Markets reacted quite violently to yesterday's publication of inflationary indicators for the US. Immediately after it, the dollar strengthened sharply, but then moved to a decline. With intraday volatility of 85 points, the DXY dollar index returned to its opening levels by the end of yesterday's trading day, and the yield on 10-year US government bonds reached a new high yesterday since August 2019, exceeding 2.00%.

It is characteristic, however, that futures for the dollar index (DXY) opened today's trading day with a gap up, and futures for the main US stock indices again moved down.

According to the US Department of Labor on Thursday, the consumer price index (CPI) in January rose by 0.6% and by 7.5% in annual terms. The data beat out forecasts that had expected a 7.2% YoY increase in CPI after rising 7.0% in December. This is the 8th month in a row that the annual inflation rate has exceeded 5%, nearly 4 times the Fed's target of 2%.

The US inflation data released on Thursday, which may affect the pace and scale of the Fed's interest rate hike, has significantly increased market uncertainty. Along with the acceleration of inflation, investors' concern is growing that the Fed may not be able to cope with the rate of inflation, and this threatens hyperinflation, which can have a catastrophic effect on both the dollar and the prospects for the entire American economy.

On the eve of yesterday's publication, two members of the Fed's leadership made statements regarding the prospects for the Fed's monetary policy. Cleveland Federal Reserve President Loretta Mester said that decisions on a new rate hike can be expected from any Fed meeting this year, but noted that if prices start to decline, the number of rate increases could be reduced. Atlanta Federal Reserve President Raphael Bostic also confirmed that he expects three or four rate hikes this year, and everything will depend on the market reaction to the actions of the central bank. Although both of them said that the first March increase is likely to be small (+0.25%), many economists suggest that the Fed will act more aggressively, and the March increase could be +0.50% or even +0.75%.

Thus, as we noted above, after yesterday's publication of the CPI indices, the uncertainty on the market has increased. Still, many economists believe that the dollar has a lot of upside potential, especially against the currencies of countries whose central banks are unlikely to raise interest rates quickly. This primarily applies to the ECB.

In January, annual inflation in the Eurozone was 5.1%, while inflation in the UK in December was 5.4%, and in the US 7%. The accelerating rise in inflation in the Eurozone seems to have come as a surprise to the ECB and fueled speculation that the ECB may be forced to hike interest rates sharply to curb inflation. Economists attribute higher inflation to crisis-related factors such as supply problems and significant price increases as a result of the economic recovery, as well as high energy prices.

However, ECB President Christine Lagarde signaled earlier this week that there is a danger of tightening monetary policy too quickly even as Eurozone inflation remains high. Economists expect the ECB to make its first rate hike (by 25 basis points) in December.

Pressure on the euro's position is also exerted by weak data released at the beginning of the week from Germany, whose economy is the locomotive of the entire European economy. According to these data, the volume of industrial production in December decreased by 0.3% (forecasts suggested an increase of 0.4%). In annual terms, the rate of decline in production accelerated from -2.2% to -4.1%, which also turned out to be worse than the forecast of a drop of -2.4%.

Thus, the divergence of the curves that reflect the dynamics of the monetary policies of the Fed and the ECB will increase over time. And this is one of the most important factors in favor of further strengthening of the USD, if, of course, the Fed manages to quickly cope with accelerating inflation as a result of these actions.

Today, market participants will pay attention to the publication (at 15:00 GMT) of the preliminary index of consumer confidence from the University of Michigan. This indicator reflects the confidence of American consumers in the economic development of the country.

A high level indicates economic growth, while a low level indicates stagnation. Previous indicator values: 67.2 in January 2022, 70.6 in December, 67.4 in November, 71.7 in October, 72.8 in September 2021. An increase in the indicator will strengthen the USD, and a decrease in the value will weaken the dollar. The data shows uneven recovery of this indicator, which is negative for the USD. Data worse than previous values may have a negative impact on the dollar in the short term. However, the relative growth of the indicator (according to the forecast, the value of 67.5 is expected) should support the dollar quotes, including in the EUR/USD pair, which is trading near 1.1390 at the time of publication of this article, just above the important short-term support level of 1.1386. Its breakdown will be a signal for the resumption of short positions.

Technical analysis and trading recommendations

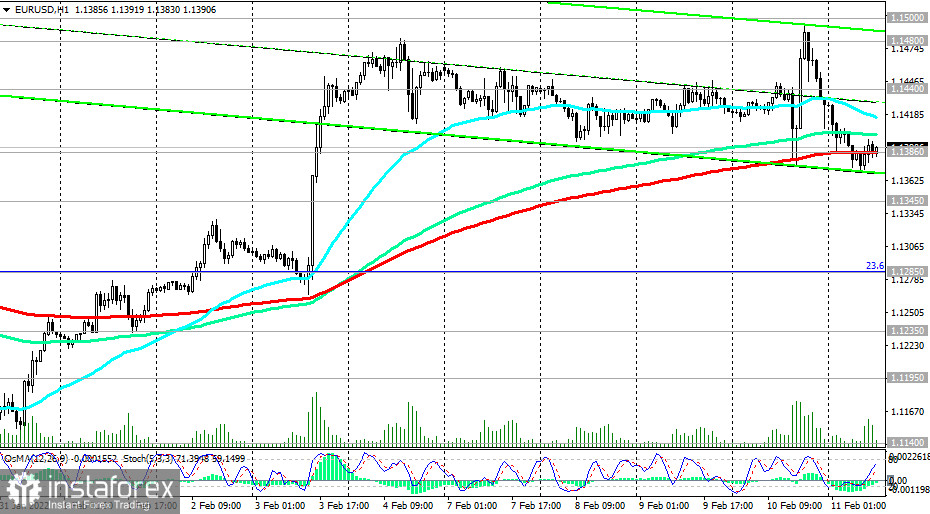

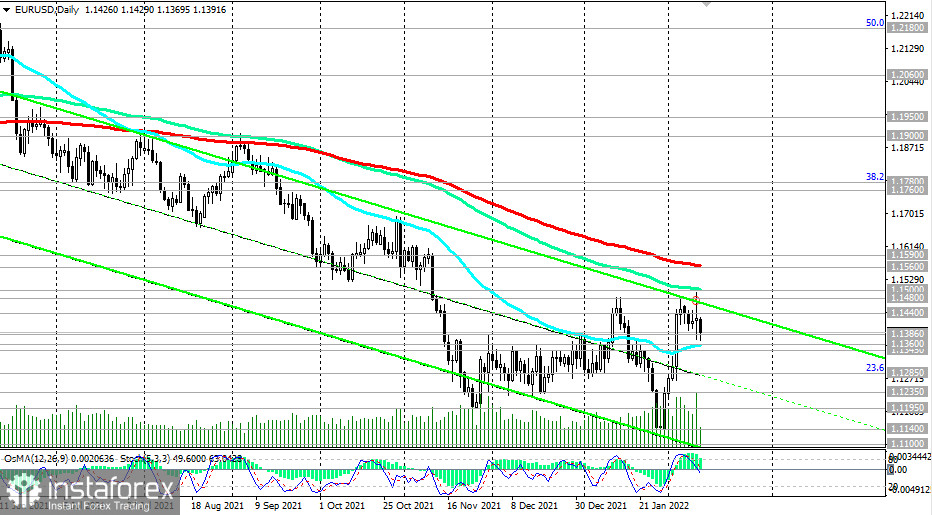

EUR/USD failed to develop an upward trend above the resistance levels of 1.1480, 1.1500 (144 EMA on the daily chart). Today the pair is falling again, moving inside the descending channel on the daily chart. A sell signal will be a breakdown of the important short-term support level 1.1386 (200 EMA on the 1-hour chart). The immediate downside targets are at support levels 1.1360 (50 EMA on the daily chart), 1.1345 (200 EMA on the 4-hour chart).

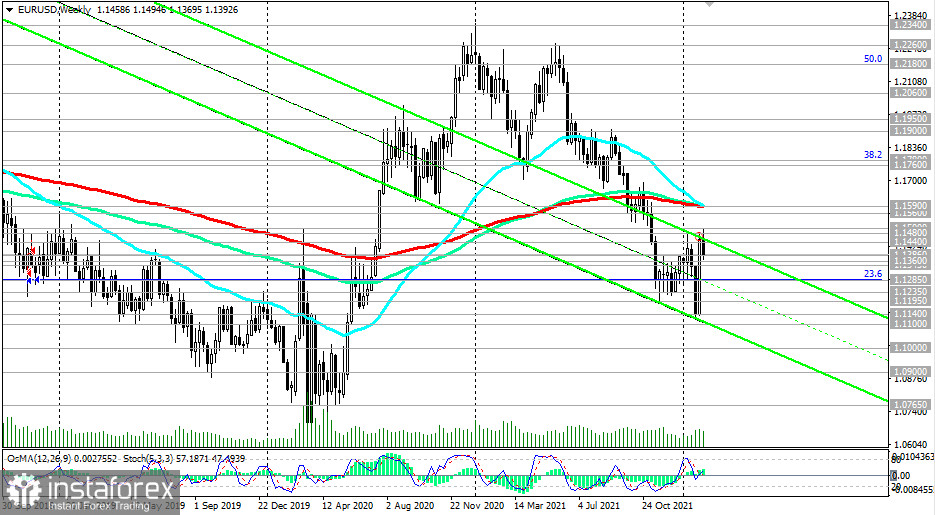

Their breakdown will strengthen the downward dynamics and send EUR/USD towards 1.1140 (local and January lows), 1.1100 (lower limit of the downward channel on the weekly chart).

In an alternative scenario, EUR/USD will again attempt to grow towards the key resistance levels of 1.1560 (200 EMA on the daily chart), 1.1590 (200 EMA on the weekly chart). In turn, their breakdown may return EUR/USD to the zone of a long-term bull market with the prospect of growth to the resistance levels of 1.1760 (200 EMA on the monthly chart), 1.1780 (38.2% Fibonacci level of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014, to 1.0500).

In our main scenario, the growth of EUR/USD will still be limited by the resistance levels of 1.1500, 1.1560, 1.1590, while short positions remain preferable.

Support levels: 1.1386, 1.1360, 1.1345, 1.1285, 1.1235, 1.1195, 1.1174, 1.1100, 1.1000, 1.0900, 1.0730

Resistance levels: 1.1440, 1.1480, 1.1500, 1.1560, 1.1590

Trading Recommendations

Sell in the market. Stop Loss 1.1450. Take-Profit 1.1360, 1.1345, 1.1285, 1.1235, 1.1195, 1.1174, 1.1100, 1.1000, 1.0900, 1.0730

Buy Stop 1.1450. Stop Loss 1.1365. Take-Profit 1.1480, 1.1500, 1.1560, 1.1590

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română