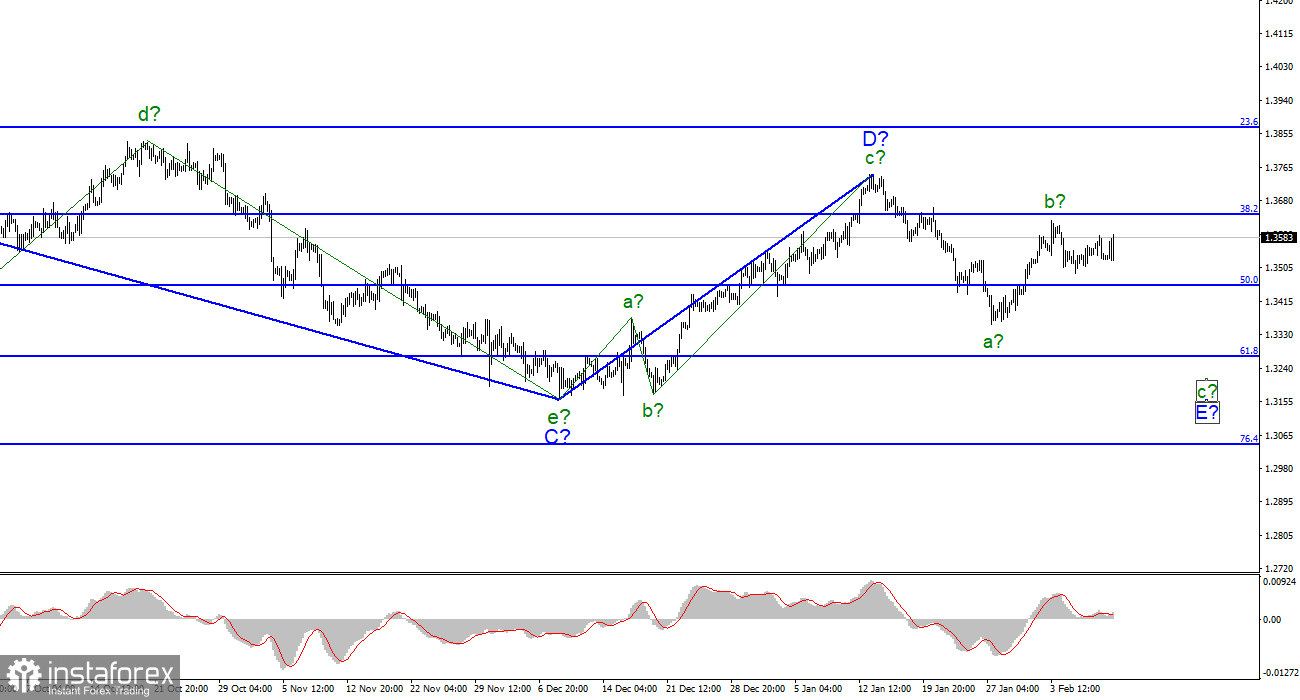

The wave pattern for the Pound/Dollar instrument continues to look very convincing, but it may change in the near future. The increase in today's quotes complicates the expected wave b and it turns out to be longer and stronger than wave a. This conclusion suggests that the instrument is still trying to build a new upward section of the trend, and not to continue building a downward correction. In this case, the assumed wave D will be interpreted as the first wave of the correction section of trend A, since it is still three-wave, therefore, it cannot be wave 1.

A successful attempt to break through the 1.3642 mark will indicate the market's readiness to buy the instrument, which may lead to the exit of quotes beyond the peak of the assumed wave D. At the same time, the current wave marking can still maintain its integrity if an attempt to break through the 1.3642 mark turns out to be unsuccessful.

British pound did not mind the U.S. inflation report

The exchange rate of the Pound/Dollar instrument increased by 100 basis points on Thursday. The catalyst for the increase in the British pound was the report on U.S. inflation, which increased from 7.0% to 7.5% YoY. If at first the instrument was declining, which was quite expected, then literally an hour later a strong increase in the quotes of the British pound began.

From the point of view of wave marking, there is still an opportunity to save it. However, if the pound continues to grow on the news that suggests a rise in the dollar, then the wave marking will be broken.

UK's GDP and industrial production reports will be released tomorrow. I do not think that they will have a strong influence on the movement of the instrument, but, nevertheless, they can do it. At the same time, we will understand whether the market intends to continue buying the pound. In particular, if the UK statistics turn out to be weak, and the British currency continues to rise, this will definitely mean that the news background is not taken into account by the markets and they are ready to buy the pound no matter what.

Market expectations according to UK statistics now differ little from the previous values of both indicators. However, the GDP for December may decrease by 0.5% compared to November. Industrial production can grow only by 0.1% MoM. According to forecasts, the statistics will be weak, so tomorrow the British pound will have the opportunity to resume the decline, as prescribed by the wave pattern and the news background of Thursday.

Overall conclusions

The wave pattern of the Pound/Dollar instrument assumes the construction of wave E. However, at the moment, the construction of a new upward wave has begun, because the sales of the pound so far look unattractive. The instrument has returned to the 1.3645 mark, and now wave b takes on a three-wave appearance. But the continuation of the increase in quotes may mean that wave b is not such. In this case, a revision of the wave markup will be required. Therefore, I advise selling now with targets located near the 1.3272 mark, which corresponds to 61.8% Fibonacci level, if a new attempt to break through the 1.3645 mark is unsuccessful.

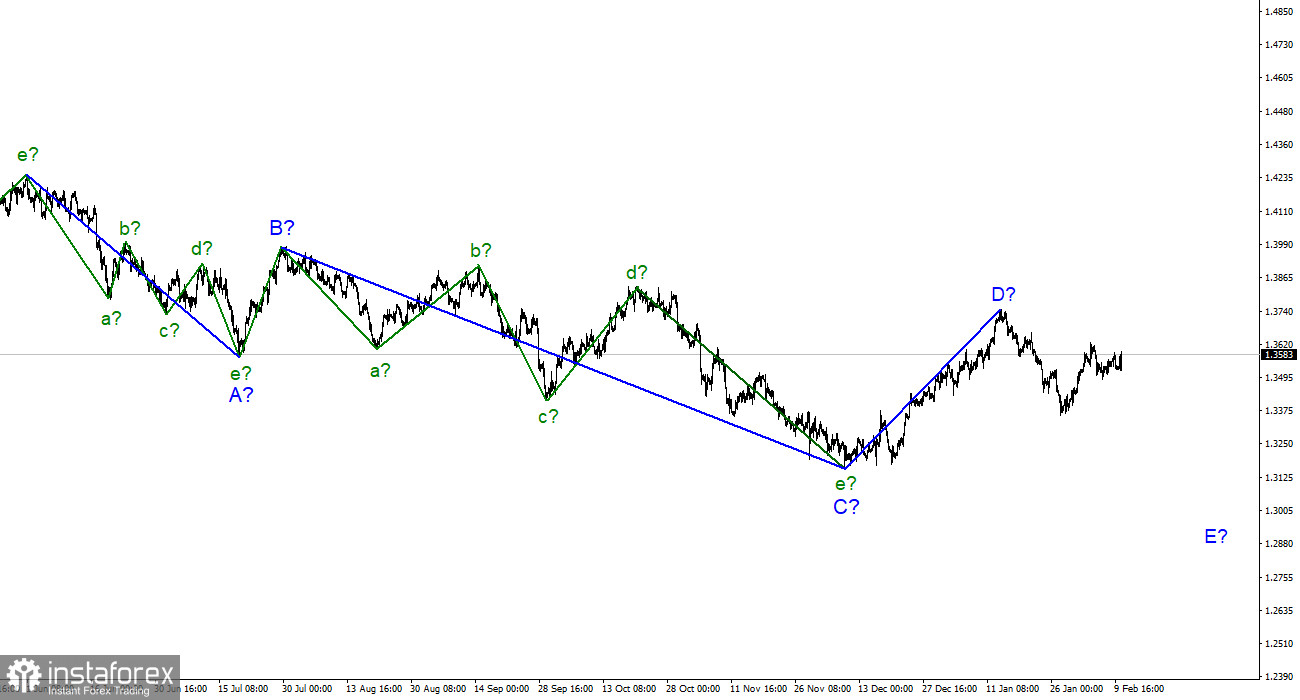

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be a three-wave, so I cannot interpret it as wave 1 of a new upward trend segment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română