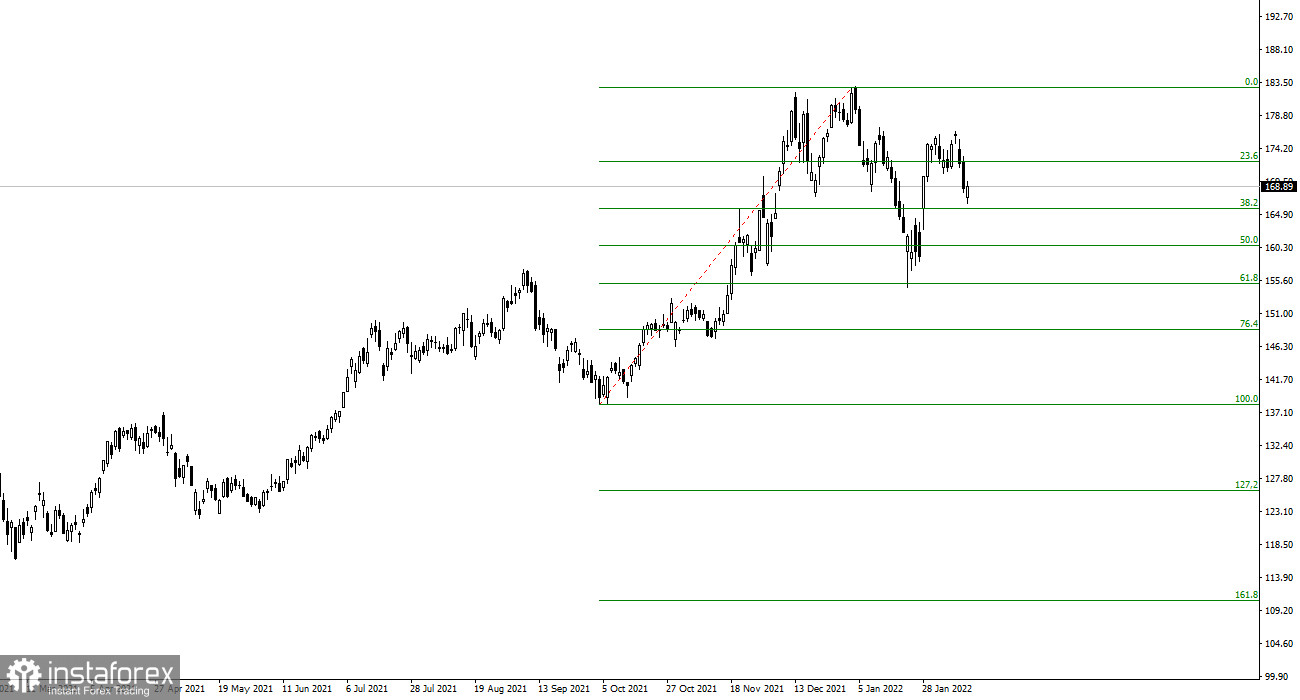

Apple

Apple shares felt most confident in the conditions of the impending crisis. Their cost has hardly changed yesterday and is now $ 168. Nevertheless, a descending set of waves for this instrument is forming, so the decline may continue.

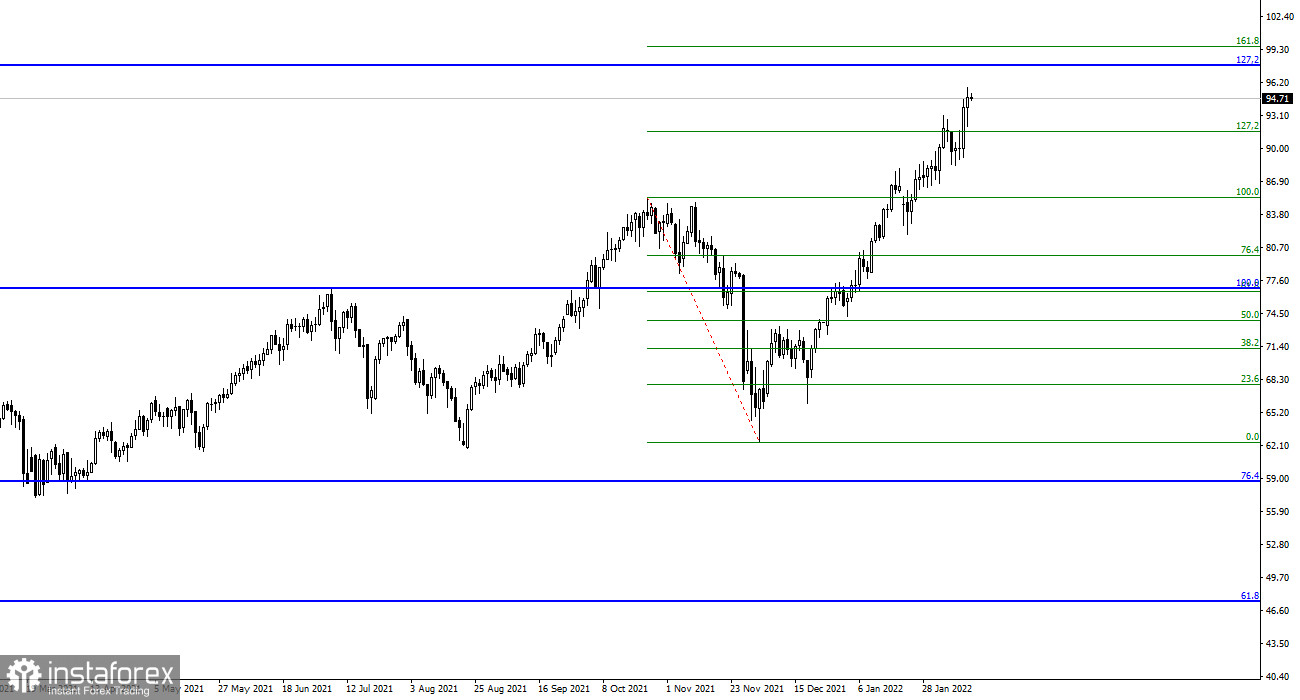

Oil

Oil is the only instrument supported by geopolitical concerns. Its price surged to $95 per barrel, after a successful attempt to break through $91.64, which corresponds to 127.2% Fibonacci. The target of this instrument is $97.87.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română