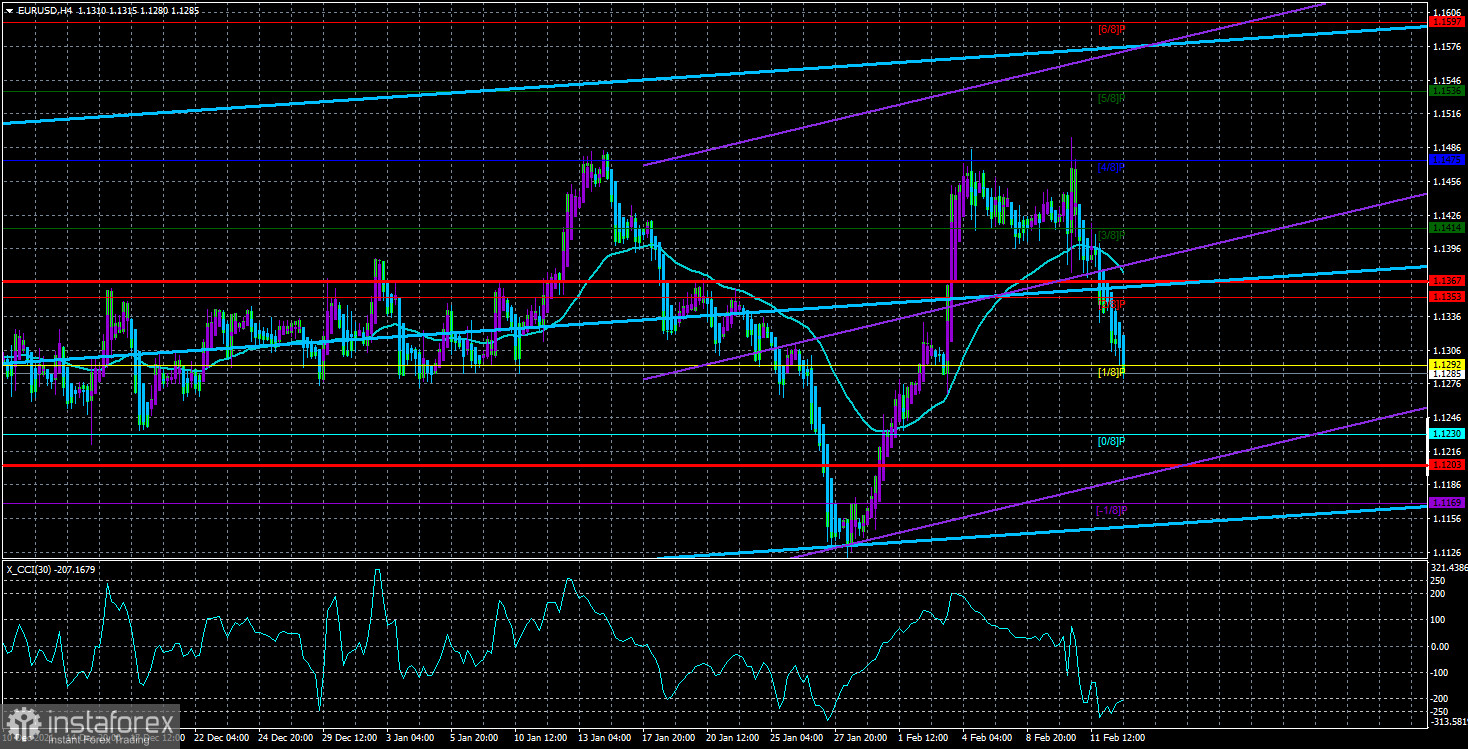

\The EUR/USD currency pair started on Monday by falling by another 60 points and worked out the Senkou Span B line according to the Ichimoku indicator on the 4-hour TF. According to the "Linear Regression Channels" system, the price continues to be located below the moving average line and after a rebound from the important level of 1.1475, it is still set for further decline. We have repeatedly said that at this time, the European currency has practically no reason to grow. So it remains after Monday. In principle, there is very little change in the foreign exchange market right now. The situation for the euro currency is only getting worse day by day. If earlier the main negative factor for it was the factor of possible multiple increases in the Fed rate, now this issue is already somewhat different.

Now the Fed is thinking about a faster and more ambitious rate hike, as inflation in the US continues to accelerate and does so at a much higher rate than experts expected from it. Therefore, an emergency meeting of the Fed began last night, the results of which should be known today. And what can the Fed do in the current conditions? From our point of view, this is obvious. Either raise the rate, or prepare a springboard for a rate hike in March, but immediately by 0.5%. In any case, we are talking about tightening monetary policy. And this is in any case a "bullish" factor for the dollar. Thus, whatever decision the Fed makes on Monday or Tuesday, it will still provoke a rise in the dollar. Or, if no important decisions are made/announced, then there will simply be no reaction. On the euro currency, bulls are now weak from a technical point of view. They failed to overcome the level of 1.1475, from which the price has bounced three times in total in recent weeks. Therefore, there is no need to talk about any growth of the euro at all now.

Euro currency: the situation is stalemate.

Apart from the fact that macroeconomic factors are not on the side of the euro now, the fundamental background also does not support the purchase of the euro currency. If the background was at least neutral now, then we could count on the growth of the EU currency based on the fact that technical corrections should also be, and the downward trend has been lasting for more than a year. However, in recent weeks, the issue of Ukraine's accession to NATO has become too acute, with which Moscow does not agree. Therefore, now there are more than 100 thousand of the Russian army on the borders with Ukraine and an armed conflict can begin at any moment. We do not want and will not understand the vicissitudes of this conflict, each side has its interests on the world stage. We are talking again about the confrontation between the United States and the Russian Federation, and from the escalation of this confrontation, chips can fly in different directions for a long time. We are more interested in the foreign exchange market. And in conditions of geopolitical tension, the US currency usually becomes more expensive, since many use it as a reserve asset. That's another possible reason for the strengthening of the dollar in the coming weeks.

Of course, it all depends on whether there will be a war or not. As they say, there are no winners in any war, all participants in the conflict will suffer certain losses. Washington and the EU countries are already preparing a new package of "destructive" sanctions against Russia if there is an invasion of Ukraine. Naturally, any development of the situation will affect the mood of traders. And, to be honest, now it is even impossible to say with certainty what exactly will happen in the foreign exchange market with this or that pair. We see now that the pound sterling paired with the US currency is just riding on a "swing", although there seems to be no special reason for this. The main thing is different. If the escalation continues, then the trading conditions in the markets will deteriorate greatly. And this point should be taken into account both in short-term and medium-term trading. But we still believe that the parties will be able to resolve all disputed issues through diplomacy.

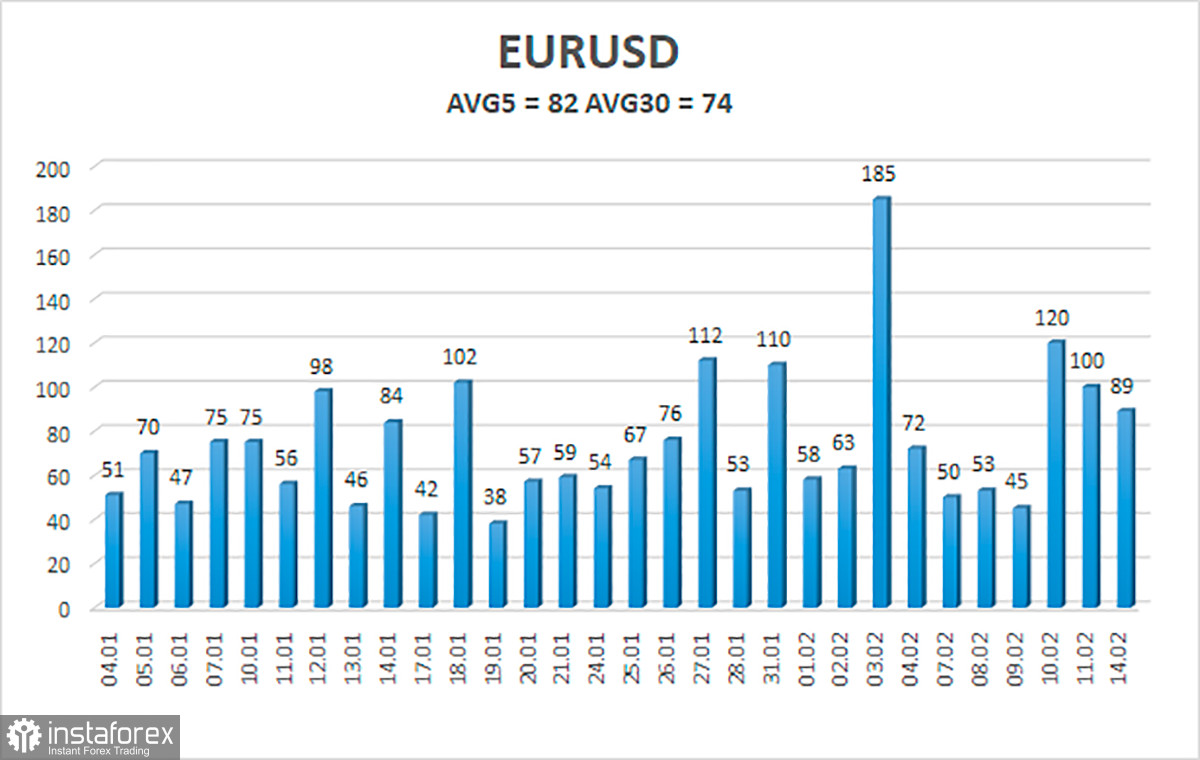

The volatility of the euro/dollar currency pair as of February 15 is 82 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1203 and 1.1367. A reversal of the Heiken Ashi indicator upwards will signal a round of upward correction.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now you should stay in short positions with targets of 1.1230 and 1.1203 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than fixing the price above the moving average with a target of 1.1414.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română