By and large, the pound stands still. If you really find fault, then there is rather a symbolic decrease, the scale of which fits into the concept of statistical error. Which, in general, is not surprising, since the macroeconomic calendar is completely empty. And apparently, this situation will last for another couple of days. Until Thursday, when the data on inflation in the United States will be published.

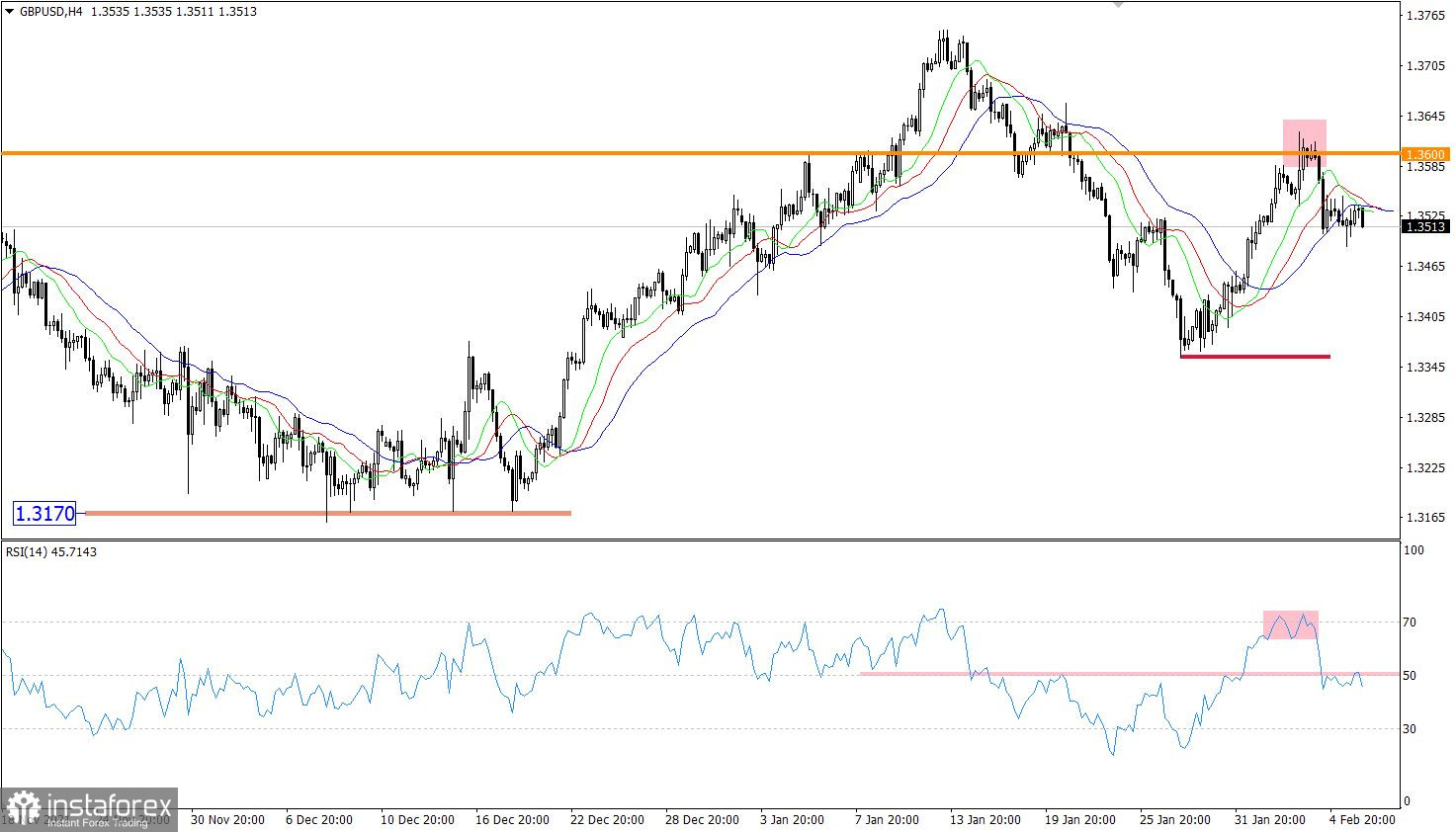

The GBPUSD currency pair rebounded from the resistance level of 1.3600, as a result of which there was a partial recovery move relative to the recent upward cycle.

The technical instrument RSI in the four-hour period confirms the growth of the volume of short positions by crossing the signal line 50 from top to bottom.

The Alligator indicator in the four-hour period has an intertwining between the MA moving lines, which indicates the completion of the upward cycle.

Expectations and prospects:

In this situation, keeping the price stable below 1.3500 in a four-hour period will increase the bears' chances for a subsequent decline towards 1.3450. Otherwise, the stagnation within the value of 1.3500 may drag on, which will disrupt the process of restoring dollar positions.

A complex indicator analysis gives a sell signal based on the short-term and intraday periods due to the price reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română