Long-term perspective.

The EUR/USD currency pair has increased by 300 points during the current week. It would probably be possible to assume that the fundamental support of the European currency was very strong since the one-way movement for this pair by 300 points is a very strong trend. However, upon closer examination, it becomes clear that this is not entirely true. Let's start with the fact that the euro currency began to grow on Monday. At the beginning of the week, there were practically no important macroeconomic and fundamental events, so the pair grew on pure "technique". This is not surprising, because the price moves not only when there is a "foundation" or "macroeconomics". But already on Thursday, the results of the ECB meeting were summed up, which cannot be called "hawkish". Nevertheless, the euro currency has grown by 150 points this day. Someone saw "hawkish" hints in Christine Lagarde's speech, but the movement by 150 points is commensurate with the decision to raise the rate, but not with a couple of ephemeral hints. Moreover, everyone has known for a long time: The ECB is not going to raise rates this year. Then what could be the reason for the powerful upward movement? From our point of view, what we warned about in recent articles has happened. The bears were simply fed up with the euro/dollar pair sales, which persisted throughout 2021. Now it is the turn of the growth of the European currency. We believe that now, more than ever, there are great chances for the formation of a new, medium-term (a year or two) upward trend. During the second half of 2021, we have repeatedly said that the entire downward movement of the pair is, in fact, a correction against the more powerful upward trend of 2020. The correction has likely been completed, and now a new upward trend is beginning.

COT analysis.

The new COT report, which was released on Friday, showed an increase in the "bullish" mood among a group of professional traders ("Non-commercial"). As you can see in the illustration above, the green line indicating the "Non-commercial" net position continues to be above zero, although it has slightly decreased following the results of the last COT report. However, there is nothing to be surprised about, since Thursday, when the ECB summed up the results of the meeting, and traders were trading very actively, did not get into the latest report. Thus, even without data on Wednesday, Thursday, and Friday, we see that major players are slowly starting to buy the euro currency, and do not continue to sell it. The red and green lines of the first indicator were near the zero level for a long time, which signaled the end of the last trend. And the past trend is the downward trend of 2021. Given that market participants completely ignored the fundamental background of last week, we conclude that the time for dollar purchases and euro sales has come to an end. The "sharp start" of the euro also speaks in favor of the beginning of a new upward trend. The EU currency has grown almost out of the blue by 300 points in 5 days. This is how most trends begin. Of course, nothing prevents traders from winning back this injustice in the new week. Still, the pair should be adjusted from time to time, even if the fundamental background does not speak in favor of this. But for now, we consider this scenario to be an alternative scenario.

Analysis of fundamental events.

What to say about the "foundation" this week? The week began with the publication of the Eurozone GDP report for the fourth quarter. It turned out to be weaker than the weakest forecasts and much weaker than the US GDP for the same period. However, as we can see, this did not prevent the euro from growing by 90 points. On Wednesday, a report on inflation in the European Union was released, which for many unexpectedly exceeded the forecasts and the value of the previous month (much-expected inflation to slow down), but in the case of the ECB, this does not matter, since it is still not going to abandon monetary stimulus ahead of time and raise rates. Therefore, the increase in inflation should not have supported the euro currency. But the euro rose both on Tuesday and Wednesday. On Thursday, it became known that the ECB is not going to change monetary policy in the coming months or even a year. Christine Lagarde still believes that inflation will begin to slow down "by itself." Just as Jerome Powell believed a few months ago. In any case, the absence of any changes and announcements should not have led to an increase in the euro by 150 points. I don't even want to talk about Friday and the Nonfarm Payrolls report.

Trading plan for the week of February 7-11:

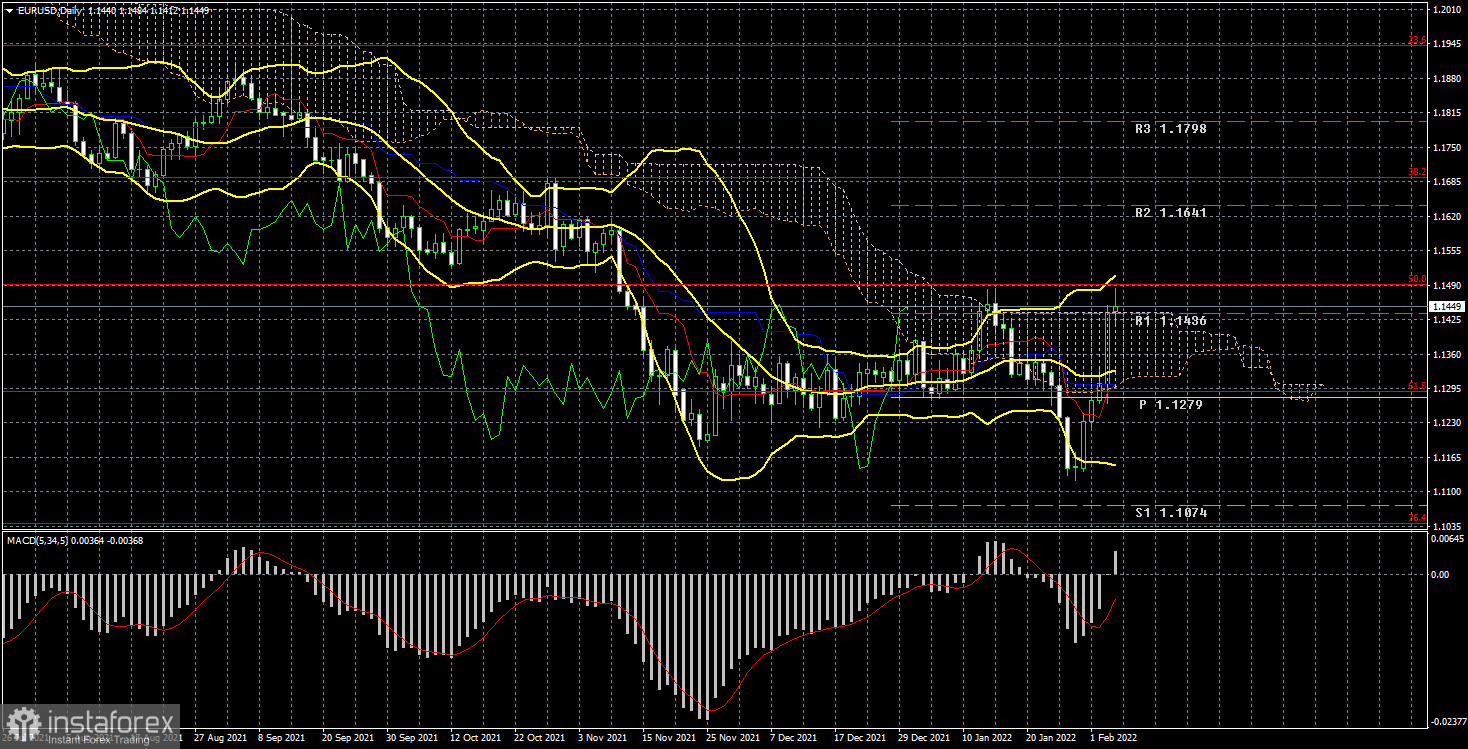

1) On the 24-hour timeframe, the pair is again trying to start a new upward trend, but at the moment, it has again rested on the Senkou Span B. It is possible that this time there will be a rebound from it, but now we believe that after a slight pullback, the pair's growth will continue. Thus, if there is a new rebound from the critical line or overcoming the Ichimoku cloud, we recommend buying a pair.

2) As for the sales of the euro/dollar pair, this requires a new consolidation of the price below the critical line. Between the levels of 1.1100 and 1.1200, traders have already shown that they are not ready to continue selling the euro, so there is a high probability that the downward trend is over. At least, at the moment, we can make exactly this conclusion, given the COT data and the "foundation" of last week.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română