Stock markets continue to evaluate the results of corporate reporting of companies, keeping in mind the expected release of consumer inflation data in the US tomorrow, Thursday.

On Tuesday, American stock indices were supported by strong reports from Chipotle, Amgen, Harley-Davidson, Chegg, DuPont, Centene, and several other companies. At the same time, Apple, Microsoft, Amazon, securities of banking companies Bank of America, JPMorgan Chase & Co, and Wells Fargo, also supported the positive mood and rising stocks.

The increase in the yield of US government bonds and the slight growth of the US dollar against a basket of major currencies did not affect the dynamics of the stock market. First of all, the US dollar's strengthening against other major currencies is supported by the weakening of the euro, which was facilitated by the statements of ECB President C. Lagarde on Monday, when she said that there is no need to start a cycle of raising interest rates.

Why is the ECB is not in a rush yet to follow the Fed and signal decisions to start raising rates?

There are two reasons. The first reason is very common – the European economy is in a very difficult situation due to the consequences of the COVID-19 pandemic. Numerous successive lockdowns have caused serious damage to the economies of the countries of the region, so the regulator is striving and will do everything to delay the start of the process of raising interest rates, thereby supporting the recovery of the euro area economy. The second one is that albeit having high inflation (5.1%), it is still noticeably lower than in the US (7.00%). According to the forecast, the updated consumer inflation data to be released tomorrow may show growth again and will report to the level of 7.3% in annual terms.

We believe that the ECB will pull until the last and keep all parameters of monetary policy unchanged.

In this case, the European stock market will receive support provided by the ultra-soft monetary policy, while the euro will remain under pressure. On the other hand, a possible resumption of US inflation may convince market participants that the Fed will have to more aggressively raise interest rates in March not by the expected 0.25%, but immediately by 0.50%. But this is another story, which may be continued as a result of a more vigorous increase in inflationary pressure in the United States.

In general, we believe that positive moods can be expected on the stock markets today, as proven by the dynamics of futures for stock indices both in Europe and in America. The US dollar may locally grow on the ICE index against a basket of major currencies.

Forecast for the day:

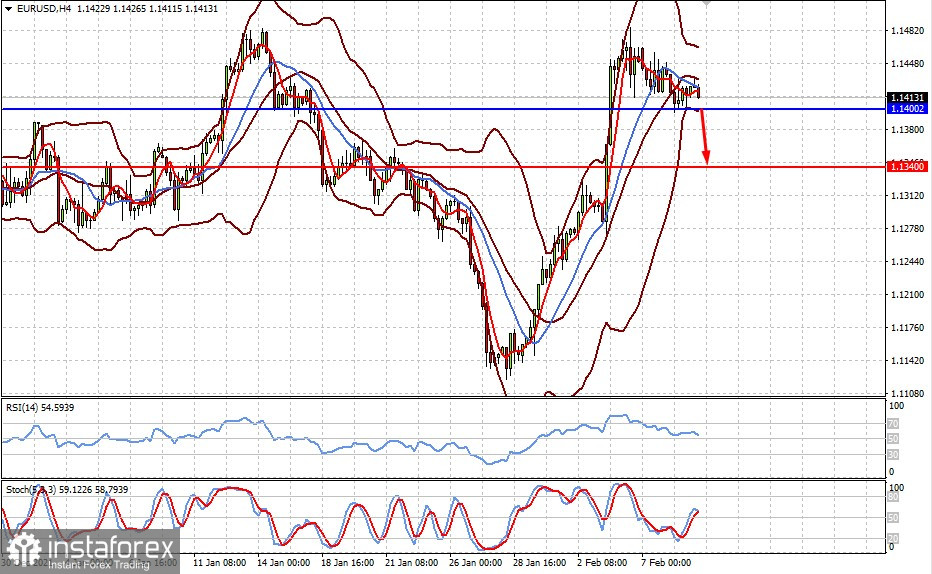

The EUR/USD pair remains above the level of 1.1400. A decline below it may become the basis for the pair's decline to 1.1340.

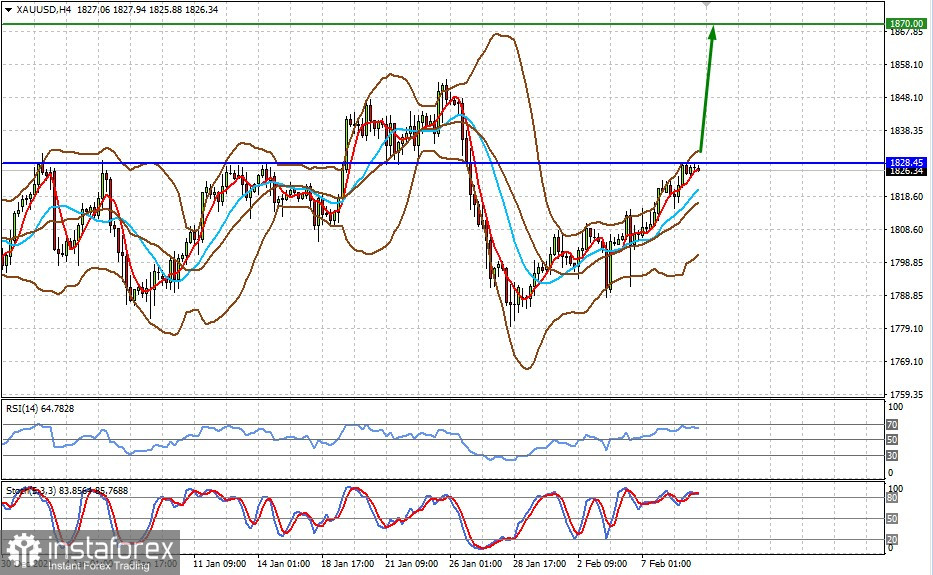

Spot gold is receiving support amid rising inflation in the US and the whole world. The breakdown of the level of 1828.45 may stimulate further price growth to 1870.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română