The pound-dollar pair cannot determine the vector of its movement. The price has been "walking" in a fairly wide price range for several months, and the dynamics are undulating. There was another rise in October 2021 - traders conquered the 38th figure, but only for a few days. This was followed by a large-scale recession, which ended in early December. The GBP/USD bears made an almost 700-point march, pulling the price to the 1.3150 mark. However, they were not destined to enter the area of the 30th figure: the US currency once again fell under a sell-off, after which the GBP/USD pair went up again. As part of the next upward wave, the price has updated the current year's high, having been designated at 1.3750. This target turned out to be the "ceiling" of the widest price range – at this level, the bears once again seized the initiative from the bulls, and since then they have been trying to repeat the autumn success.

Looking ahead, it is worth noting that bearish successes leave much to be desired. Even despite the general strengthening of the greenback, the pound staunchly holds the defense, not allowing bears to go below the 35th figure. Over the past two weeks, the peculiar battlefield has narrowed to 150 points. GBP/USD bulls are trying to settle within the 36th figure, bears are trying to decline below the support level of 1.3500. And at the moment, both sides of the confrontation look like losers. None of them fulfilled their "task": starting from February 2, the pair stormed the 36th price level four times, but returned back each time. Downward attempts to "escape" also ended in failure. Therefore, at the moment, both short and long positions on the pair look risky, especially on the eve of the publication of British inflation (the release is scheduled for next Wednesday).

It is noteworthy that this week the most important macroeconomic reports failed to push GBP/USD beyond the 35th figure. For example, the US inflation did not impress the pair's traders at all. Moreover, in many other currency pairs, the greenback, after a short pause, still began to gain momentum (for example, EUR/USD), whereas it could not show character in the GBP/USD pair. But the very contradictory data on the growth of the British economy, which was recently published, were interpreted in favor of the pound.

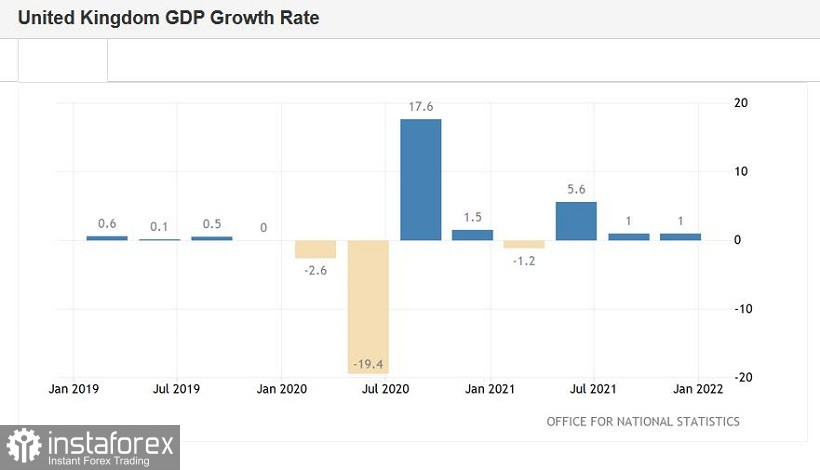

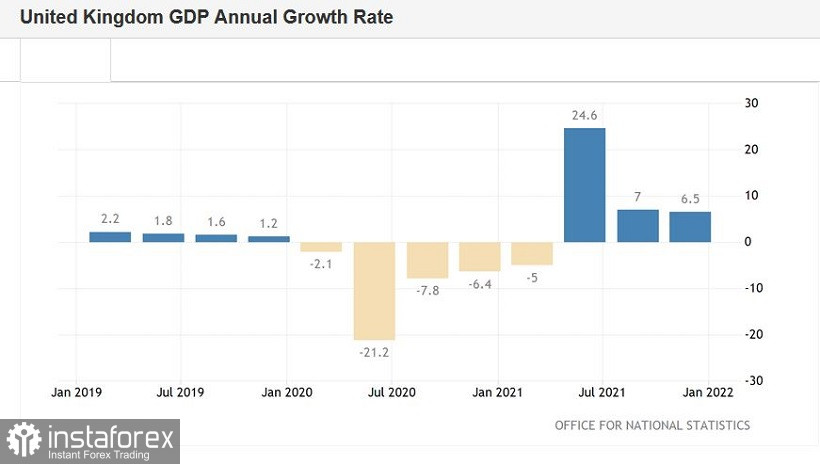

Thus, the British economy grew by 1% on a quarterly basis in the fourth quarter (as in the third quarter). Most experts expected to see this indicator slightly higher (at around 1.2%). In annual terms, the indicator slowed down to 6.5% (from the previous value of 7.0%). However, in this case, analysts predicted a sadder result, at the level of 6.3%. On a monthly basis, the volume of GDP in December decreased by 0.2% (an increase to 0.7% was recorded in November). But again, according to most experts, the decline should have been deeper, so this component came out in the green zone. The indicators of industrial production showed a contradictory result: on a monthly basis, the indicator slowed down to 0.3% (with a forecast of a decline to 0.1%), while on an annual basis it came out of the negative area and reached 0.4% (with a forecast of growth to 0.6%). A similar situation has developed in the processing industry: with a forecast decline to -0.1%, production increased by 0.2% (on a monthly basis). And on the contrary, in annual terms, with the forecast of growth to 1.7%, the indicator rose only to 1.3% (although in November it was below zero). In the construction sector, both indicators also came out in the green zone - both in annual and monthly terms. But in the service sector, despite the weakening of quarantine, the indicators could not reach the forecast levels.

As you can see, the results are really quite contradictory – they could be interpreted against the British currency. On the other hand, there was nothing catastrophic in today's release. And this was enough for the GBP/USD bulls to organize another counterattack.

It should be noted here that the Bank of England is one of the few central banks that has outstripped the Federal Reserve in terms of raising interest rates (before the pound, only the kiwi did this). Therefore, the pound enjoys support not only from macroeconomic reports, but also from the actions of the British central bank. The only question is how aggressive the pace of rate hikes will be this year. Fed Chairman Jerome Powell allowed a consistent rate increase at literally every meeting. After the release of data on the growth of inflation in the United States, traders also assumed that in March the Fed would decide on a 50-point increase. The BoE, in turn, is voicing more restrained rhetoric. In particular, BoE Chief Economist Huw Pill said that the central bank would apply a "balanced approach to political decisions." At the same time, he was skeptical about the likelihood of a "quick return" of the rate to a certain level. Similar rhetoric was previously voiced by his colleagues. According to currency strategists at Nomura Holdings, the BOE will raise the rate by 25 basis points on a quarterly basis.

However, such a scenario may change, both in the hawkish direction and in the opposite direction. Much will depend on the dynamics of inflation and labor market indicators. That is why the key release for the pound, which will be published next week (Wednesday), will determine the fate of the British currency – including in pairs with the dollar. The overall consumer price index showed strong, consistent growth in annual terms for almost the entire last year. Since September 2021, a spasmodic dynamics has been recorded. If next week the indicator "slackens" for the first time in many months, that is, it shows a slowdown, the pound will collapse throughout the market. And vice versa – the "green color" of the release will help bulls not only to gain a foothold within the 36th figure, but also to claim the 37th price level.

Thus, given the trading dynamics of GBP/USD, it is impossible to talk about the priority of the upward or downward scenario. Therefore, you can either take a wait-and-see position on the pair, or go into short positions on the upward spikes, when approaching the 1.3650 mark. I believe that before the release of the British inflation report, the pair will continue to trade in a wide price range of 1.3500-1.3650.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română