EUR/USD

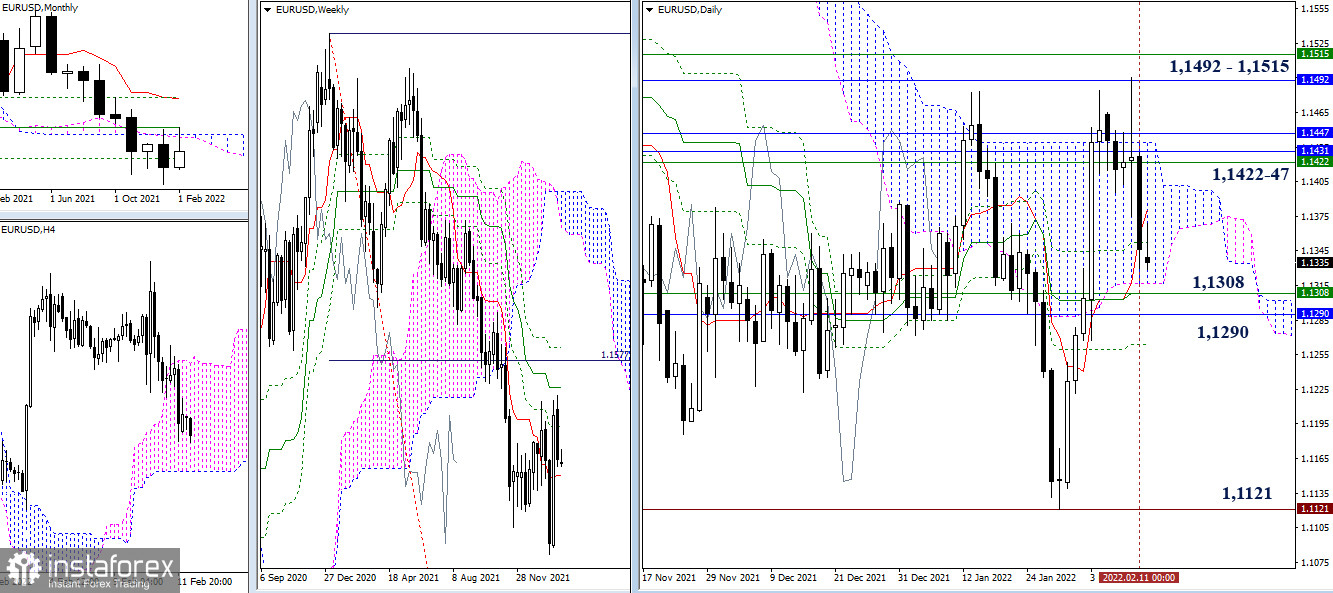

Sellers were able to consolidate their moods last week, but to develop the situation and level out what the opponent had previously achieved, several important levels are necessary to be broken. So, we can see the levels of 1.1308 (weekly short-term trend + daily medium-term trend) and 1.1290 (monthly Fibo Kijun) in the nearest cluster of supports. Their breakdown will allow us to eliminate the monthly golden cross and gain support for the weekly short term. Further, it is important to restore the weekly downward trend (minimum extremum 1.1121).

On the other hand, the two closest resistance zones are still important for the bulls – the accumulation of levels of different timeframes within 1.1422 - 1.1447 and the combination of resistances of medium-term trends (1.1492 monthly + 1.1515 weekly).

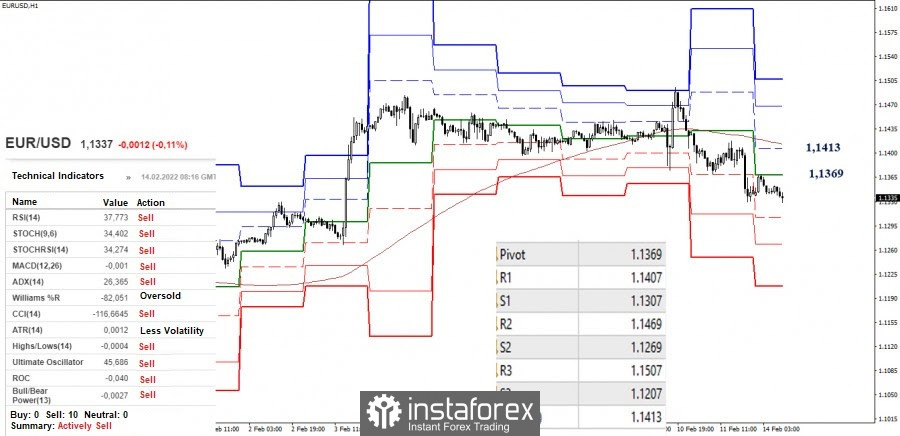

The advantage in the smaller timeframes at the time of analysis belongs to the bears, who updated the last week's low today. The downward intraday pivot points are the support of the classic pivot levels (1.1307 - 1.1269 - 1.1207). The key levels here act as resistance levels set at 1.1369 (central pivot level) and 1.1413 (long-term weekly trend), the breakdown of which can change the current balance of power. After that, it would be better to re-evaluate the overall situation.

GBP/USD

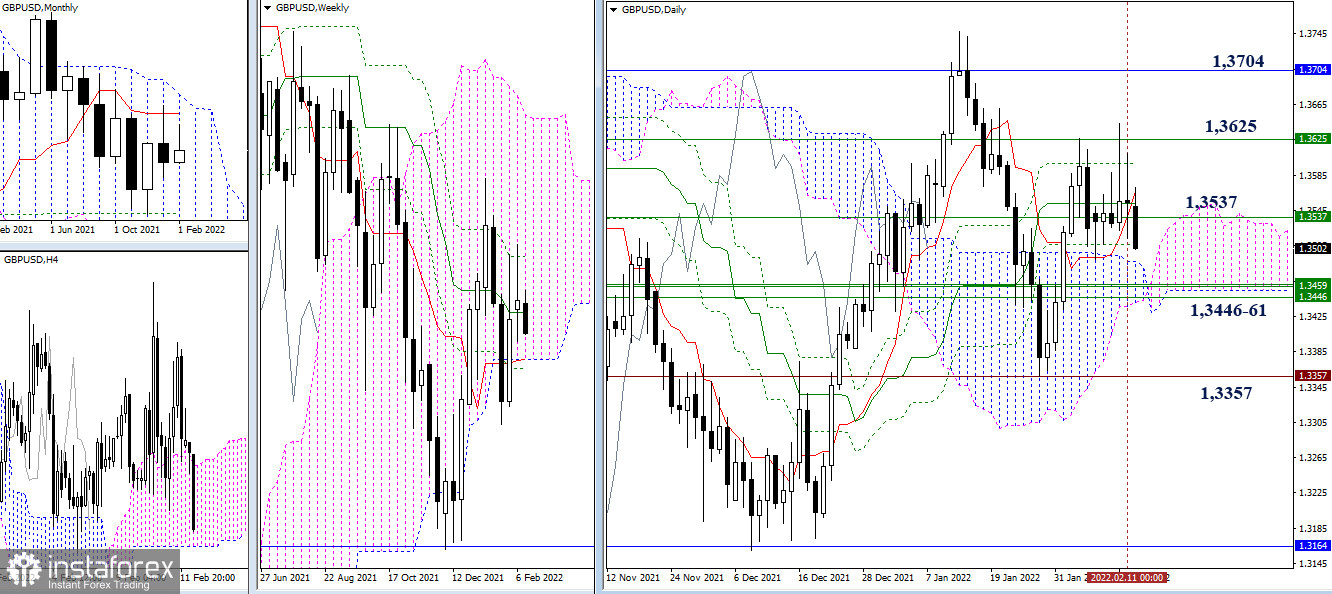

The previous week was marked in history by an uncertainty candle. The most significant pivot points have retained their position, so the main conclusions and expectations announced last week have retained their relevance. The center of the current attraction is still the weekly medium-term trend (1.3537). There are important levels along the way of the development of the movement. For the bears, the area 1.3446 - 1.3461 (daily cloud + weekly levels) and the update of the minimum extremum (1.3357) can be important, while for the bulls, their interests are connected with breaking through the resistance levels of 1.3625 (final level of the weekly dead cross) and 1.3704 (monthly short-term trend).

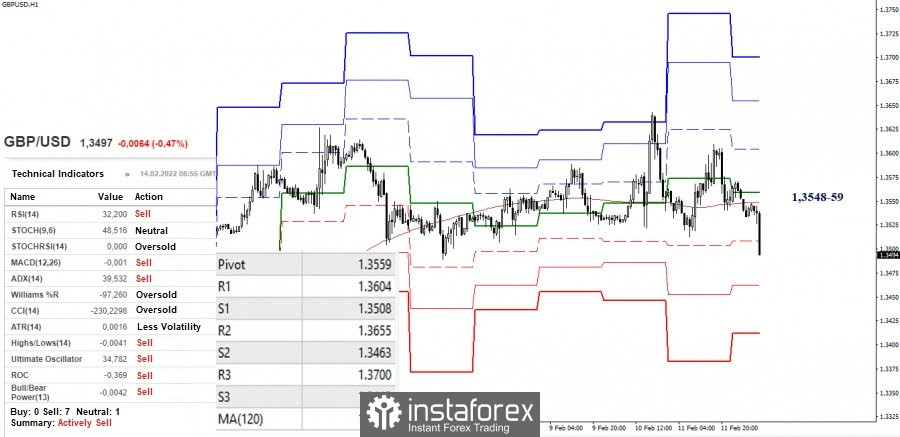

Bearish traders in the smaller timeframes tried to take control of the situation again. The downward pivot points can be noted at 1.3508 - 1.3463 - 1.3412 (support of the classic pivot levels). The key levels here join forces in the area of 1.3548-59 (central pivot level + weekly long-term trend), so a consolidation above them may change the current balance of power.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română