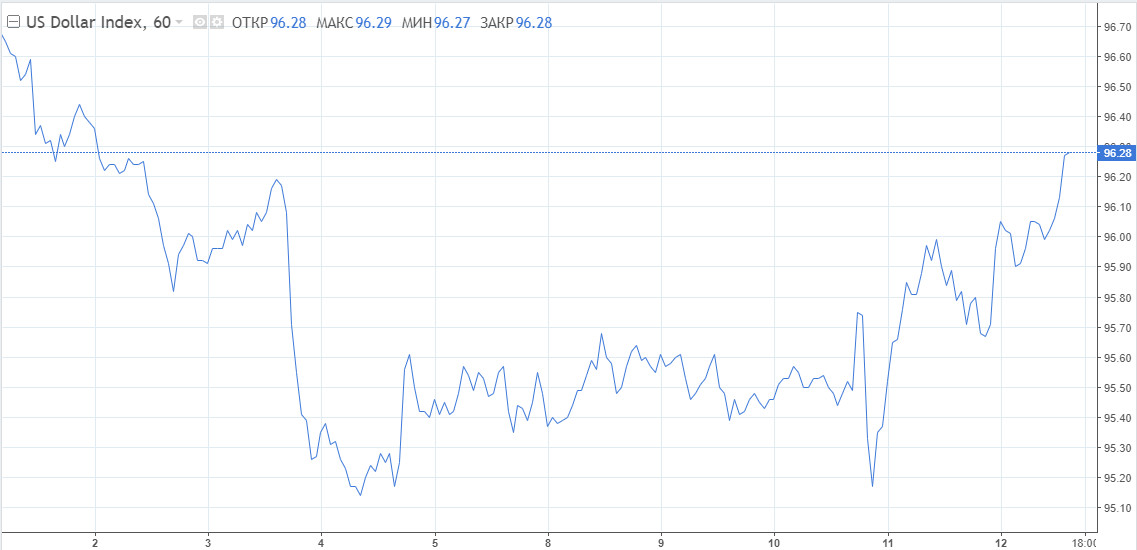

The dollar intensified gains in the US session, with markets on Monday driven by geopolitics and resulting risk aversion. Headlines of a possible Russian military incursion into Ukraine this week are forcing traders to hide in defensive assets such as the dollar.

The tensions eased slightly after Russian Foreign Minister Sergei Lavrov announced specific proposals put forward by the US to reduce military risks. The parties are returning to diplomacy; it looks like another negotiation is ahead. Nevertheless, investors are not yet ready to believe in a positive outcome. Neither negotiations nor attempts to resolve the issues through diplomacy have led nowhere, so risk aversion continues. The markets need more solid evidence, whether it will appear soon is not clear. The only thing left to do is to wait.

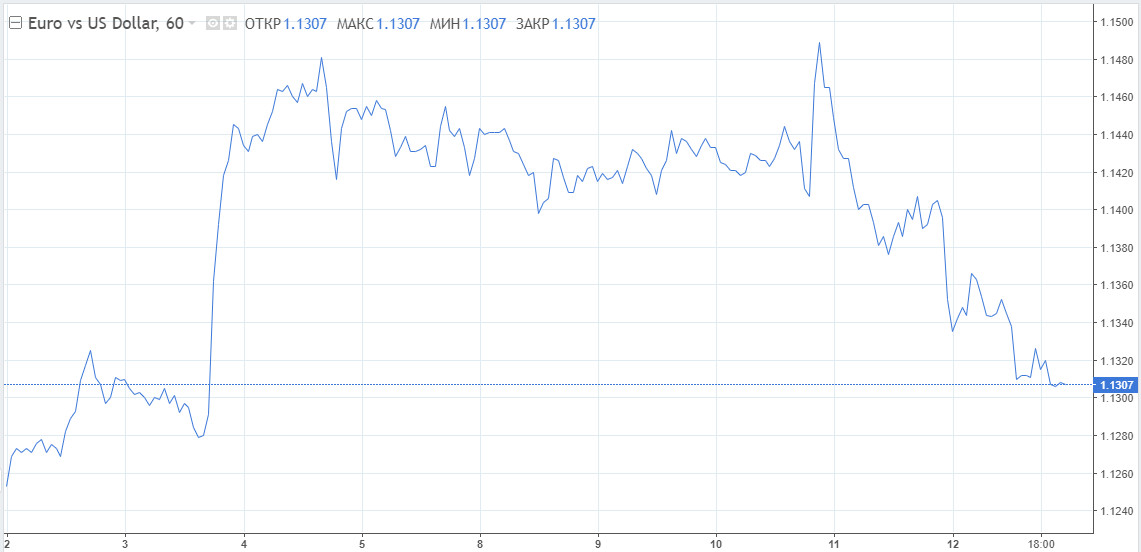

EUR/USD is now largely dependent on the geopolitical factor. If Russia does invade Ukraine, the quote could immediately fall to 1,000, Scotiabank analysts forecast.

On Monday, the euro dropped below 1.1300, but for now it is trying to hold that level. Otherwise, the exchange rate could go lower rather quickly.

The EUR/USD pair shows a bearish mood. At the same time, it would not be correct to talk about a continuation of the downward trend as the euro already looks oversold. A rebound, or a trade, around 1.1300 looks most likely.

Support levels are located at 1.1300, 1.1260, 1.1220. Resistance levels are at 1.1350, 1.1390, 1.1440.

The macroeconomic calendar played no role on Monday as it was in the shadow of geopolitics. Meanwhile, ECB head Christine Lagarde gave a speech to the European Parliament today. Market players are most interested in the future of monetary policy. A reduction in hawkish rhetoric could put further pressure on EUR/USD.

The focus is also on a speech by James Bullard, President of the St Louis Fed. Notably, Bullard is this year's voting member of the Open Market Committee. The official is in favour of raising the key rate by a full percentage point as early as July.

The key event for Forex will be the publication of the minutes of the US Federal Reserve's January meeting, which resulted in the regulator keeping the rate unchanged while signalling for a rate hike at the next meetings. Market players will be looking for more hints on further central bank policy. With a tougher rate hike by the regulator, the dollar could rise even more.

As Bullard pointed out, there was a time when the Fed could have raised the rate by 25bp. "right now". This could also have been the case on Friday immediately after the publication of the record CPI reading. In response to the COVID-19 outbreak, the regulator adjusted policy between scheduled meetings, why wouldn't a similar move be made now.

According to Bullard, such tactics are not overly aggressive and should not upset the markets too much.

The dollar index is renewing highs and rising further, breaking the 96.00 mark. The next target for buyers is at 96.90.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română