XAU/USD is trading in the green at 1,744 at the time of writing. Technically, the price action signaled that the downside movement is over and that the price could develop a new leg higher.

Fundamentally, the yellow metal turned to the upside after the US data publication. The Flash Services PMI dropped from 47.8 to 46.1 points, even though traders expected a potential growth to 48.0 points, while Flash Manufacturing PMI dropped from 50.4 to 47.6 points far below 50.0 estimates signaling contraction in this sector as well. This is the reason why the USD depreciated and Gold jumped higher.

Still, the FOMC Meeting Minutes could be decisive today. This is seen as a high-impact event and could really shake the price.

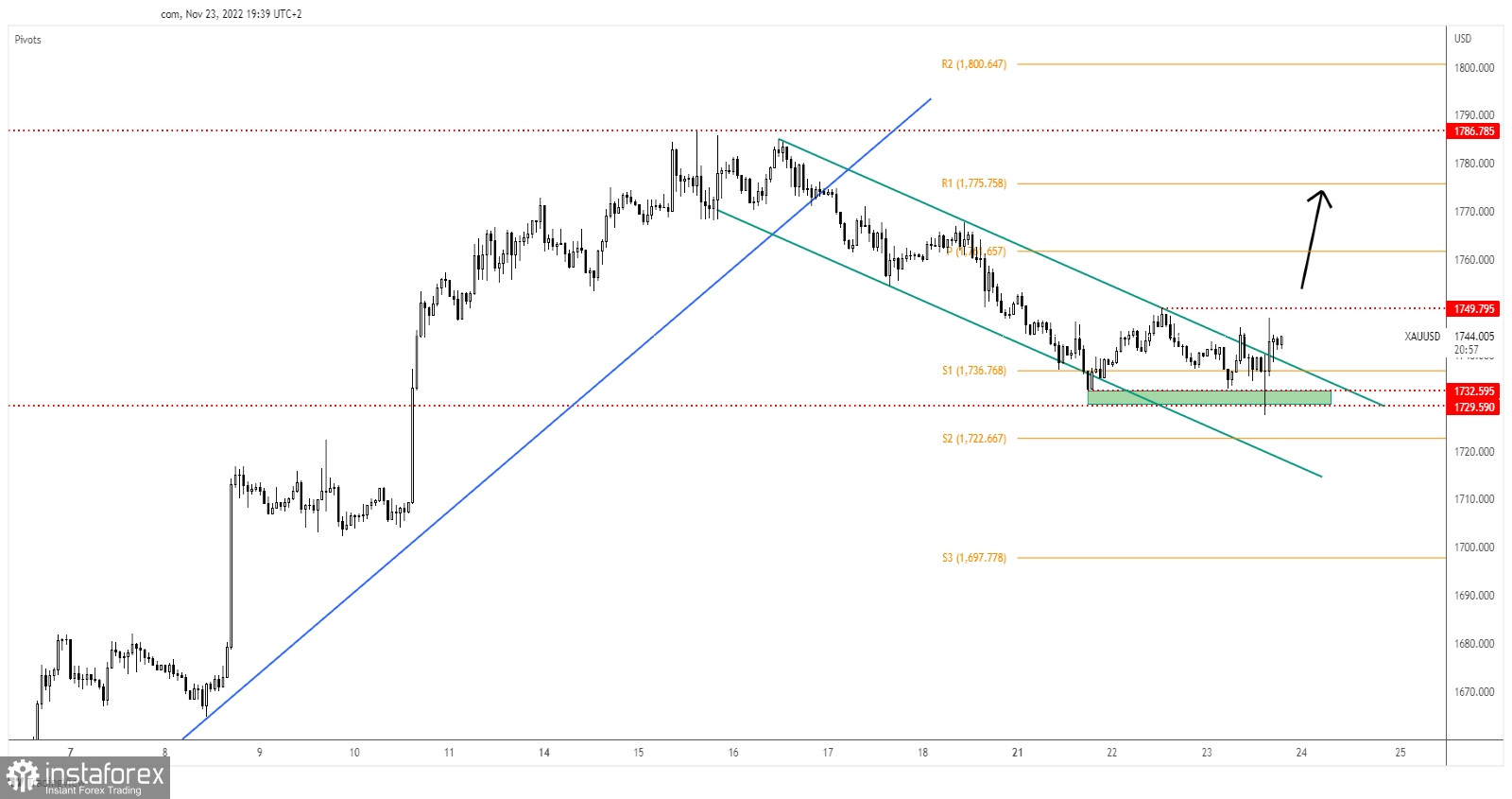

Gold Down Channel Breakout!

Gold registered a false breakdown with great separation below the 1,732 - 1,729 support zone and now it has passed above the downtrend line signaling that the downside movement could be over.

Now, it's trapped between 1,729 and 1,749 levels. Escaping from this range could bring a strong move. After its false breakdown, the price action signaled an upside breakout.

Gold Forecast!

A valid breakout above 1,749, a new higher high validates a new leg higher. This is seen as a long signal. 1,786 stands as an upside target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română