Global markets ended the past week with the strongest one-time drop in stock indices, primarily in the United States, which already collapsed amid the previously presented inflation data and pulled the markets down.

The United States and the West as a whole continue to play up the topic of geopolitical tensions in the media, trying to take control of the entire information space, but it seems that investors have not yet reacted to this, except for the crude oil market, but this is a different story. The topic of the Fed's interest rate hikes remains in focus. Investors have completely revised their views on the rate increase rates after the publication of the CPI data, which rose to 7.5% against the forecast of 7.3% and the previous value of 7.0%. According to the dynamics of futures on federal funds rates, it is believed that the Fed will raise the key interest rate not by 0.25%, but immediately by 0.50% at the March meeting.

Considering the current situation, there is a rumor that an emergency meeting of the US regulator may be held today and rates will be raised. If this happens, we can expect the continuation of a strong collapse of the US stock market, which will be transmitted to other global stock markets. Time will tell how it will be, but in the context of high US inflation, which soared to the level of the last quarter of the 20th century, anything can be expected.

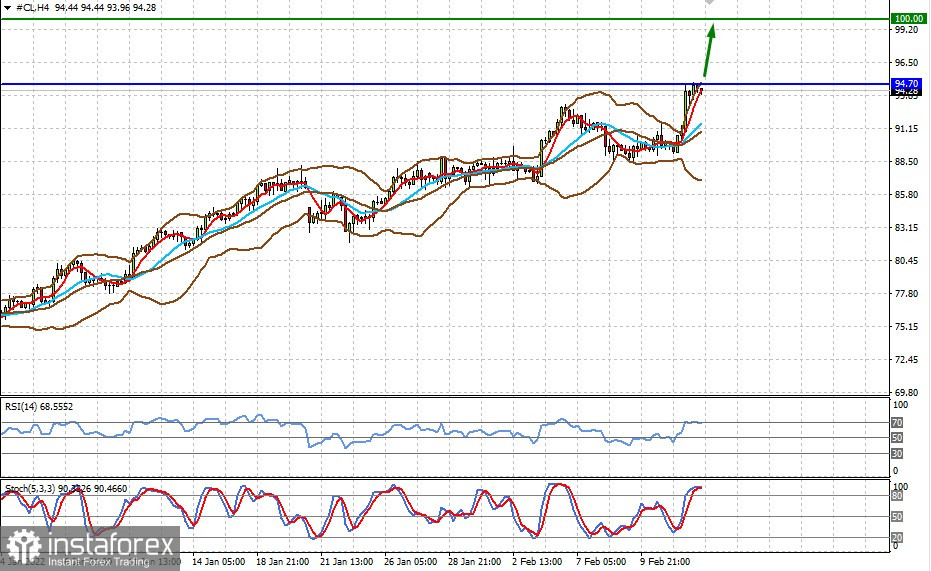

The crude oil market is reacting to the unprecedented rise in geopolitical tensions between the US and Russia with a surge in crude oil prices. Earlier, prices for Brent and WTI crude rose by 1.16%, to 95.54, and 1.30%, to 94.31 dollars per barrel. Gold, silver, and other industrial metals are also rising. According to the ICE index, the US dollar in the currency market receives support, albeit not so significant. One gets the impression that the markets are either waiting for something or consider everything that is happening on the part of Washington to be only a factor of external pressure amid the negotiation process that is already underway.

Oddly enough, the opinions of some market participants appear in the media, who believe that the rate of inflation growth in the US should slow down sharply.

Observing everything that is happening, we believe that it is necessary to follow the political news very closely since they are currently playing a leading role in influencing the situation on the markets. It should also be understood that any unexpected easing of tensions will lead to a sharp increase in demand for risky assets and a weakening of the US dollar.

Forecast for the day:

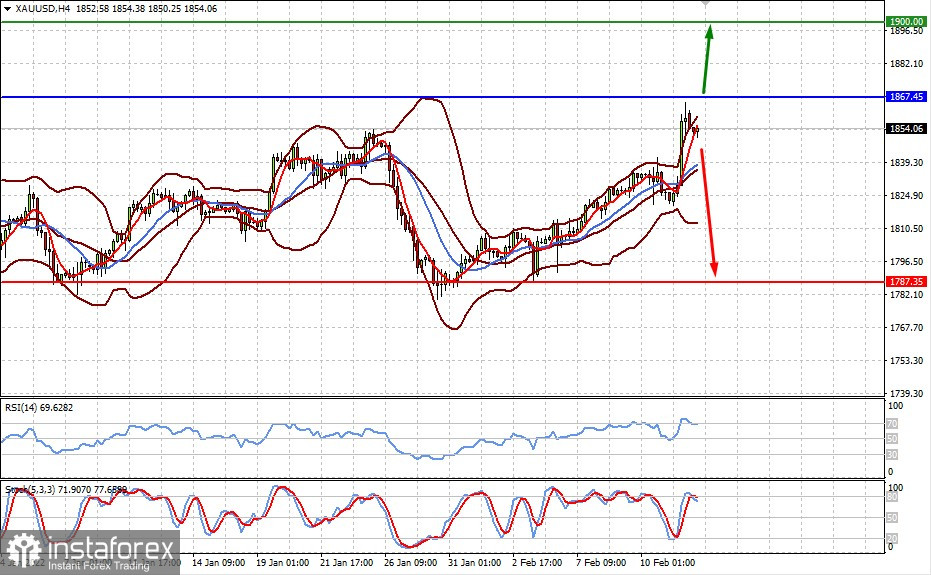

The continuation of tension will stimulate the price growth of gold as a protective asset. In this case, the breakdown of the level of 1867.45 will lead to a rise to 1900.00. But if the tension weakens, then the price of the "yellow metal" will collapse by 1787.35.

The price of American WTI oil has every chance to continue growing at around $100.00 per barrel, provided that the geopolitical tensions persist and the strong resistance level of 94.70 is broken.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română