US recovered the $3.6 billion worth of bitcoins stolen in 2016, when Bitfinex was hacked. Ilya Lichtenstein and his wife, Heather Morgan, were brought before the federal court in Manhattan because the two reportedly conspired to launder 119,754 bitcoins after a hacker attacked Bitfinex's systems and withdrew a very large amount of cryptocurrency. "Today's arrests, and the department's largest financial seizure ever, show that cryptocurrency is not a safe haven for criminals," said Deputy Attorney General Lisa Monaco. "In a futile effort to maintain digital anonymity, the defendants laundered stolen funds through a labyrinth of cryptocurrency transactions."

In total, the amount of BTC stolen was approximately $4.5 billion.

Initially, the court was planning to release Liechtenstein and Morgan on bail, but the government asked not to approve it since the two have around $300 million in their accounts, and that could easily allow them to hide from the investigation. Both are sentenced to 20-year term in prison.

Following the announcement, a token known as Unus Sed Leo, which was issued in part to recapitalize the Bitfinex exchange after the 2016 hack, surged more than 50%. It appears that Bitfinex fulfilled its promise before that if the stolen funds are recovered, it will allocate about 80% of the recovered funds to repurchase and burn outstanding Unus Sed Leo tokens.

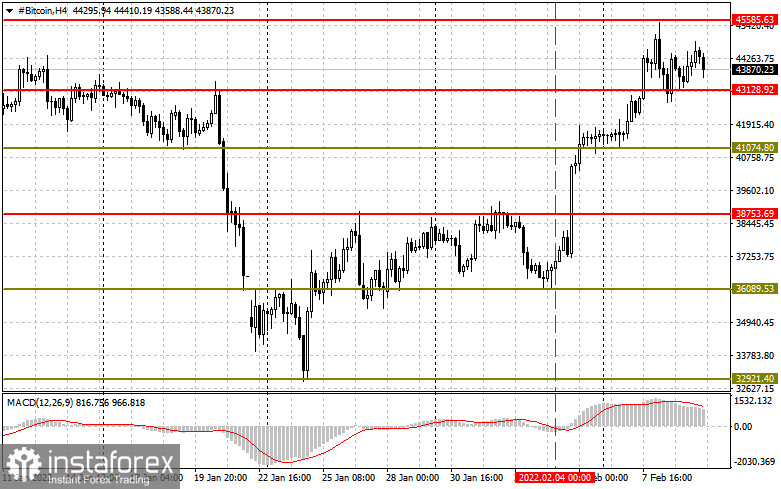

Technical analysis for Bitcoin

BTC is trading above $43,120. If bulls manage to retain this momentum, price could soar to $45,580, $48,554 and $51,810. If not, BTC will dip to $38,700.

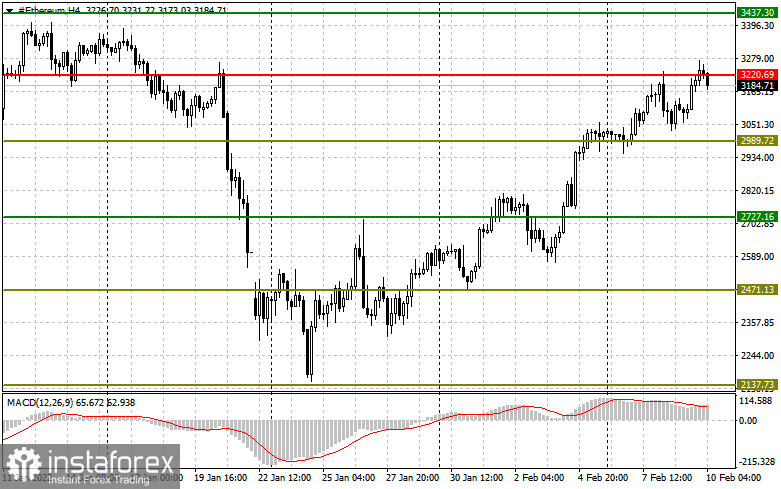

Technical analysis for Ethereum

ETH surpassed $2,980, but halted at $3,220. It seems that no one is interested in buying above $3,220, so the price is stuck at this level. But if bulls manage to push the quote up, ETH could increase to $3,430 and $3,670. If not, it will dip to $2,730, and then fall further to $2 470.

Upcoming reports from the US Department of Labor are likely to have strong impact on the Fed monetary policy and the stock market. Since those have deep correlation with cryptocurrencies, it is likely that when a decline occurs, crypto will dip as well. So be patient and do not rush to buy at the current highs.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română