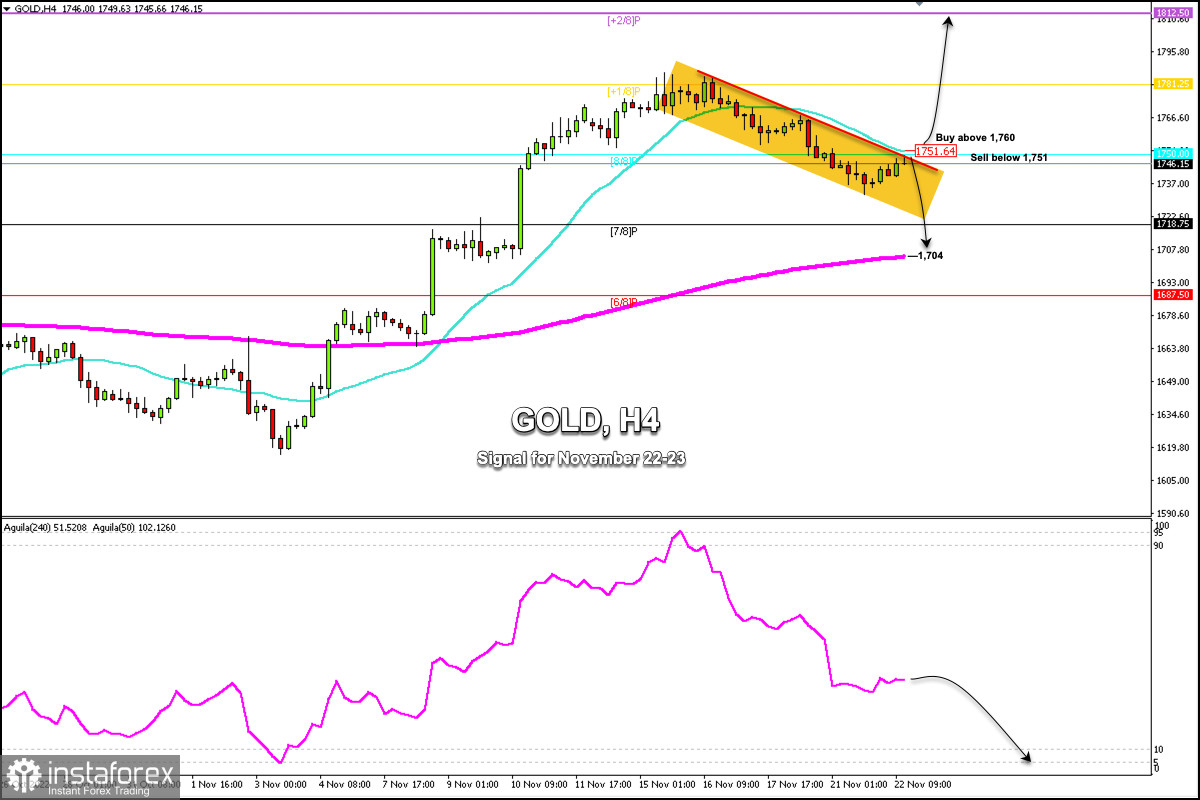

Early in the American session, Gold (XAU/USD) is trading around 1,741 below the 21 SMA located at 1,751.64 and below the downtrend channel which has been in progress since November 11.

Gold bounced from the weekly low of 1,735. It is likely to develop a technical correction in the next few hours and the price could return towards 7/8 Murray located at 1,717 and could even reach the 200 EMA located at 1,704.

If the price of gold returns above 1,760, it will be key for the continuation of the uptrend. Additionally, with a sharp break above the strong resistance of 1,781 (+1/8 Murray), the metal could reach the psychological level of 1,800 and even the resistance zone of 1,812 (+2/8 Murray).

Gold could continue to be under downward pressure because the Fed could raise its interest rates by 0.50% in December and inflation could increase compared to the declines in October. Such prospects could prevent XAU/USD from breaking above 1,812 in the next few days, hence, there will be a clear signal to continue selling.

Our forecast is that Gold is likely to trade below 8/8 Murray located at 1,750 in the next few hours. So, the price could fall towards the 200 EMA located at 1,704.

Above 1,760, there will be a clear signal to buy with targets at 1,781 and 1,712. Gold is likely to reach the 200 EMA area in the next few days. This is a strong technical bounce area and could be a clear signal to buy if the price consolidates above it.

The eagle indicator is giving a negative signal, so any technical bounce will be considered an opportunity to sell only if gold settles below 1,751.

Our trading plan for the next few hours is to sell below 1,751 (21 SMA) with targets at 1,735, 1,718, and 1,704 (200 EMA).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română