Analysis of Monday's trades:

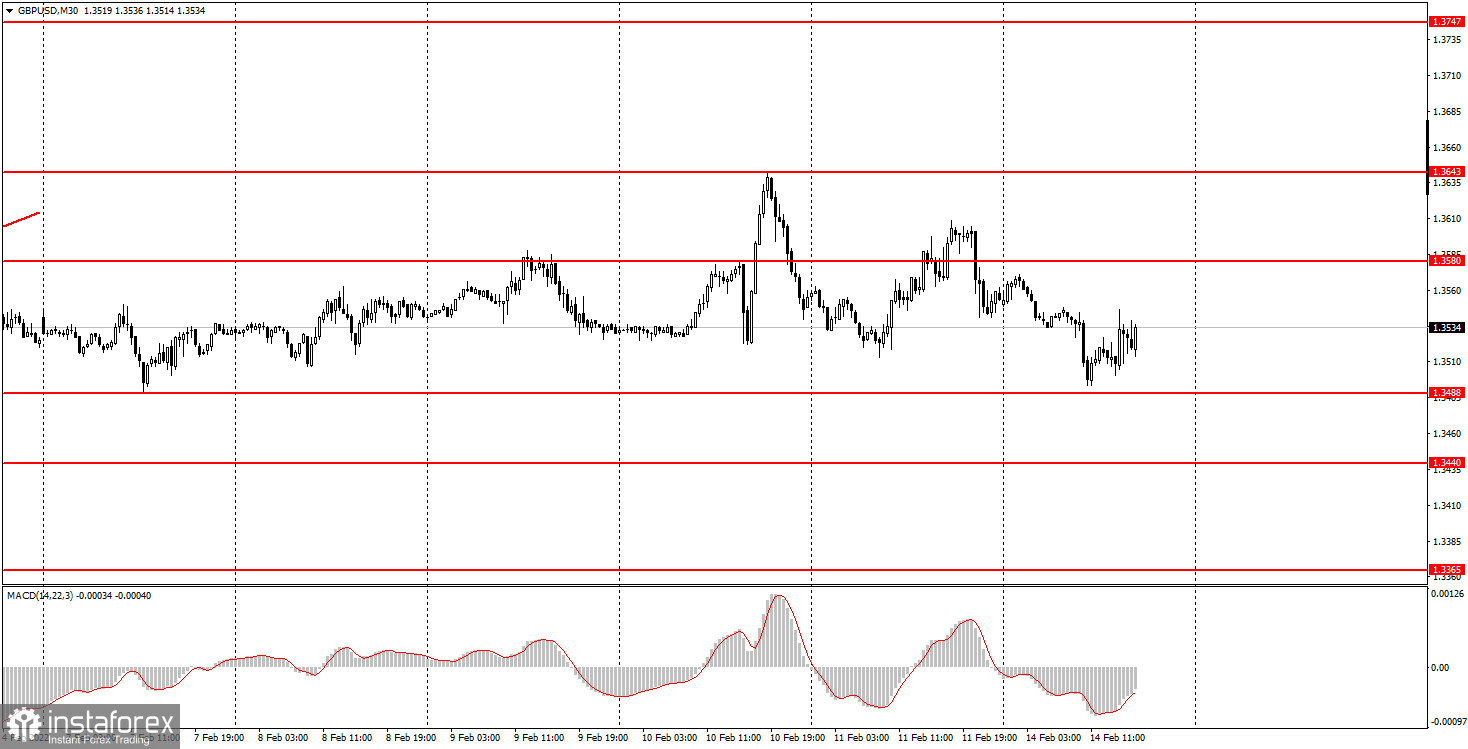

GBP/USD 30M Chart

On Monday, February 14th, the GBP/USD pair continued trading in the last week's mode, i.e. it was swinging with no definite direction. Unlike the EUR/USD pair, which at least is moving in a certain trend, the cable has been trading mixed for over a week already, and it seems to be still indecisive. In the past six days, the rate was fluctuating between 1,3500 and 1,3600. That's why the current situation looks more like a flat trend which is poor conditions for traders. There were few macroeconomic reports on Monday, whereas the fundamental factors were abundant which brought even more uncertainty to the market. First, the Federal Reserve surprised the markets by announcing a special meeting to discuss the interest rate policy. Second, the geopolitical tensions in Eastern Europe escalated further. Under these circumstances, the euro is doing really great compared to the British pound.

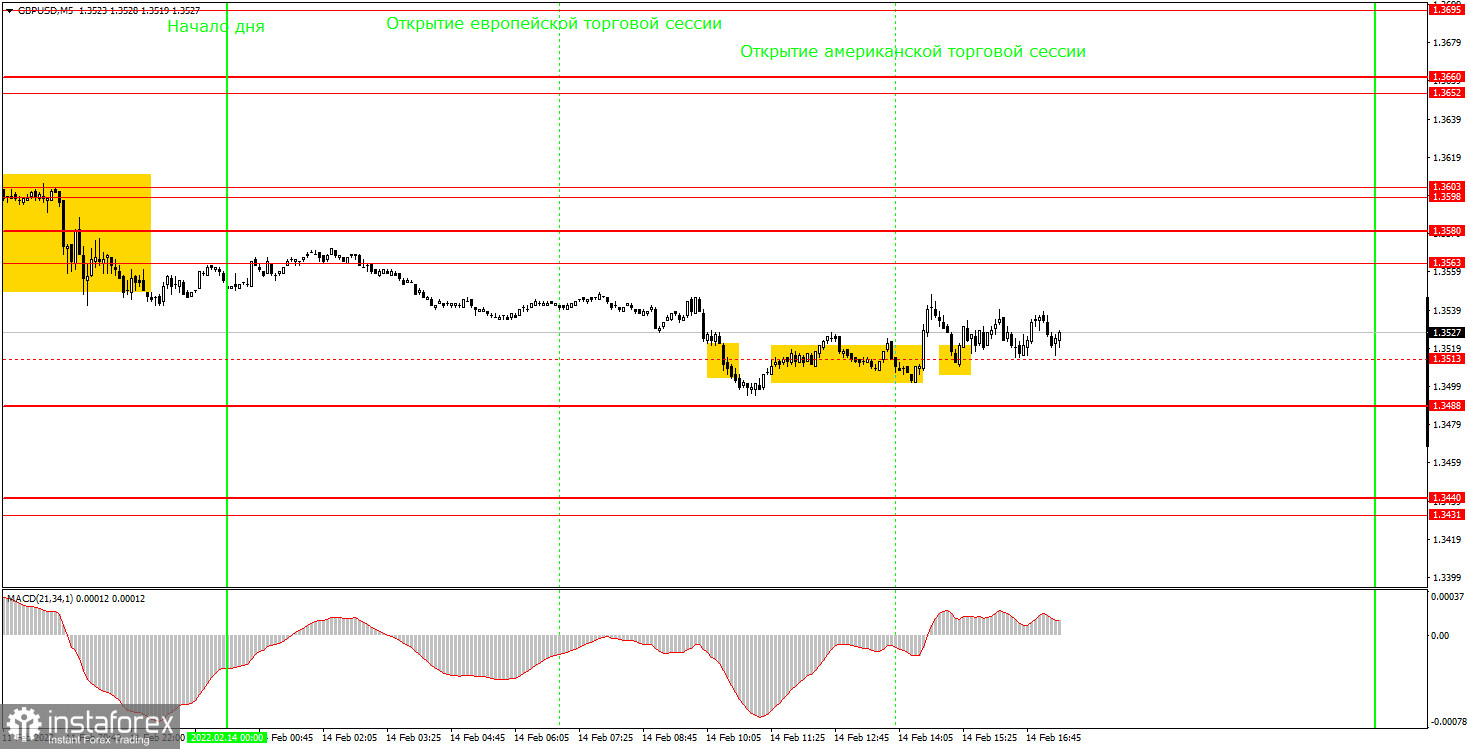

GBP/USD 5M Chart

The technical picture on the 5M chart looks rather complicated. Last week, the pair was stuck in a flat trend, and the start of this week was the same. During the European session, there was a moment when the pair demonstrated some robust movements, but later in the day, it lost momentum. So, the situation is even worse than with the EUR/USD. There are still a lot of levels on the 5M time frame as the price remained in a narrow price range which can be clearly seen in bigger time frames. Naturally, false signals were formed during a flat trend. The first sell signal appeared when the rate broke below 1,3513. After that, the price could not reach the next level which was just 25 pips away from the first level. Consequently, the pair tried to form another signal near 1.3513 but also failed. For several hours, the rate fluctuated alongside this level, unable to break it. At that moment, it became clear that we are unlikely to see any definite trend on Monday, so we just ignored all the signals that were formed near 1.3513.

Trading plan for Tuesday, February 15th:

As seen on the 30M time frame, the upward tendency has been invalidated. The pair has been stuck between 1.3488 and 1.3643 for six days already. We cannot say for sure that the trend is flat, but no directional moves can be seen currently. That is why the pound sterling is likely to be trading in a mixed mode. The target levels on the 5M time frame can be found at 1.3431-1.3440, 1.3488, 1.3563-1.3580, 1.3598-1.3603, 1.3652-1.3660. Set a Stop loss at a breakeven point if the rate goes 20 pips in your direction after opening a trade. Tomorrow, an array of important data from the UK is slated for release including the Unemployment report, the Wages stats, and the Claimant Count Change. At the same time, the market is eager to learn the Fed decision following its special meeting. So, Tuesday is going to be a rather eventful day.

The basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break)/ The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read a chart:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română