Markets have been trading sluggishly for four days in a row. On top of that, the economic calendar also remains uneventful. There are no market-moving events. This is why speculators are looking forward to the US inflation report, which is due today. It is sure to stir up market activity. Analysts are trying to figure out the outcome. The Consumer Price Index is expected to rise to 7.1% from 7.0%. There have been rumors lately that the Fed may hike the interest rate by 0.50% at once. If consumer prices grow higher, the regulator is likely to do so. Nevertheless, the Fed already voiced plans to tighten monetary policy. So, the question is how many hikes could be. Analysts point out that soaring inflation that surpasses wage growth is an extremely negative factor for the economy. After the publication of inflation data, market sentiment may turn either bullish or bearish.

US CPI:

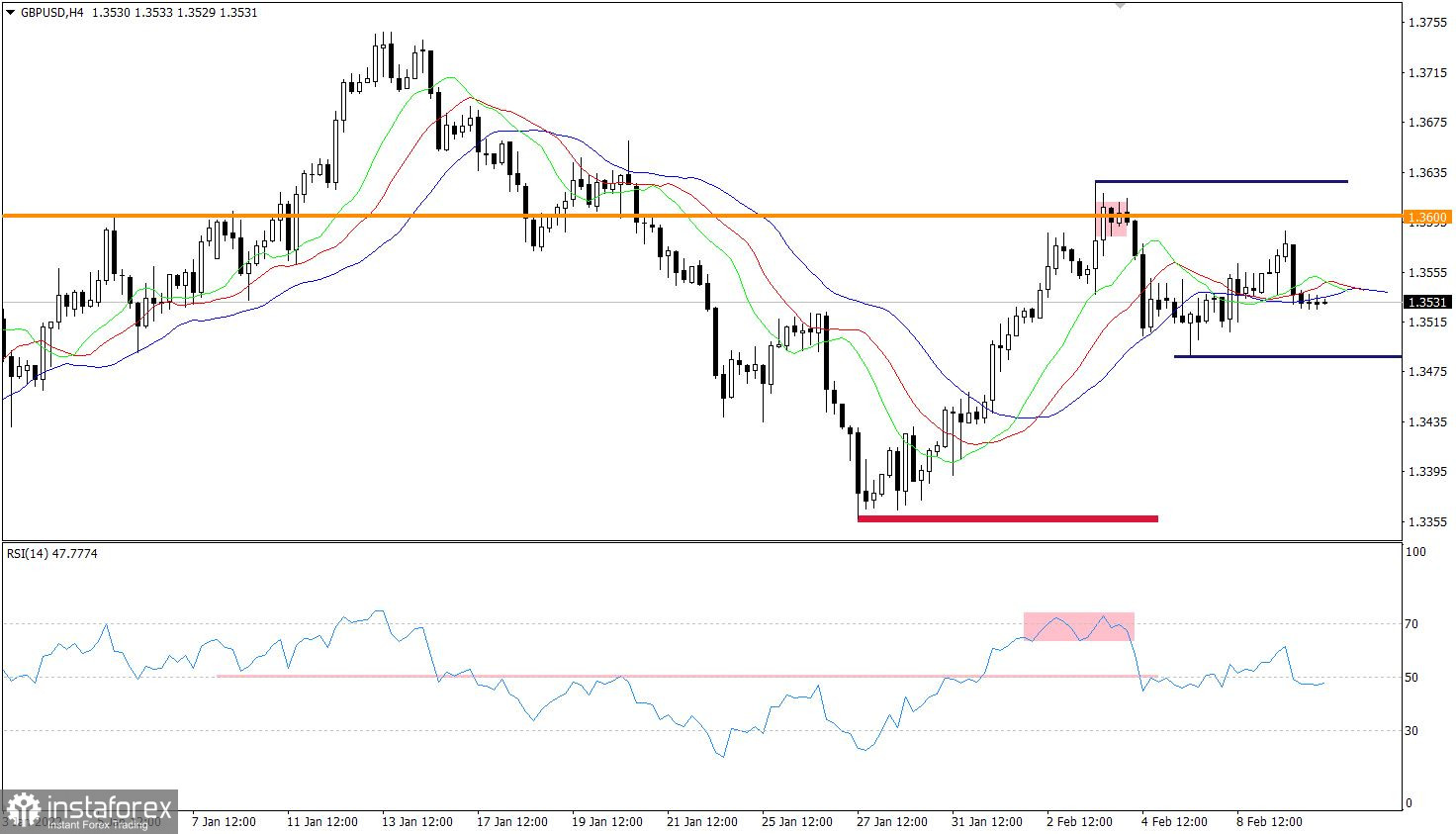

Despite the rollback from the resistance level of 1.3600 last week, the pound/dollar pair is still hovering near this level. It signals market uncertainty, which may be a great opportunity for traders to reap a profit later.

The RSI indicator is moving along the 50 line on the 4H chart, which indicates low trading volumes.

The Alligator indicator also points at sluggish trading on the 4H chart by interweaving between the moving averages lines. Alligator D1 gives a buy signal.

On the daily chart, Doji candlesticks signal market stagnation. They may also indicate a gradual increase in trading volumes.

Outlook

The price is holding between the resistance level of 1.3600 and the dynamic pivot point of 1.3500. It indicates the accumulation stage. At the same time, several Doji candlesticks may show an upward reversal on the daily chart.

Trading within the range is considered less profitable than trading with the Breakout Strategy. If the price consolidates above 1.3630, it is recommended to open long positions. It would be better to open short positions at 1.3480 if the price keeps dropping from the resistance level to 1.3400.

The complex indicator analysis gives mixed signals on short-term and intraday charts as the pair is trading in the sideways channel.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română