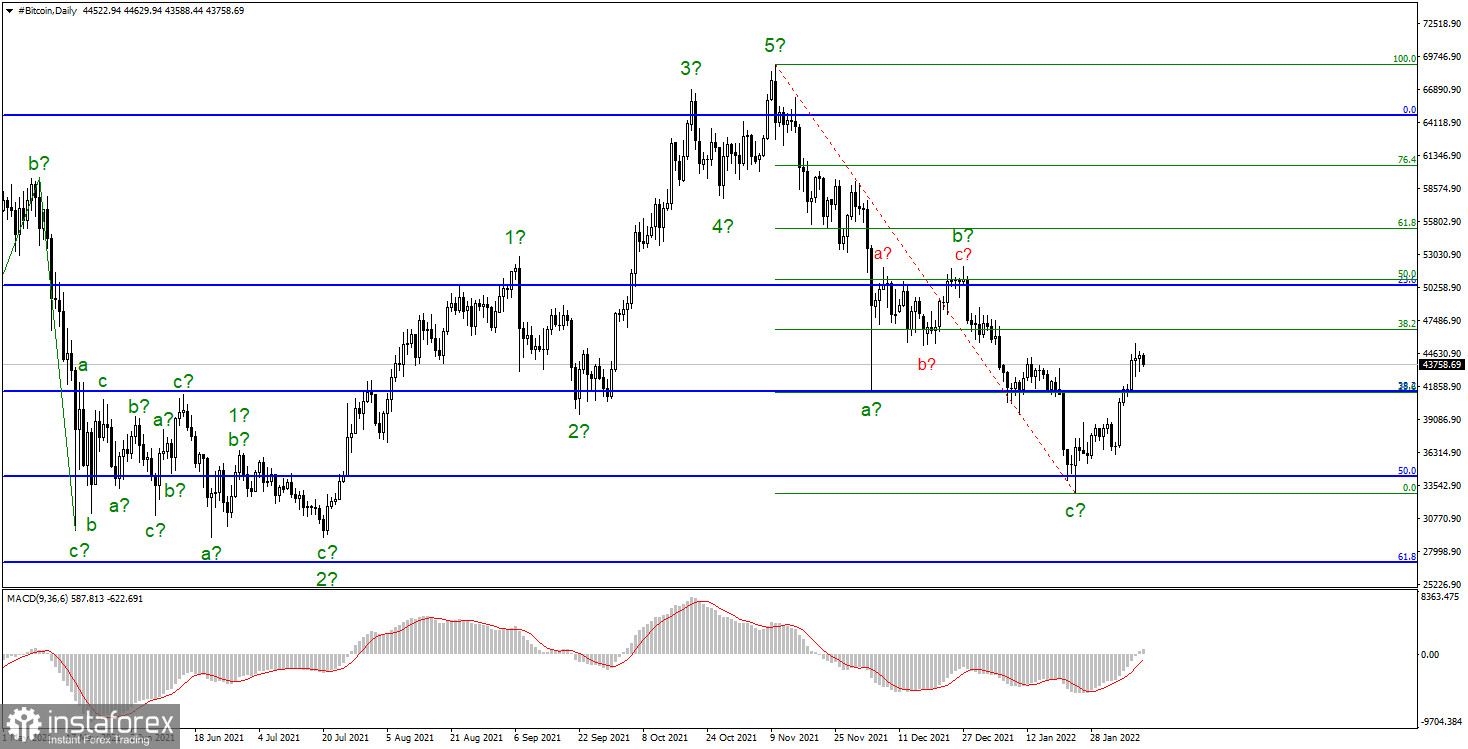

Bitcoin is still struggling to recover. The quotes' slight decline yesterday cannot be the basis for the conclusion that the formation of an upward wave is already completed. At the moment, it is not even clear what exactly this wave is. It was already said that this may be the first wave of a new upward trend section (possibly also a corrective one), or it may be wave d of the current downward trend section. Since there is no signal about the end of the construction of this wave, it is too early to expect Bitcoin's new decline. Rather, its value will continue to grow for now. The news background remains weak for this cryptocurrency and the entire cryptocurrency market. It should be noted that over the past few months, not only Bitcoin has shown a decline. For the most part, other cryptocurrencies also declined. Analysts attribute this drop to a future Fed rate hike.

- Bitcoin forecast: $100,000 or $11,000?

Meanwhile, prominent Bloomberg analyst Mike McGlone has updated his Bitcoin forecast. McGlone now believes that the cryptocurrency is in the process of forming a sustainable basis for future price increases. Currently, the "ceiling" for the world's first cryptocurrency is the level of $100,000 per coin. But in the meantime, it may spend some more time in the formation of the "bottom". That is, Bitcoin can decline again in the range of $30-38 thousand.

Niall Ferguson, the author of The Ascent of Money, has a different opinion. He believes that the dynamics of the bitcoin exchange rate will continue, then the cryptocurrency can fall to $11,000 this year. Such a drop would equal 83% of the maximum value of bitcoin last year. It is worth noting that this is a fairly common opinion: every upward trend ends with a fall of 80-90%. However, Ferguson also notes that Bitcoin's level of adoption by the community has grown tremendously in recent years. First, hedge funds entered the market, then banks and this process of popularization of cryptocurrencies continues. An increasing number of people and organizations are ready to invest in Bitcoin, so a more serious drop should not be expected. Ferguson also calls the growth of Bitcoin a long-term perspective, but he needs to survive the "crypto winter" first.

- Inflation is still high, which could help Bitcoin

The topic of inflation is a separate topic for the entire cryptocurrency market. It is 7% in the US and is at risk of further increasing. Throughout the previous year, many investors have "found" Bitcoin as a means of fighting inflation, so even despite the rate hike, the cryptocurrency may feel relatively stable this year. However, it will be a worse time for Bitcoin if inflation returns to 2-3%, and rates will already be at 2-3%. If this happens, safe assets will become more attractive to investors than cryptocurrencies.

The downward trend section continues to form. An unsuccessful attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, allowed the quotes to start leaving the lows reached. However, it is still too early to talk about the end of the downward section of the trend. It can take a five-wave form and continue its construction with targets near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci within wave e. So far, the wave marking does not imply the construction of a new downward wave. There is not a single signal for this, and the corrective set of waves a - b - c looks quite complete, so the option of building a new upward trend section from the current levels can also be considered. To sell Bitcoin, new downward signals are needed – unsuccessful attempts to break through levels located above the current rate, or a reversal of the MACD indicator. In general, any signs that the upward wave that is currently being built is already done.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română