Mike McGlone, senior commodity strategist at Bloomberg, posted an optimistic analysis on Twitter regarding the outlook for the main cryptocurrency. However, he does not exclude that the bottom for bitcoin has not yet been reached.

According to McGlone's tweet, the suggestion that the bottom hasn't been reached is because it hasn't happened yet in the U.S. stock market. However, unlike stocks, Bitcoin seems to be showing multidirectional strength. The thing is that, as an asset, it is gradually maturing to get the status of a global digital instrument.

McGlone stressed that Bitcoin is likely to go out of circulation, even though most traditional assets have faced strong deflationary forces this year due to last year's excesses.

Earlier this month, he tweeted that the current stock market downturn could prevent the Fed from raising interest rates in March and would likely strengthen safe-haven assets such as bitcoin and gold.

However, McGlone is optimistic about the main cryptocurrency. He has already reported many times on Twitter that Bitcoin will reach $100,000 per coin in the near future.

Drop in Tether address activity a bullish factor for Bitcoin

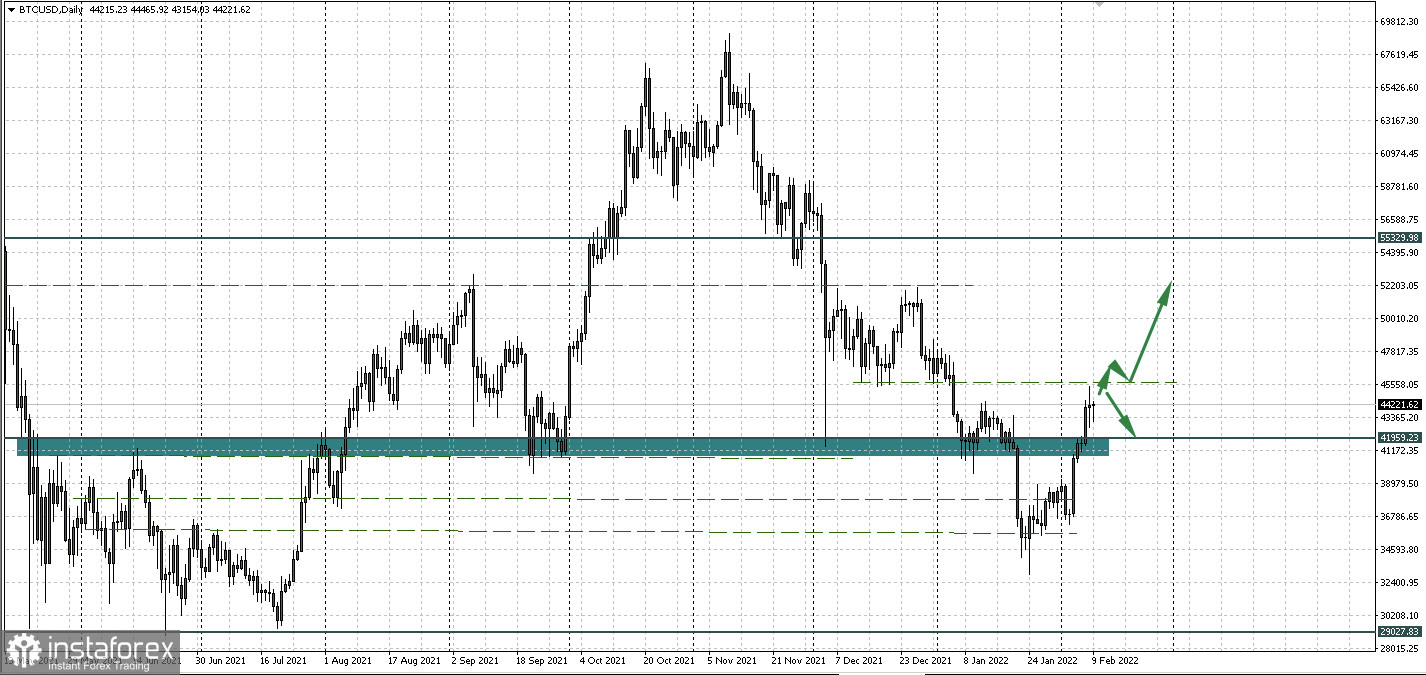

According to a report released today by network data provider Santiment, Bitcoin is poised to rise in value. The company's analytical team wrote on Twitter that the strong decline in USDT address activity creates the prerequisites for this.

The volume of daily activity of Tether wallets fell to a two-year low. The decline began to take place gradually after Bitcoin reached an all-time high of $69,000 in November last year.

Santiment notes that it has been established from previous analytical observations that as soon as the number of USDT transactions starts to decrease, the price of bitcoin starts to rise.

JP Morgan predicts Bitcoin to rise to $150,000

Major U.S. bank JP Morgan has raised its long-term price target for bitcoin to $150,000. However, this is only a small increase from last year's forecast of $146,000.

JP Morgan analysts note that in order to achieve this target, the market capitalization of bitcoins must match the amount of private investment in gold. Now for the precious metal, it is about $2.7 trillion. By comparison, Bitcoin's market capitalization peaked at $1.3 trillion in mid-November last year.

In general, JP Morgan experts believe that Bitcoin is overvalued at the moment, and its rate against the dollar on spot exchanges should be about 13% lower, which is about $38,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română