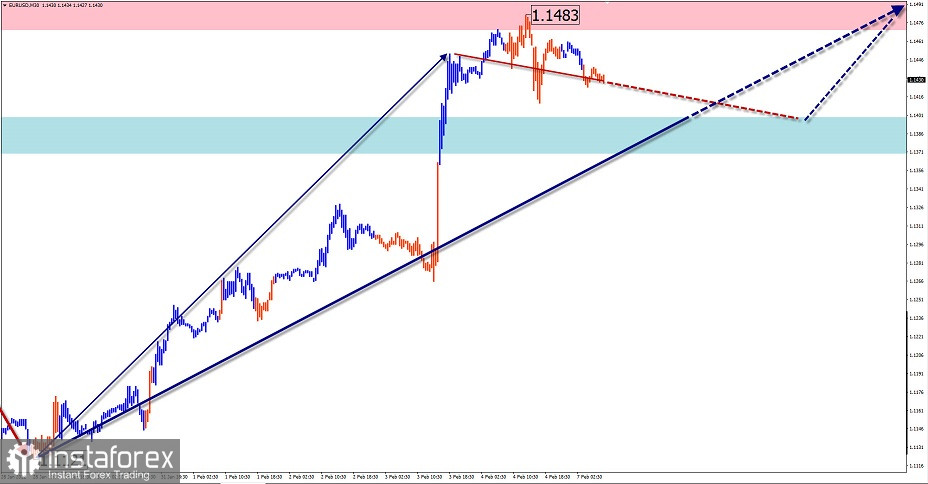

EUR/USD

Analysis:

It is highly probable that the upward movement of the European currency from January 28 has given rise to a new wave in the main direction. The price has reached the resistance level of the large timeframe. Before the continuation of the uptrend, the wave level in the correction should be increased.

Outlook:

The euro is expected to move sideways between the closest encounter zones in the next 24 hours. Resumption of price growth is likely at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 1.1470/1.1500

Support:

- 1.1400/1.1370

Recommendations:

Until the end of the upcoming pullback, trading in the euro market could lead to losses. It is recommended to watch for reversal signals to open long positions at the end of the upcoming pullback.

USD/JPY

Analysis:

The main Japanese yen pair chart has been dominated by an uptrend since early last year. The incomplete section has been reporting since January 14. A correction has been forming in the wave structure during the last 2 weeks. There are no signals of its completion on the chart at the moment of analysis.

Outlook:

Today, there is a high probability of the yen price moving in the corridor between the closest areas of the counter direction. In the first half of the day, an upward vector is more likely. A rate shift and a rate decrease can be expected at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 115.60/115.90

Support:

- 115.00/114.70

Recommendations:

Trading in the Japanese yen market today is possible only within individual sessions, with fractional lots. Opening short positions is more risky.

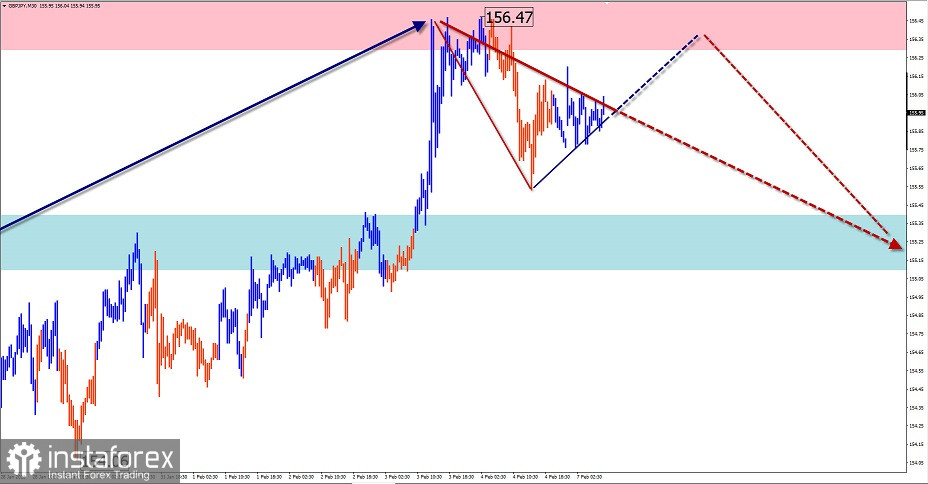

GBP/JPY

Analysis:

The chart of the English pound and Japanese yen continues its strong move to the north of the price chart. The unfinished section is timing from January 24. The price has reached a powerful resistance. The price needs to correct before it can continue its rise.

Outlook:

Price is expected to move mostly sideways in the coming days. In the first half of the day, an upward vector is more likely. In the resistance zone, a reversal and resumption of price decline can be expected further on.

Potential reversal zones

Resistance:

- 156.30/156.60

Support:

- 155.40/155.10

Recommendations:

In flat conditions, trades carry higher risk and are not recommended. It is optimal to refrain from trading the pair until a pullback is completed, with tracking signals for buying at the end of the pullback.

GOLD

Analysis:

A flat rising wave has been forming on the gold chart since last March. Its structure most closely resembles a horizontal pennant, or a descending triangle. The last unfinished section is ascending from January 28. This wave has unconfirmed reversal potential so far.

Outlook:

In the coming trading sessions, there is a high probability of starting a downward flat from the resistance zone to the area of estimated support. After the end of it, we can expect a renewal of price growth.

Potential reversal zones

Resistance:

- 1810.0/1815.0

Support:

- 1790.0/1785.0

Recommendations:

There are no near-term trading conditions in the gold market. It is recommended to refrain from trading the instrument until there are confirmed buying signals at the end of the upcoming pullback.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analysed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română