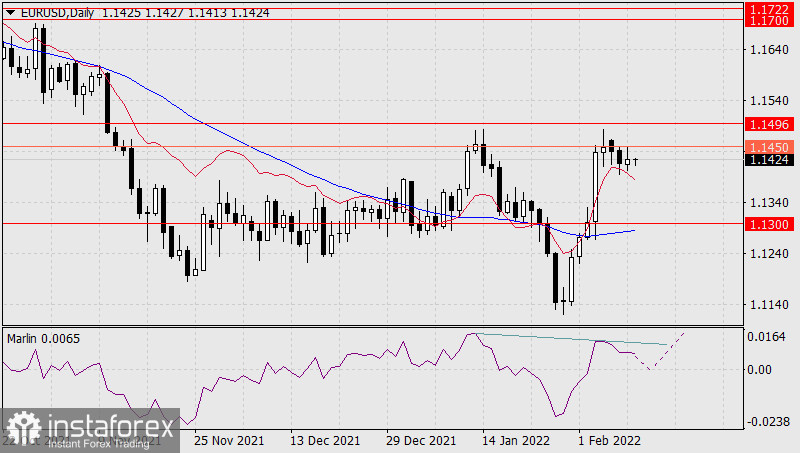

Today, the US will release data on inflation for January. Monthly CPI growth is projected to increase by 0.5%, the annual rate is expected at 7.3% against 7.0% y/y a month earlier. Core CPI is expected to rise to 5.9% y/y against 5.5% y/y in December. The first sign that the big players were tired of buying the euro against the data appeared last Friday and this Monday - the euro did not settle in the 1.1450/96 range with the release of strong US employment data. Now, if inflationary indicators turn out to be no worse than forecasted, we can expect the euro to fall. The target remains the same – 1.1300 – the August 2018 low. Below this level is the MACD indicator line, which is an independent support.

Also in favor of the fall is the increasing convergence of the price with the Marlin Oscillator. In general, the convergence is not strong, therefore, if the signal line of the oscillator does not go into negative territory during the price decline, the price and the oscillator may turn into a medium-term increase, as shown on the daily chart by a dashed line.

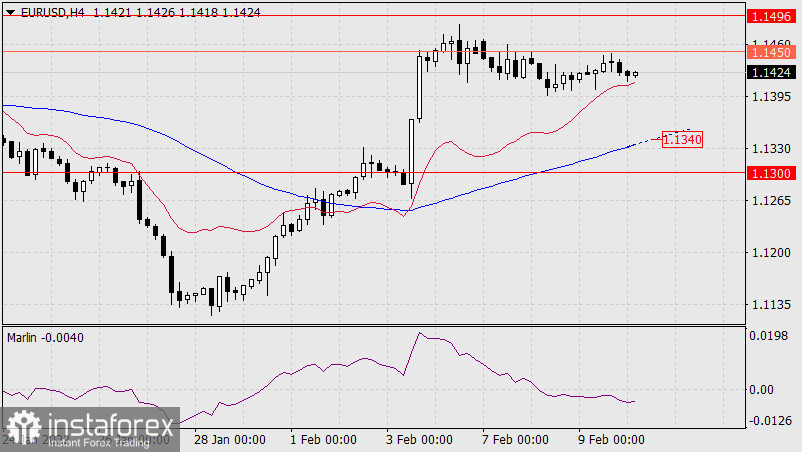

The downward trend is intensifying on the H4 chart. The price has lost momentum, has not consolidated in the range of 1.1450/96, the Marlin Oscillator is developing a decline in the downward trend zone. But the price still has support, up to the level of 1.1300 – the MACD line on H4 in the area of 1.1340. In the end, it may turn out that the bulls' affairs are not so bad. And if the euro may fall by today or tomorrow, then next week investors may again show interest in risk.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română