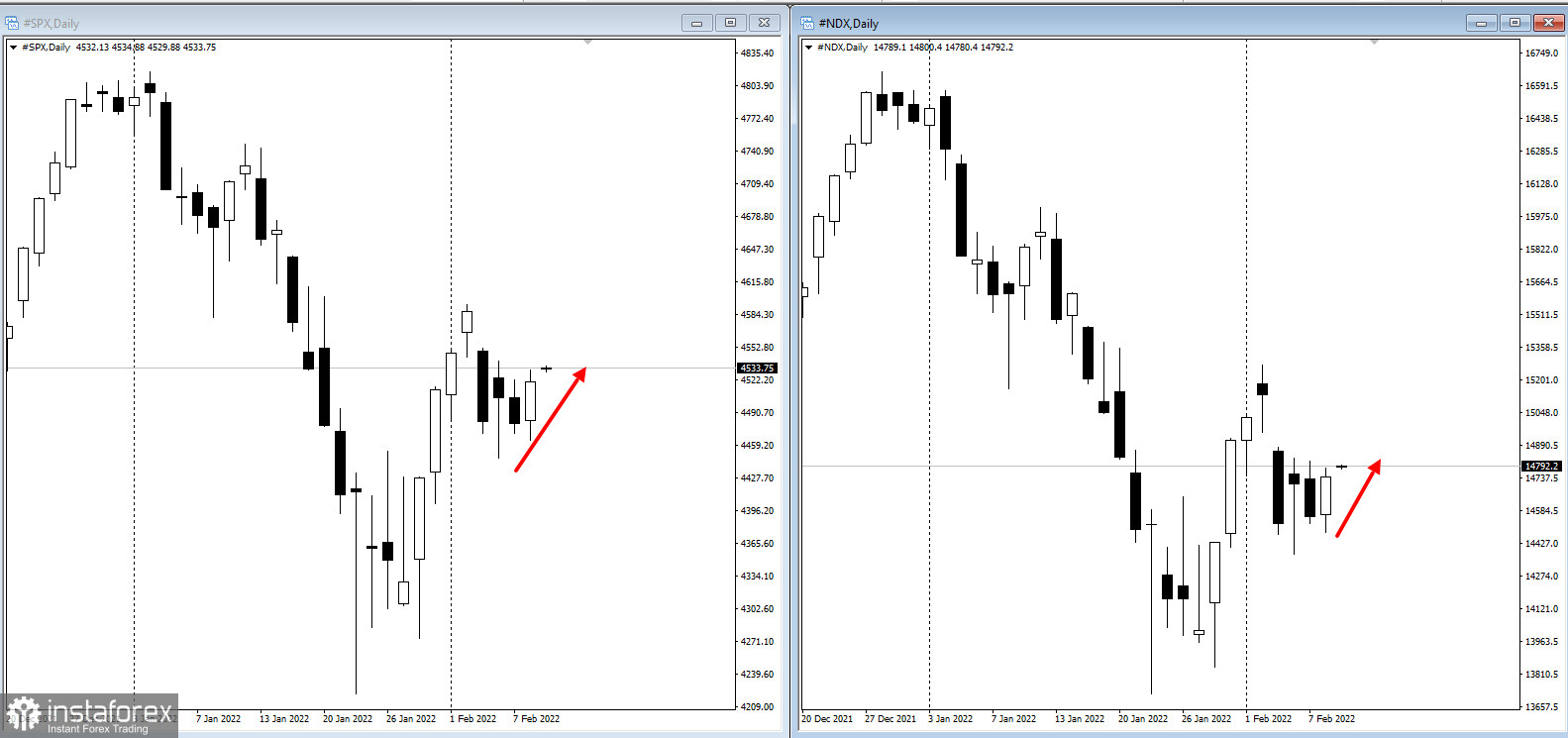

US stocks rallied on Tuesday, thanks to gains in cyclicals and small caps, which signalled improved investor confidence amid tightening monetary policy. The S&P 500 rose because of the financial and commodities sectors, while the tech-heavy Nasdaq 100 rose because of Apple, Microsoft and Amazon. But shares of Pfizer plunged after its 2022 revenue guidance fell short of estimates.

As for bonds, the yield on 10-year Treasuries climbed to 1.95%, offsetting the dip seen earlier. Some investors even bet that it will hit 3% this year as the Federal Reserve battles growing inflation. Dollar also rose slightly.

"We had modest expectations for returns for stocks coming into the year. I don't think that's changed, but I think from here, we could certainly see a constructive recovery," said Brian Nick, chief investment strategist at Nuveen. "Every market, not just the equity market, is digesting a relatively rapid pivot from the Fed. I'd say it's gone relatively well, all things considered," he added.

Investors are currently waiting for data on Thursday, which is expected to show persistently high inflation in the US. This could cause additional volatility in markets, poised for a Fed boost cycle and possible balance sheet shrinkage. But rising yields could also support some equities such as banks and value stocks, according to Goldman Sachs. In fact, of the 299 S&P 500 companies that reported results, 76% beat earnings estimates, with earnings more than 6% above forecast.

"The primary market trend appears higher aided by an economy on solid footing and resilient earnings," said Keith Lerner, co-chief investment officer and chief market strategist at Truist Advisory Services. "We are also encouraged that the market is already pricing in a great deal of rate hikes, that investor sentiment has reset sharply, and that valuations have pulled back," he added.

Other events to watch out for this week are:

- earnings reports of AstraZeneca, Commonwealth Bank of Australia, GlaxoSmithKline, Toyota Motor, Twitter, Uber and Walt Disney;

- speech of Cleveland Fed President Loretta Mester (Wednesday);

- speech of Bank of England Governor Andrew Bailey (Thursday);

- data on US CPI, and jobless claims (Thursday).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română