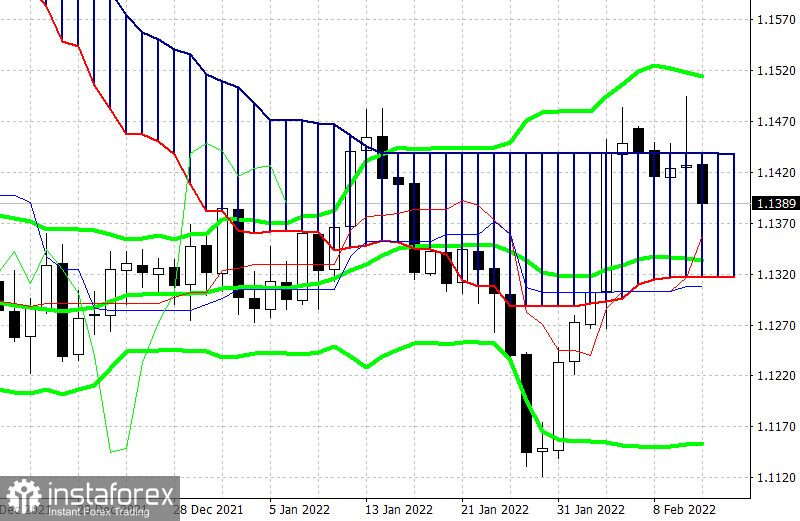

The EUR/USD pair made a quite unusual turn yesterday: it initially declined by about 50 points amid record growth in US inflation, and then showed a 100-point surge, approaching the borders of 1.15 level. Such price dynamics were clearly strange since yesterday's release did not allow any discrepancies. All indicators came out in the green zone, and year-on-year updated multi-year records. There were no "pitfalls" in this case: both general inflation increased (due to a significant increase in the cost of energy resources) and the core inflation index, which does not include volatile food and energy prices. Therefore, it is simply impossible to analyze the January report in any other way. Inflation is growing more and more and even ahead of the bold experts' forecasts. That is why the EUR/USD pair reversed and headed towards the bottom of 1.14 before Thursday closed. During the Asian session on Friday, the price went to the area of 1.13.

Yesterday's release reinforced hawkish expectations about the Fed's next steps. In particular, experts from the financial holding Wells Fargo & Company said that the US regulator will immediately raise the interest rate by 50 basis points after the results of the March meeting. At the same time, analysts warn that US inflation is likely to slow down in a few months, as the low base effect will weaken significantly. In addition, recent publications suggest that the overall growth in spending is showing a downward trend and is shifting towards services, so inflation in goods is likely to slow down in the next few months.

However, the currency market does not look at the long-term but operates with more short-term events. And the next most significant event for the USD bulls is the Fed's March meeting, at which the regulator will take the first step towards tightening monetary policy and determine its prospects. It can be recalled here that after the results of the January meeting, Fed Chairman Jerome Powell allowed the option of raising the interest rate "at every meeting this year." But at the same time, he noted that the Central Bank will monitor the dynamics of key macroeconomic indicators, primarily in the field of inflation and the labor market. That is, he connects the pace of monetary tightening to the main economic indicators.

In this context, it should be noted that the latest releases contribute to the fact that the American regulator adheres to an aggressive line of behavior. And although the February Nonfarm will still be published before the March meeting, the fundamental picture is currently in favor of the Fed's hawkish actions. The US inflation in January accelerated to multi-year highs (not only the general CPI, but also the core), and the number of employed increased by half a million, contrary to negative forecasts. At the same time, the average hourly wage in the country rose to 5.7% year-on-year, which is the best result since June 2020. There is also growth to 0.7% in monthly terms, which is the strongest growth rate since May 2021. Before that, the most important inflation indicator for the Fed, PCE (the strongest growth rate since 1989), was released in the "green zone". Yesterday's release only added to the picture – the consumer price index (both core and general) reached a 40-year high.

In other words, the current fundamental picture speaks in favor of further strengthening of the US dollar at least in pair with the euro. There are too many factors on one scale. The January inflation release will allow Fed members to voice more hawkish rhetoric. At the beginning of this week, the head of the Federal Reserve Bank of Atlanta, Raphael Bostic, said that it is necessary to raise the interest rate four times this year. However, he did not rule out a more aggressive pace of monetary tightening. For now, he is confident of a 25-point rate hike at the March meeting, but at the same time he is "leaving all other options open." We believe that the next records of US inflation will force the Fed members to take more decisive steps to curb it.

In turn, the euro is still hopeful. The translucent tacit hints of ECB President Christine Lagarde allowed the euro to soar at the end of the January meeting but did not allow the US dollar to develop an upward trend in the pair. After leaving the borders of the 15th mark, EUR/USD buyers stepped back. In such conditions, the downward reversal was predetermined, which was only a matter of time. Yesterday's inflation release was a kind of trigger.

Therefore, it is still advisable to use any upward surges in the pair to open short positions. The nearest downward target is 1.1330 (middle line of the Bollinger Bands indicator on the daily chart). The next price limit is the target of 1.1310 (lower border of the Kumo cloud on the same timeframe). The breakdown of this support level will open the way to the area of 1.12.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română