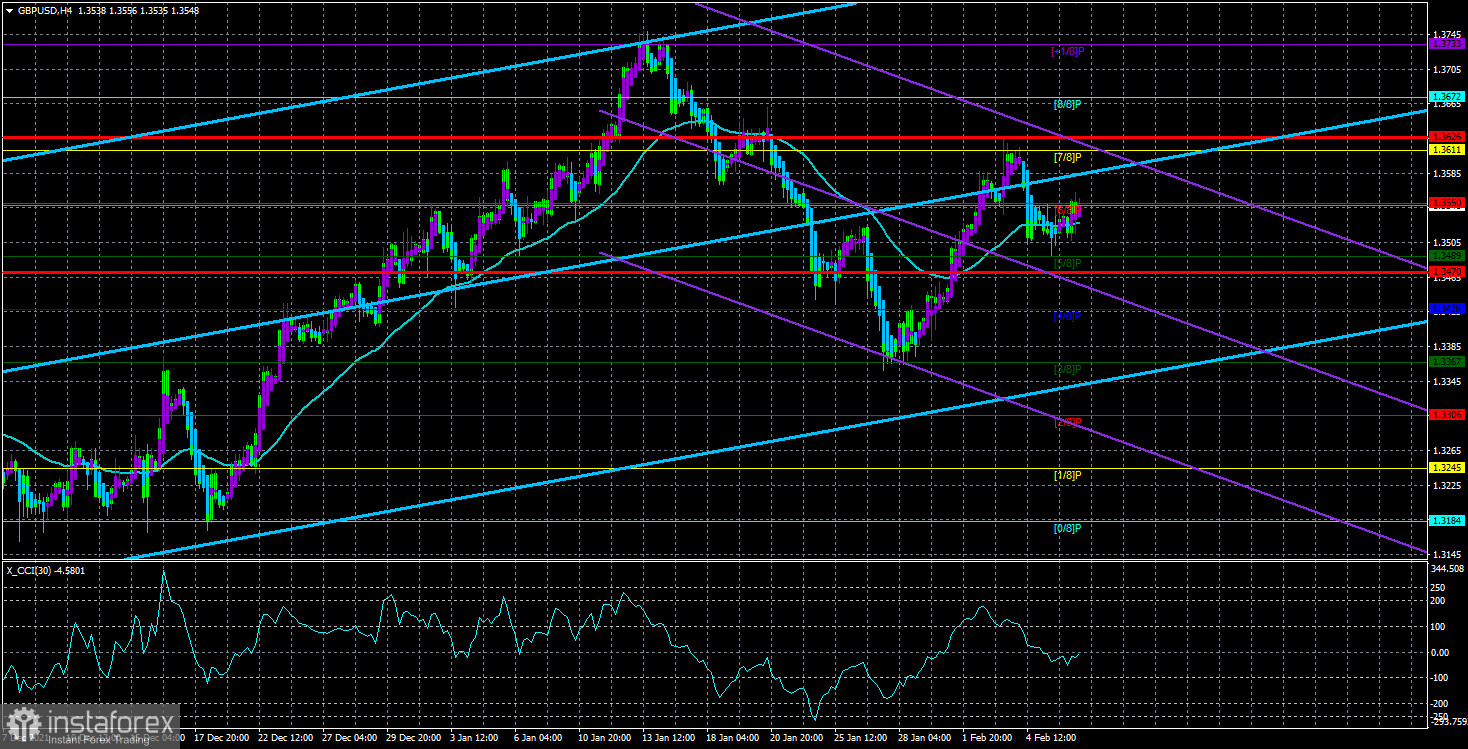

The GBP/USD currency pair continued to trade unintelligibly on Tuesday. A day earlier, the pair dropped to the moving average line and even slightly below it. However, on Tuesday, it returned above the moving average. However, for most of the day, it was in a weak movement, which did not lead to a significant change in the technical picture. Thus, at the moment, it can be concluded that the upward trend continues. At the same time, it is very shaky. Recall that the technical picture for the pound on almost all timeframes now looks very ambiguous. And even COT reports do not give an accurate assessment of what is happening now. On the one hand, the pound has grown quite a lot in recent months, which may mean the formation of a new upward trend. On the other hand, growth was not so strong last week, although the Bank of England raised the key rate and almost openly stated that it was going to raise it at least twice more in 2022. Thus, right now traders are confused. This is even very visible by the movement itself. On the 24-hour TF, the pair ignored the Senkou Span B and Kijun-sen lines of the Ichimoku indicator several times. On the 4-hour TF, it first dropped by 375 points, then rose by 245, then fell by 120. Thus, the "attenuation" of the pulse is now taking place. The process is similar to how the swing stops when an extraneous force ceases to affect them. Each subsequent movement is twice as weak as the previous one. As a result, everything ends with a flat near the moving. And from moving, traders will have to decide what to do with the pound and dollar in the near future. Until they make a decision, the pair may be in the flat.

A vote of no confidence may be passed on Johnson in the near future.

We have repeatedly written that Boris Johnson is walking "on very thin ice." Or on the edge of the abyss. We will not list once again all the scandals and stories that the British Prime Minister has been involved in all the time at the head of state. Let's just say that the last straw for the public, the conservatives, and the entire Parliament was the story of the "coronavirus parties". Johnson at first denied this, then accused his assistants. They say they did not warn him that drinking wine with colleagues in quarantine is prohibited, and then apologized and tried to shift the public's attention to other topics. In particular, he canceled quarantine measures from January 27, and in every speech, he spoke about the conflict in Eastern Europe. At the same time, 5 members of Parliament, who are Johnson's assistants, resigned at once. It's very similar to "rats fleeing from a sinking ship." Conservatives understand that Johnson is losing political popularity and those who will continue to support him may find themselves on the same boat as the British Prime Minister himself when they land on it from all guns. The deputy leader of the Labor Party, Angela Rayner, said that Johnson has run out of serious people who are ready to follow him and work under his incompetent leadership. On Saturday, several members of the Conservative Party said at once that 54 letters from party members in Parliament were needed to put the question of no confidence in the Prime Minister to a vote. At the moment, 40-45 letters have already been collected. Another 10 Conservative parliamentarians are seriously thinking about whether they are ready to show support for Boris Johnson and may make a final decision in the near future. Even worse for Boris is that during the scandal with the "coronavirus parties" in the UK, the number of people who come to get vaccinated against COVID has sharply decreased. Doctors explain this by the fact that confidence in Johnson and his words has fallen among the British. In general, in the next few weeks, the question of a vote of no confidence may be put to a vote in Parliament.

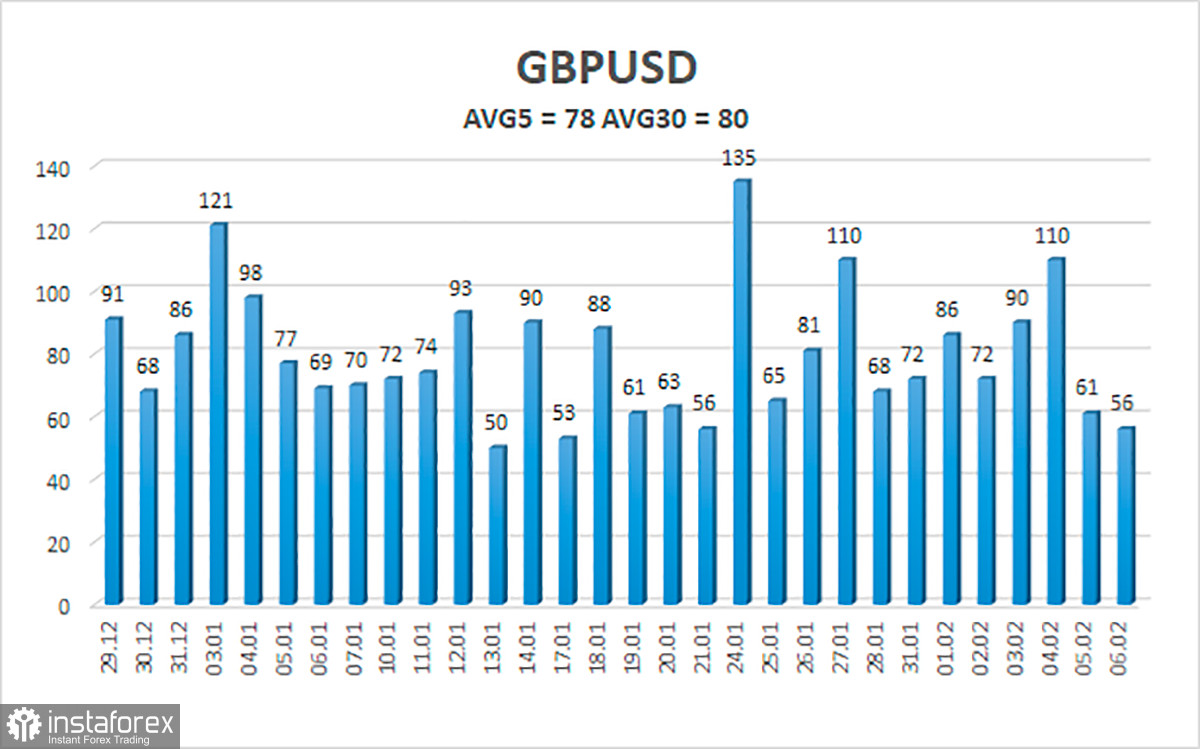

The average volatility of the GBP/USD pair is currently 78 points per day. For the pound/dollar pair, this value is "average". On Wednesday, February 9, thus, we expect movement inside the channel, limited by the levels of 1.3470 and 1.3626. The reversal of the Heiken Ashi indicator downwards signals the continuation of the downward correction.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair continues to adjust on the 4-hour timeframe. Thus, at this time, it is recommended to consider options for new long positions with targets of 1.3611 and 1.3626, but now there is a high probability of flat and frequent reversals of the Heiken Ashi indicator. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3470 and 1.3428, but the problem is the same: flat and frequent reversals of the Heiken Ashi.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română