Yesterday was a very successful day both for stock indexes and for individual stocks of large technology companies. All of them have increased in price by the end of the day. However, there was no news background. Only the US Department of Energy report on crude oil inventories was released in the morning. It became known that they were reduced by almost 5 million barrels, which should have supported oil's cost. However, it was oil's value that slightly decreased after the results of Wednesday.

Today should be more interesting for US investors. They continue to wait for the Fed to start a rate hike cycle and are ready to start new stock sales as soon as it happens. The rate hike entirely depends on what inflation will be in the coming months. Later today, the US will release a new inflation report, which will show the general dynamics. The market does not doubt that the consumer price index will continue to rise. Based on this, we believe that rising inflation may reduce demand for stocks and indices.

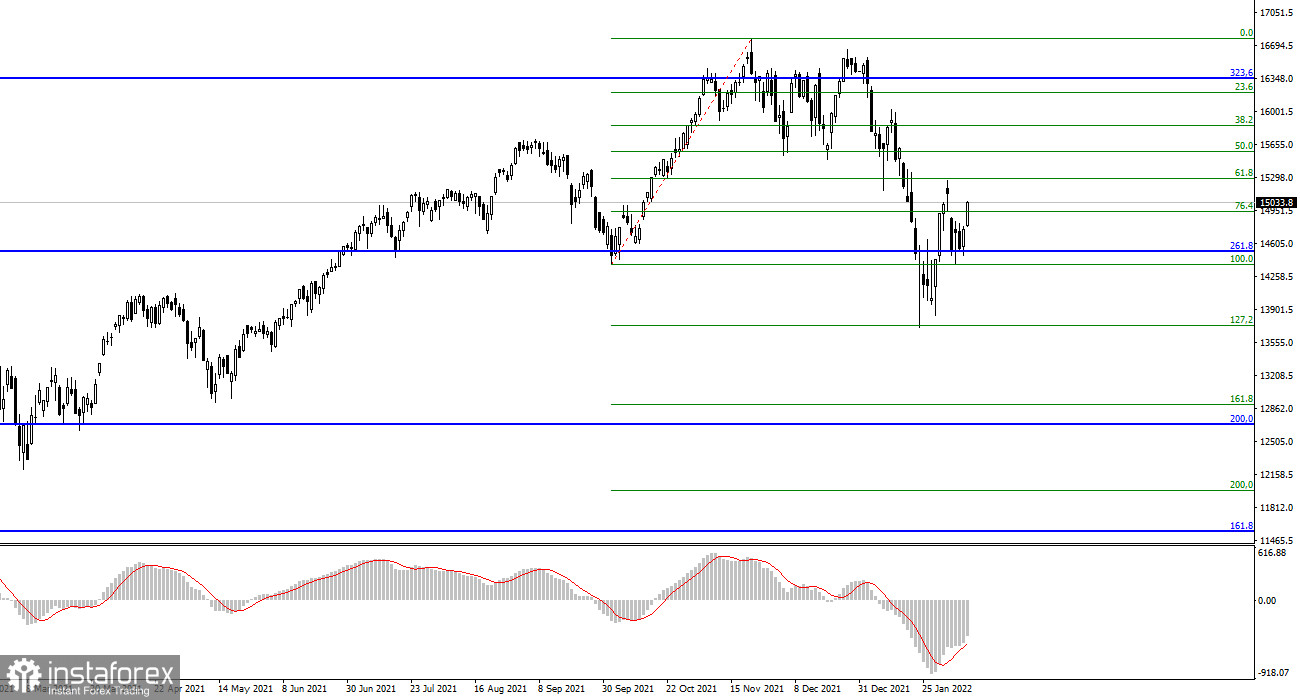

NASDAQ Composite Index

On Wednesday, the NASDAQ Composite rose 253 points and closed at 15,033 points. The index fell to the estimated level of 13730 earlier, which corresponds to 127.2% Fibonacci. At this time, a new wave of recovery has begun, which may lead to an increase in the index above 15258, which is the peak of the previous wave.

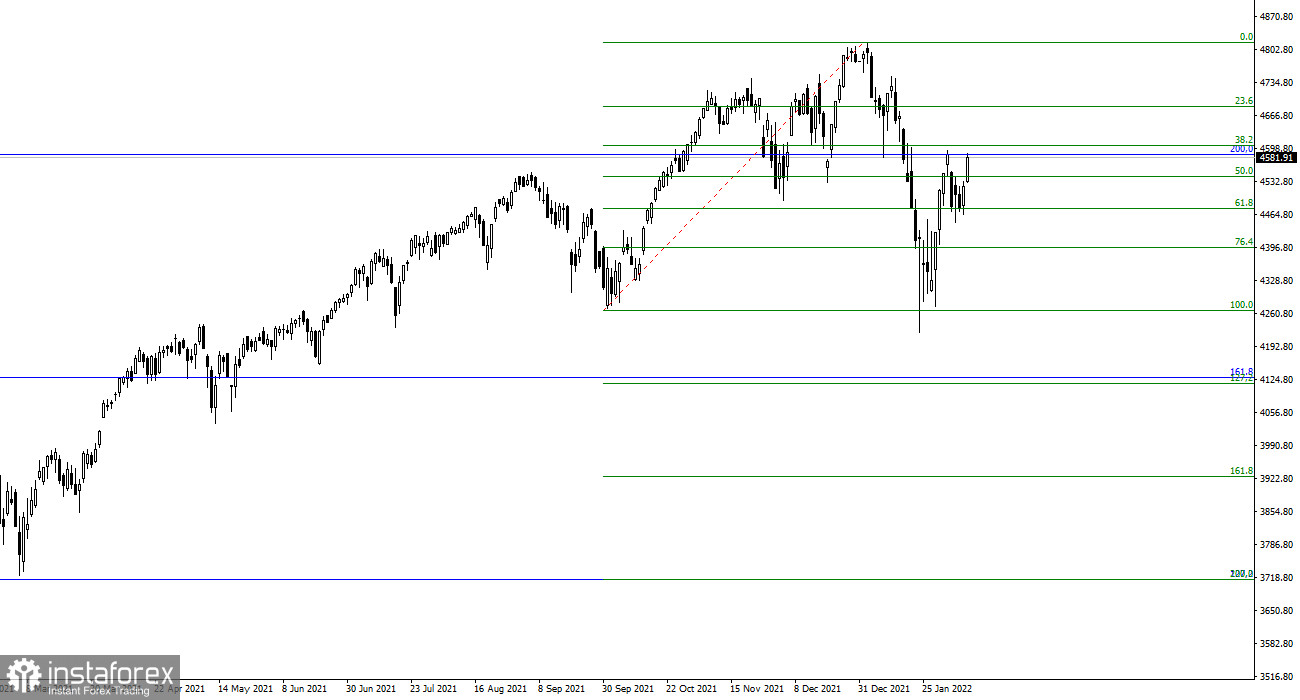

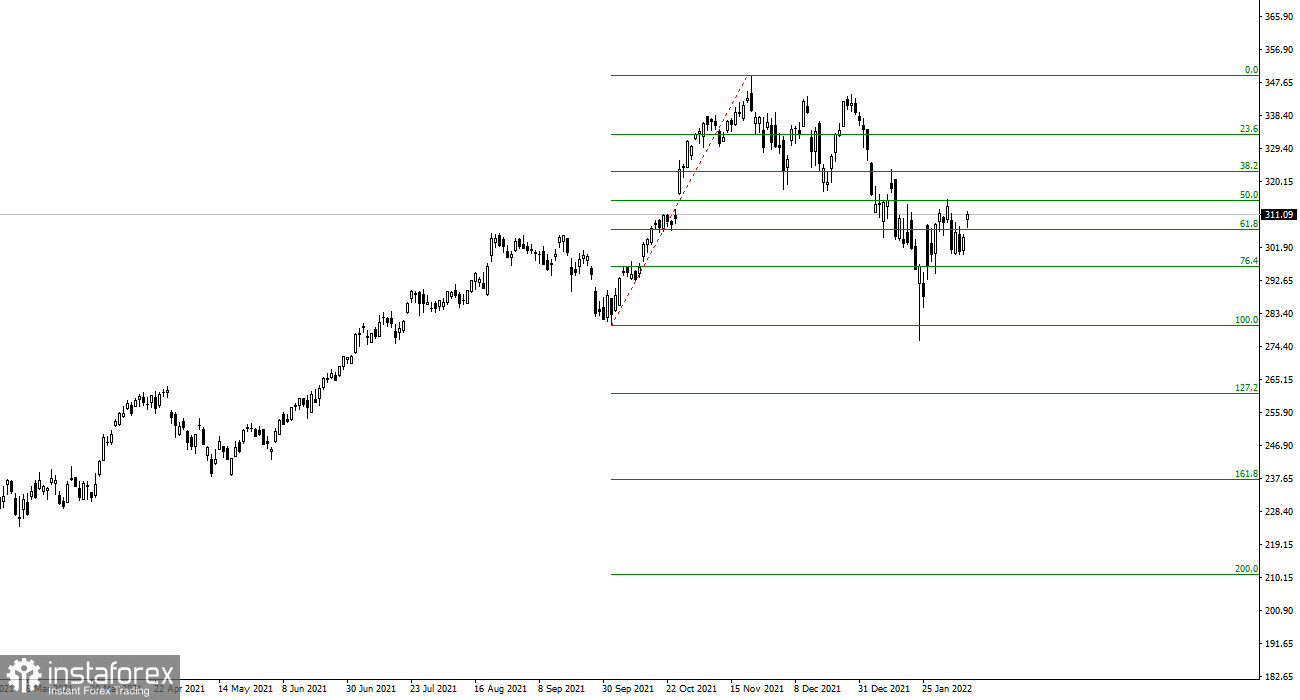

Standard & Poor's 500 index

The Standard & Poor's 500 index increased 49 points on Wednesday and closed at 4581. It is also recovering from the January corrective wave and may approach this year's peaks in the coming weeks. It shows that there is a rapid recovery.

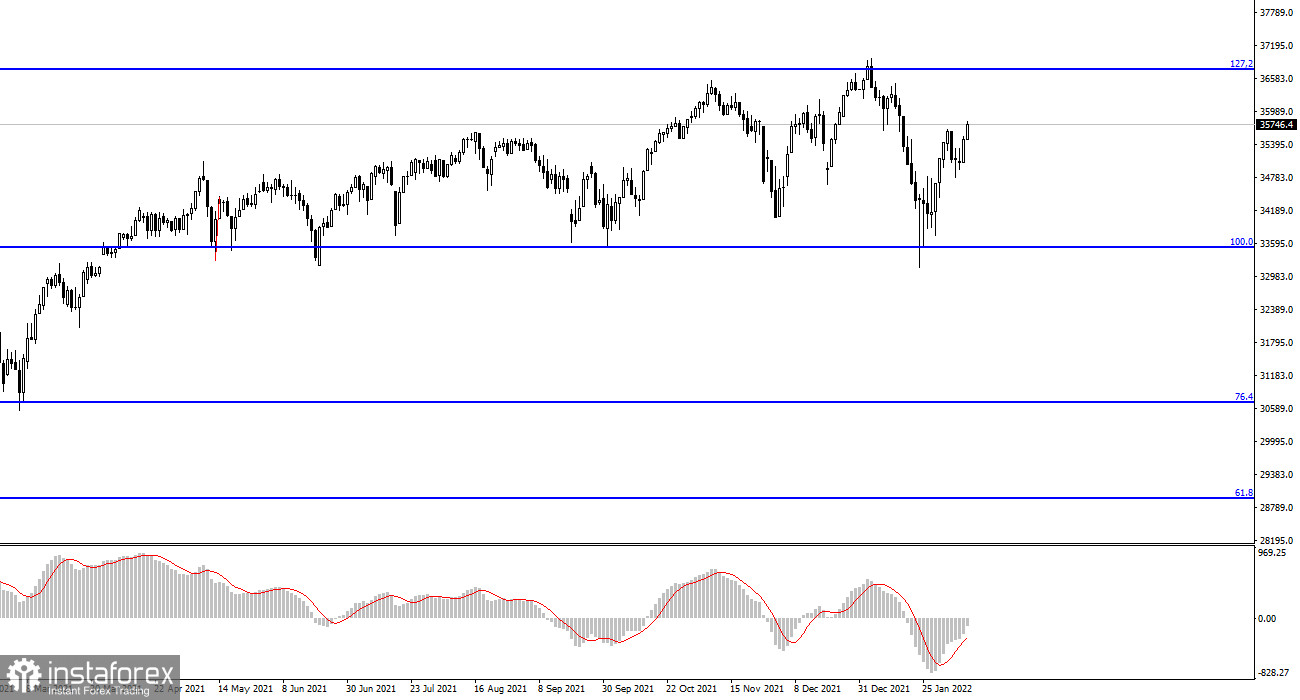

Dow Jones Index

The Dow Jones index formed the smallest correction wave. It ended near the estimated level of 33525, which corresponds to 100.0% Fibonacci. An unsuccessful attempt to break through this level led to the quotes' exit from the lows reached, but now all stock indices are the same in their recovery. This index is also aiming for 2022 highs.

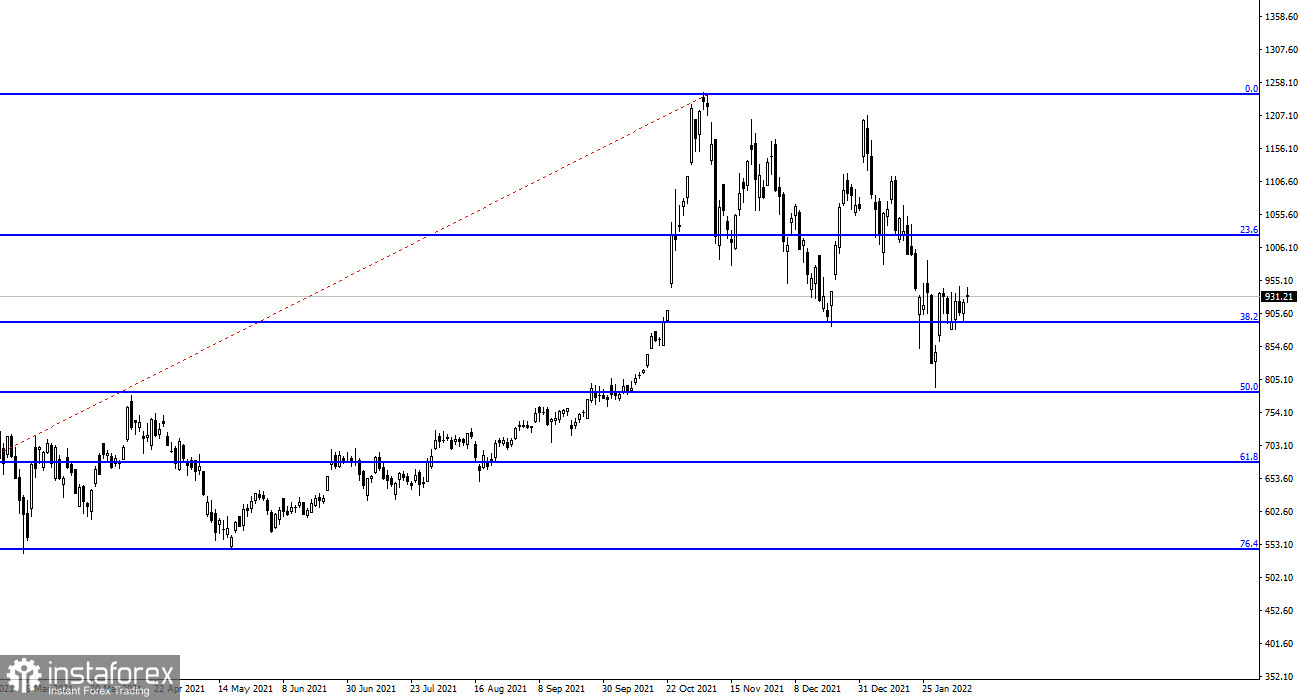

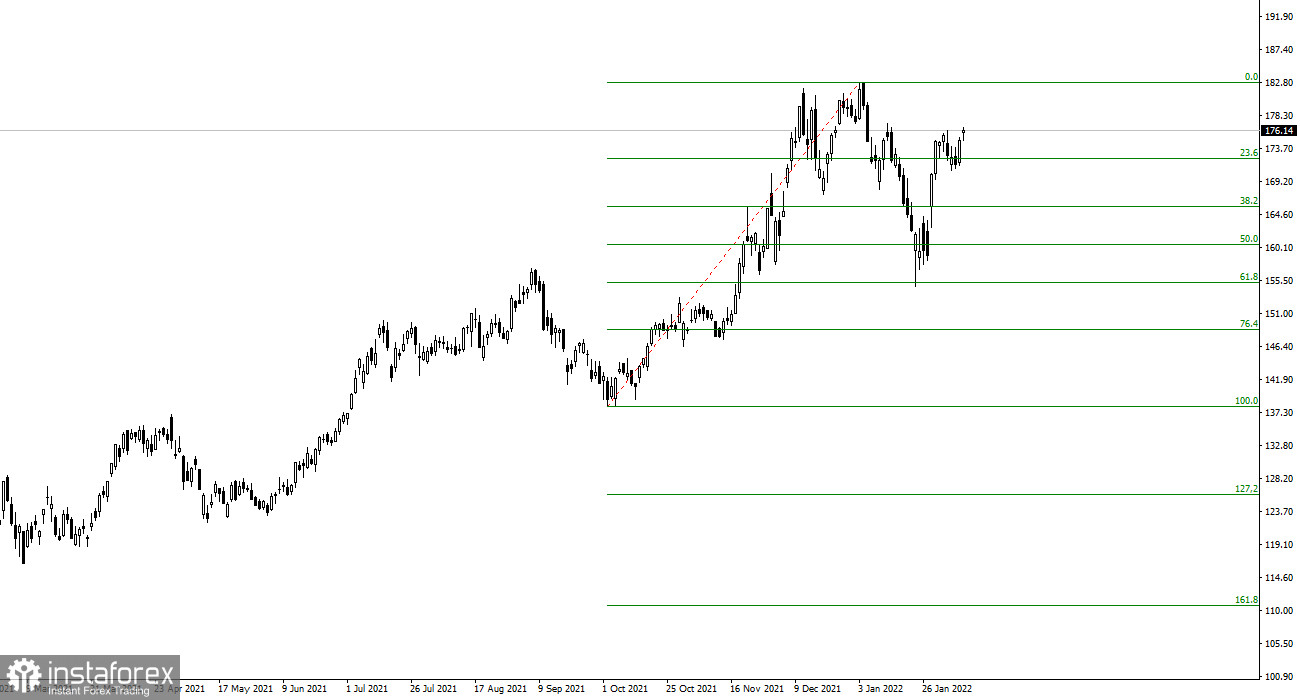

Tesla

Tesla shares do not follow stock indices. They dropped to $785 per share last month, which equates to 50.0% Fibonacci. At the moment, the price is trying to recover to complete the formation of the corrective section of the trend, which already has three waves, but the prospects for raising the Fed's rate may nullify the efforts of investors.

Microsoft

The same is true with Microsoft shares. There was a fairly strong decline in January, which corresponds to 100% of the previous upward wave. The decline stopped at around $ 280 per share and now, the market is also trying to complete the formation of a corrective set of waves.

Apple

Apple's stock feels the most confident. After a decline to $ 155, which corresponds to 61.8% Fibonacci, they began building a new upward wave, which has already returned the value to the peaks of the year. There are no sales signals yet.

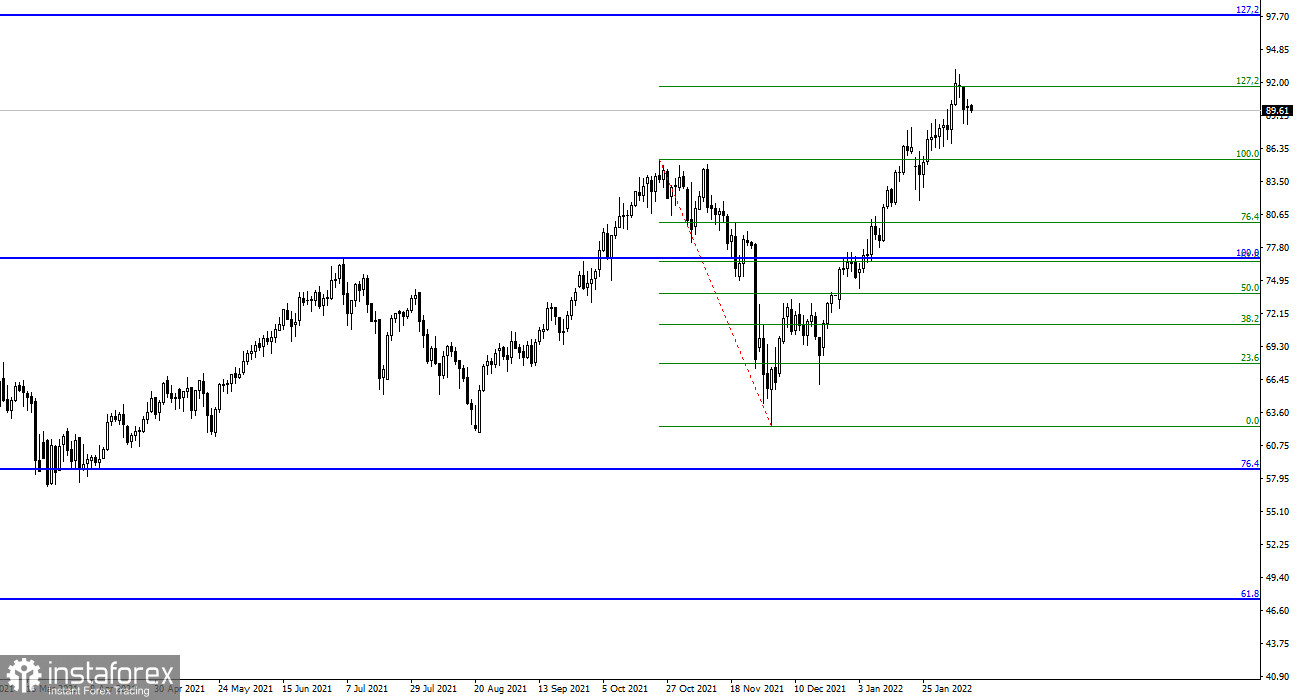

Oil

Oil's price continues to rise and made a small stop near the estimated level of $91.64, which equates to 127.2% Fibonacci. A successful attempt to break this level will allow oil to further rise with targets located around the $97.75 mark.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română