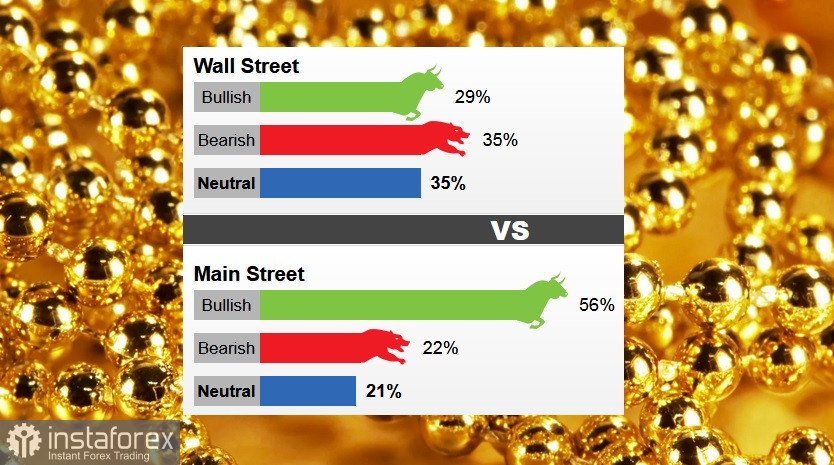

According to the latest results of the weekly gold survey, the sentiment of Wall Street analysts remains neutral-bearish.

The results also showed that retail investors remain optimistic.

Analysts say gold prices are at the center of opposing forces as the global economy faces rising inflation. However, the position of central banks is hawkish. In addition to this, volatility is increasing in financial markets as central banks reduce liquidity.

Last week, 17 Wall Street analysts took part in the gold survey. Among the participants, five, or 29%, voted for the rise in gold prices. In the same poll, "bearish" and "neutral" votes were distributed equally by six votes from each side or 35%.

As for Main Street's online polls, 683 votes were cast. Of these, 385 respondents, or 56%, expect gold prices to rise this week. Another 152 voters, or 22%, said they would decline, while 146 voters, or 21%, were neutral.

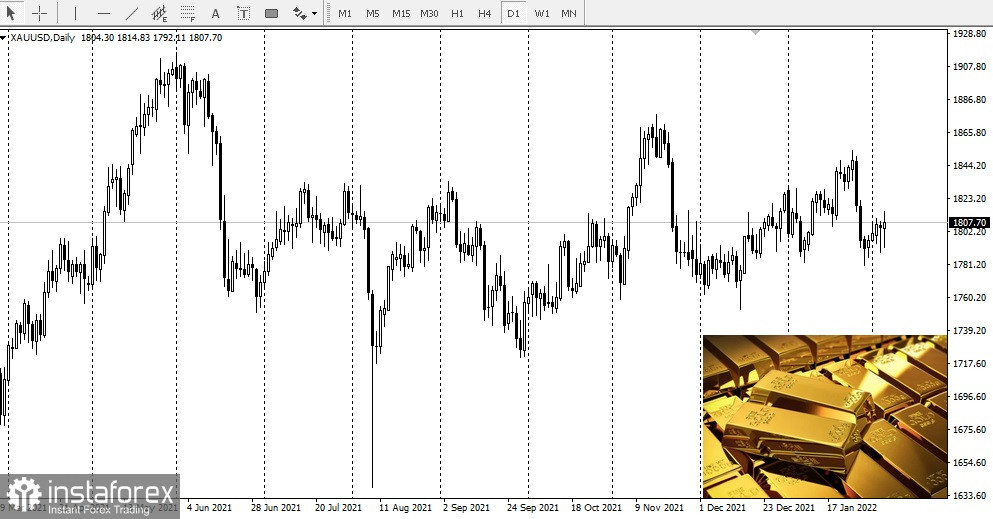

Gold's outlook comes from the fact that prices rose by 1% at the end of the past week compared to a sharp sell-off the week before last after the hawkish forecast of the Fed and its leader Jerome Powell.

Looking ahead, some analysts suggest that gold prices will struggle as markets continue to expect more aggressive moves from the US central bank. Expectations also continue to grow that a new tightening cycle will begin in March, and the Fed may raise interest rates by 50 basis points.

Strong labor market data are also expected after the Bureau of Labor Statistics reported that 467,000 jobs were created in January. The data far exceeded expectations since some economists expected job reductions.

Strong labor market data are also expected after the Bureau of Labor Statistics reported that 467,000 jobs were created in January. The data far exceeded expectations since some economists expected job reductions.

The threat of inflation also continues to grow. The report says that wages increased by only 0.7% in January, and by only 5.7% for the last 12 months.

Alliance Financial's precious metal dealer Frank McGhee says that with current jobs data and rising wage inflation, the Fed is way behind the curve and will have to play catch-up, which may put pressure on gold prices in the near future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română