Thursday was a bad day for US stocks and a lot of other stocks. The market was looking forward to the US inflation report for January, and when it did, it was shocking. All forecasts predicted an inflation growth from 7.0% to 7.2%, but the figure actually rose to 7.5%. Such a figure has not been seen in America for more than 40 years. Therefore, all instruments analyzed showed a negative trend in yesterday's trading.

It is also worth noting that the consumer price index, excluding food and energy prices, also increased and exceeded market expectations, amounting to 6.0% y/y. In addition, reports on applications for unemployment benefits were released yesterday. The number of initial requests for the reporting week amounted to 223 thousand, while the market expected 227 thousand. At the same time, the number of repeated applications amounted to 1621 thousand, while 1615 thousand were expected.

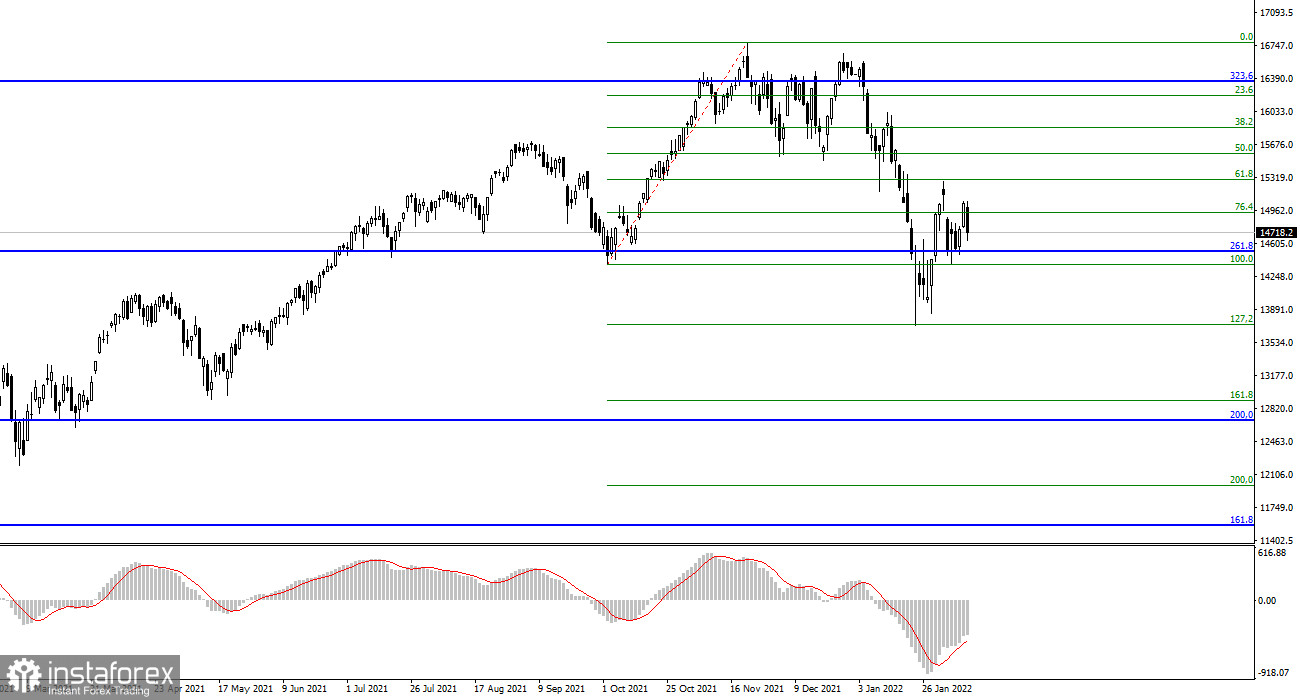

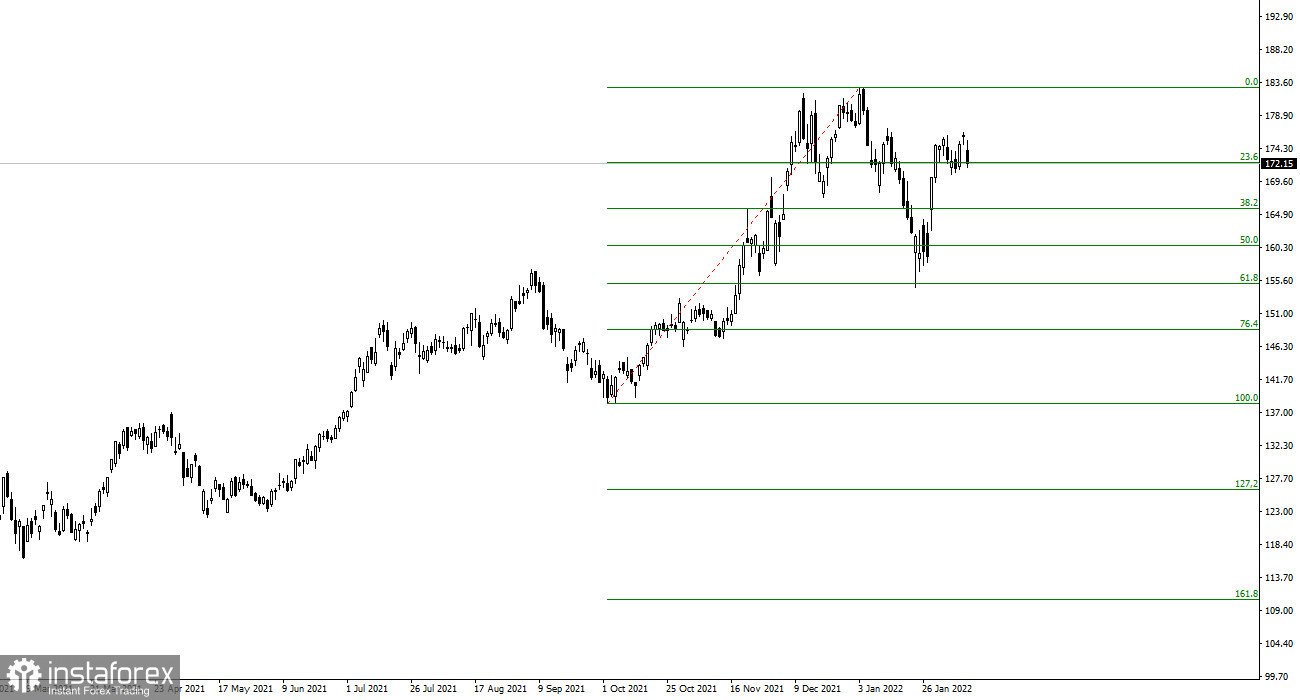

NASDAQ Composite Index

The NASDAQ Composite declined by 280 points and closed at 14,718 on Thursday. The index is currently above 14534, which equates to 261.8% Fibonacci. It retains chances for growth above this level, but under the influence of strong external factors, all US indices will show approximately the same dynamics.

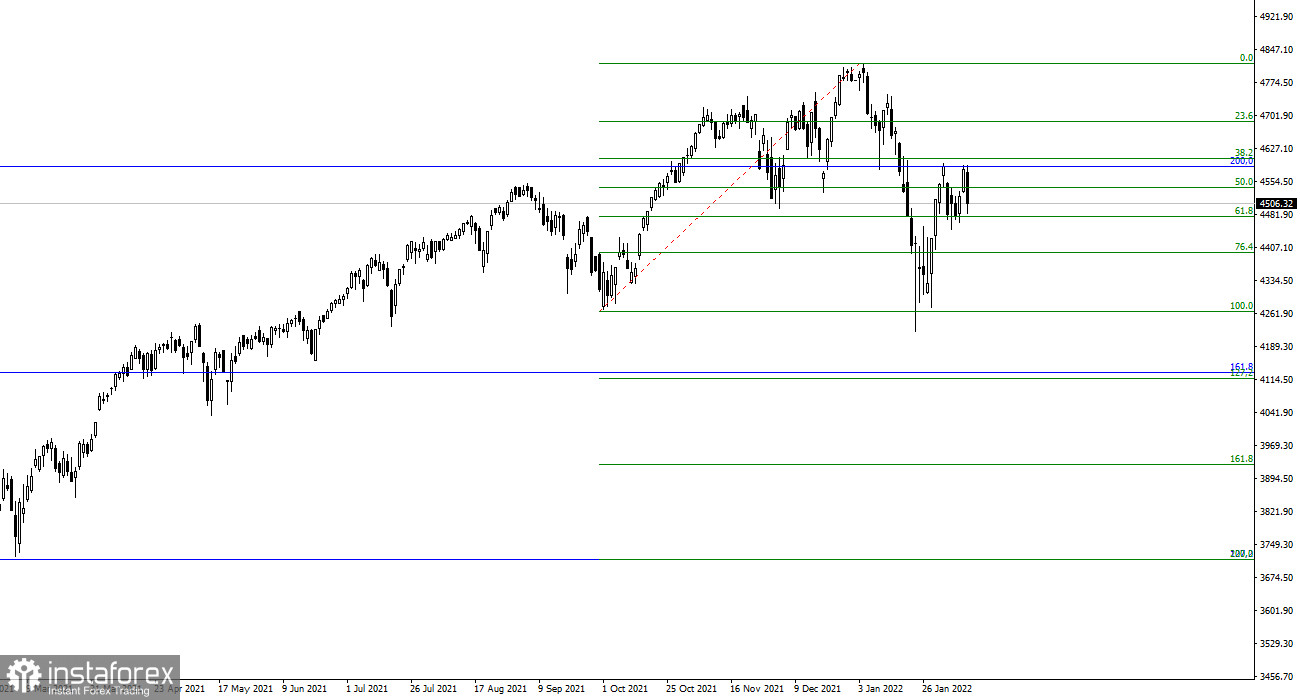

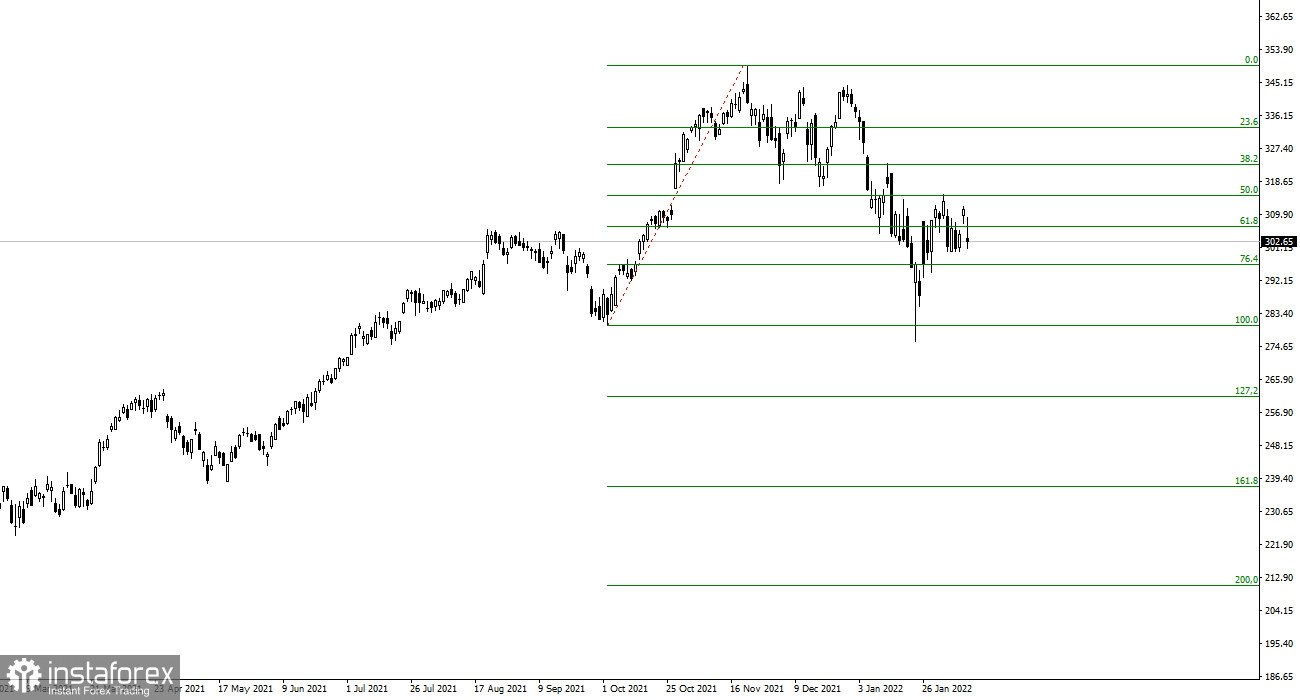

Standard & Poor's 500 index

Yesterday, the Standard & Poor's 500 index fell 73 points and closed at 4506. A new unsuccessful attempt to break through the level of 4586, which corresponds to 200.0% on the upper Fibonacci grid, led to new sales of the instrument. It is assumed that sell signals are now stronger than buy signals for all indices.

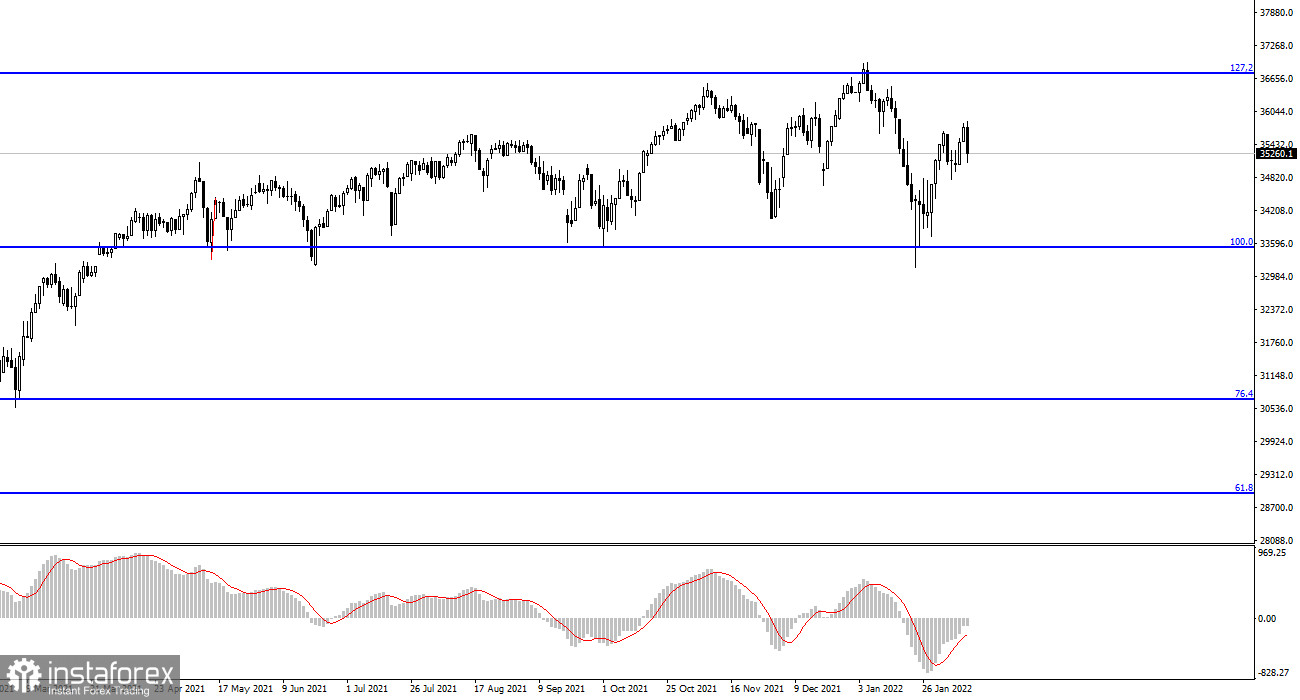

Dow Jones Index

The Dow Jones index built the smallest correction wave, which ended near the estimated level of 33525, which corresponds to 100.0% Fibonacci. The levels are broken almost perfectly, but there are no auxiliary levels between them to search for local signals. It is necessary to focus on signals for other instruments with a high correlation with Dow Jones.

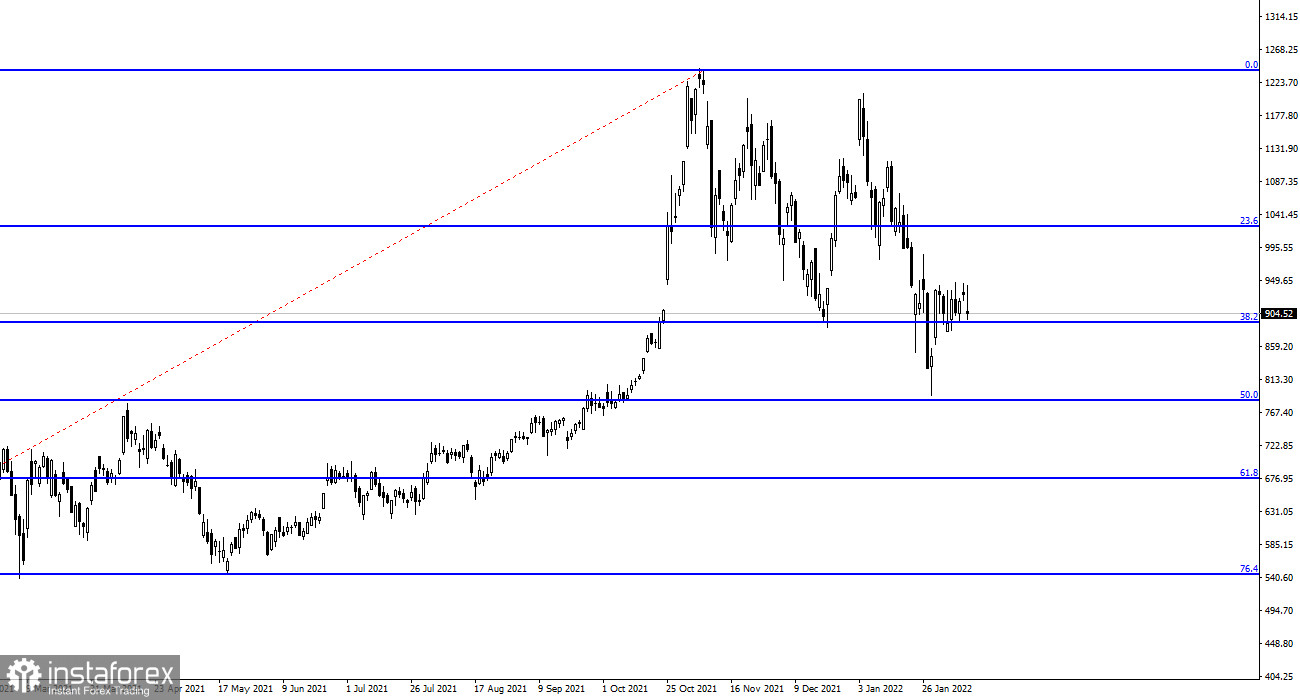

Tesla

Tesla shares plunged by $27, and there are no signals for this instrument either. A successful attempt to break through the level of $891 may indicate that the market is ready for new sales of shares of Elon Musk's company with a target around the $783 mark, which corresponds to 50.0% Fibonacci.

Microsoft

Microsoft shares can also continue to decline at any time after a failed attempt to break through the level of $314, which equates to 50.0% Fibonacci. Tech giants are suffering the most from the Fed's plans to raise interest rates in 2022.

Apple

Apple shares felt the most confident. They began to form a new upward wave after dropping to $155, which corresponds to 61.8% Fibonacci, which has already returned the level to the highs of the year. So far, there are no sell signals.

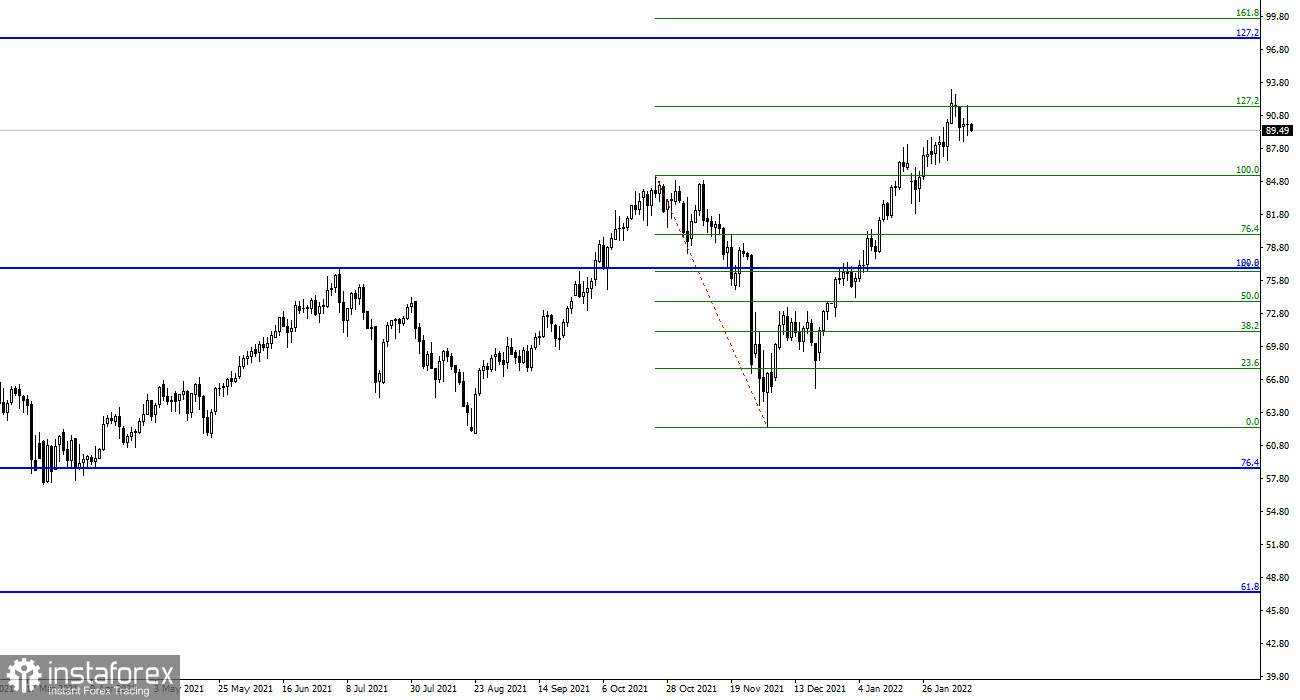

Oil

Oil's price continues to rise and slightly stopped near the estimated level of $91.64, which equates to 127.2% Fibonacci. A successful attempt to break this level will allow oil to further increase to targets around the $97.75 mark.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română