The growth of the single European currency, which began on Thursday, was sharply stopped by data on retail sales in the euro area. Their growth rates slowed down from 8.2% to 2.0%, while the forecast was 5.5%. On a monthly basis, sales even declined by 3.0%, while they were expecting a decline of only 0.4%. This was enough for the euro to freeze in place, in anticipation of the release of the report of the United States Department of Labor.

Retail Sales (Europe):

In principle, such a development of events was quite expected, due to forecasts regarding the dynamics of retail sales. The forecasts according to the report of the United States Department of Labor were such that after its publication, the euro's growth was to resume. But things didn't go according to plan. The unemployment rate itself rose from 3.9% to 4.0%, which was supposed to scare market participants and really plunge the US currency. However, this happened due to an increase in the level of economic activity from 61.9% to 62.2%. Moreover, 30,000 new jobs were not created outside of agriculture, but 467,000. In other words, unemployment will continue to decline. And its current growth is purely demographic in nature. Simply put, a fairly large number of young Americans suddenly entered the labor market and began to be considered a labor force. Banal due to age-related changes. In other words, the content of the report turned out to be incredibly optimistic. And it is surprising that after its publication, the euro did not actively begin to lose its positions.

Number of new jobs created outside agriculture (United States):

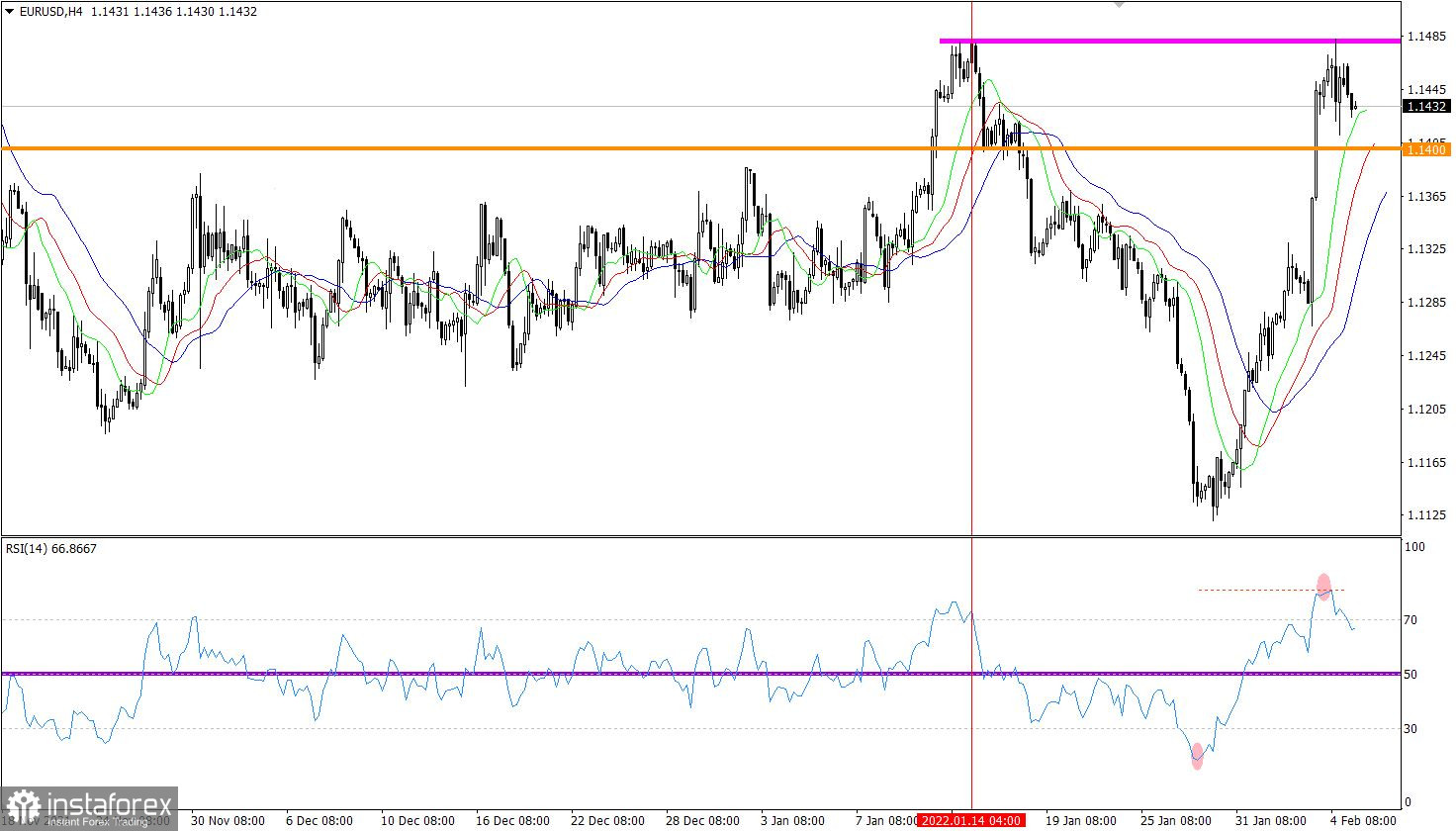

The EURUSD currency pair in the course of an intensive upward move reached the local high on January 14, where a reduction in the volume of long positions occurred on a natural basis. This led to a slowdown and, as a result, a time amplitude of 1.1410/1.1480.

The RSI technical instrument was above the 80 mark for a long time in the four-hour period, which was considered a high overbought status of the euro. During the stagnation period, the indicator crossed the 70 line from top to bottom, which may signal the beginning of the correction stage relative to the upward inertia.

The Alligator H4 and D1 indicator signals an upward cycle, there is no interlacing between the moving MA lines.

There is a downward trend on the chart of the daily period, where the usual correction may well be reclassified into an oblong one. This process will lead to a change in the trend if a number of technical conditions are confirmed.

Expectations and prospects:

Price stagnation in the 1.1410/1.1480 amplitude is highly likely to be classified in the market as a process of accumulation of trading forces. This will lead to new price jumps, for this reason, the most optimal trading tactic is considered to be the method of breaking through one or another stagnation boundary. In this case, we will be able to enter the market at the beginning of the momentum.

Complex indicator analysis has a variable signal based on short-term and intraday periods due to price stagnation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română