There are components at this time that have created ideal conditions for gold's growth – spiral inflation and geopolitical concerns. The first component was inflation data, which showed that the consumer price index rose to 7.5% in January. The second one was geopolitical tensions, which continue to escalate.

On Friday, gold prices reached their highest level in the last two months.

Consumer price data confirmed what working Americans already know: the cost of goods and services continues to spiral out of control and puts even more pressure on the average American to meet the financial needs of their households, as the price of necessities continues to rise.

Last Thursday, the Labor Department released its consumer price index for January, which was higher than the forecasts of economists polled by Bloomberg News. Expectations from their forecast assumed that inflationary pressures would increase to 7.3%, respectively, the net result of the increase in January will be 0.4%. According to the estimates of economists surveyed by Dow Jones, an annualized growth of up to 7.2% was expected in January.

The actual figures were much higher than both forecasts, with the consumer price index for all goods rising 0.6% in January, leading to an annual inflation rate of 7.5%. This is the biggest inflationary increase since February 1982.

Similarly, Friday's rally in gold is also a reflection of geopolitical tensions.

According to the data of the University of Michigan on Friday, the consumer sentiment index declined to a 10-year low of 61.7. At the same time, the report notes that consumers expect inflation to remain at around 5% by the end of 2022.

The report also says that rising inflation has been the biggest drag on consumer sentiment.

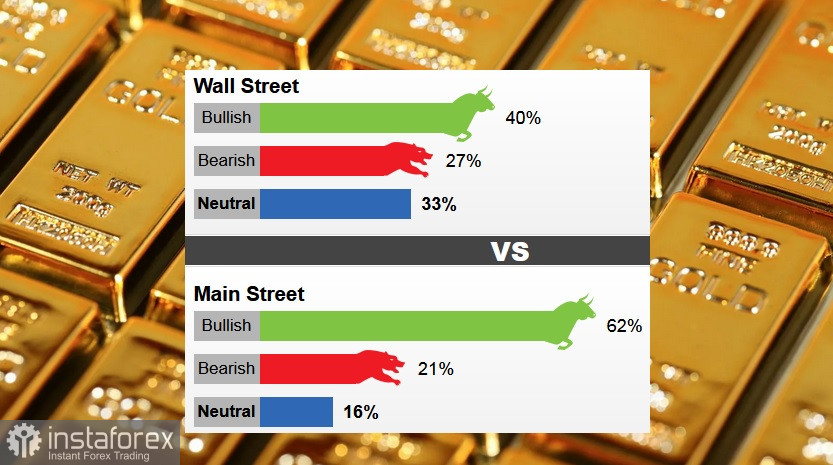

Last week, 15 Wall Street analysts took part in the gold survey. Among the participants, 6, or 40%, voted for price growth this week. At the same time, four analysts, or 27%, believe that prices will decline, while five analysts, or 33%, were neutral.

In online polls on Main Street, 597 votes were cast. Of these, 373 respondents, or 62%, expect gold to rise this week, while 128 voters, or 21%, were in favor of price reduction. At that time, 96 voters, or 16%, were neutral.

Gold is not only an attractive means of preserving well-being for consumers, but some analysts note that rising bond yields and interest rate expectations increase market volatility, and the yellow metal is also a good means of hedging risks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română