All trends reverse sooner or later. And while the EURUSD bears are still holding on to the idea of a more aggressive Fed than the ECB in 2022, you can't get away from the market. It is growing on expectations, and the U.S. dollar has already won back its expectations. The last thing it could find strength for was the best advance against the euro in the last seven months in the week to January 28. Alas, the victory of the U.S. dollar turned out to be pyrrhic. It was followed by the worst five-day week in two years.

ECB President Christine Lagarde's speech at the press conference following the January meeting of the Governing Council was filled with hawkish rhetoric. Lagarde no longer claimed that rates would not rise in 2022, she noted that there was serious concern about inflation indicators at the meeting table. Reaching a record high of 5.1%, consumer prices may remain high longer than the European Central Bank predicted. Indeed, inflation in the Eurozone regularly exceeded Bloomberg's estimates, forcing Lagarde and her colleagues to raise their forecasts. Most likely, they will do it in March.

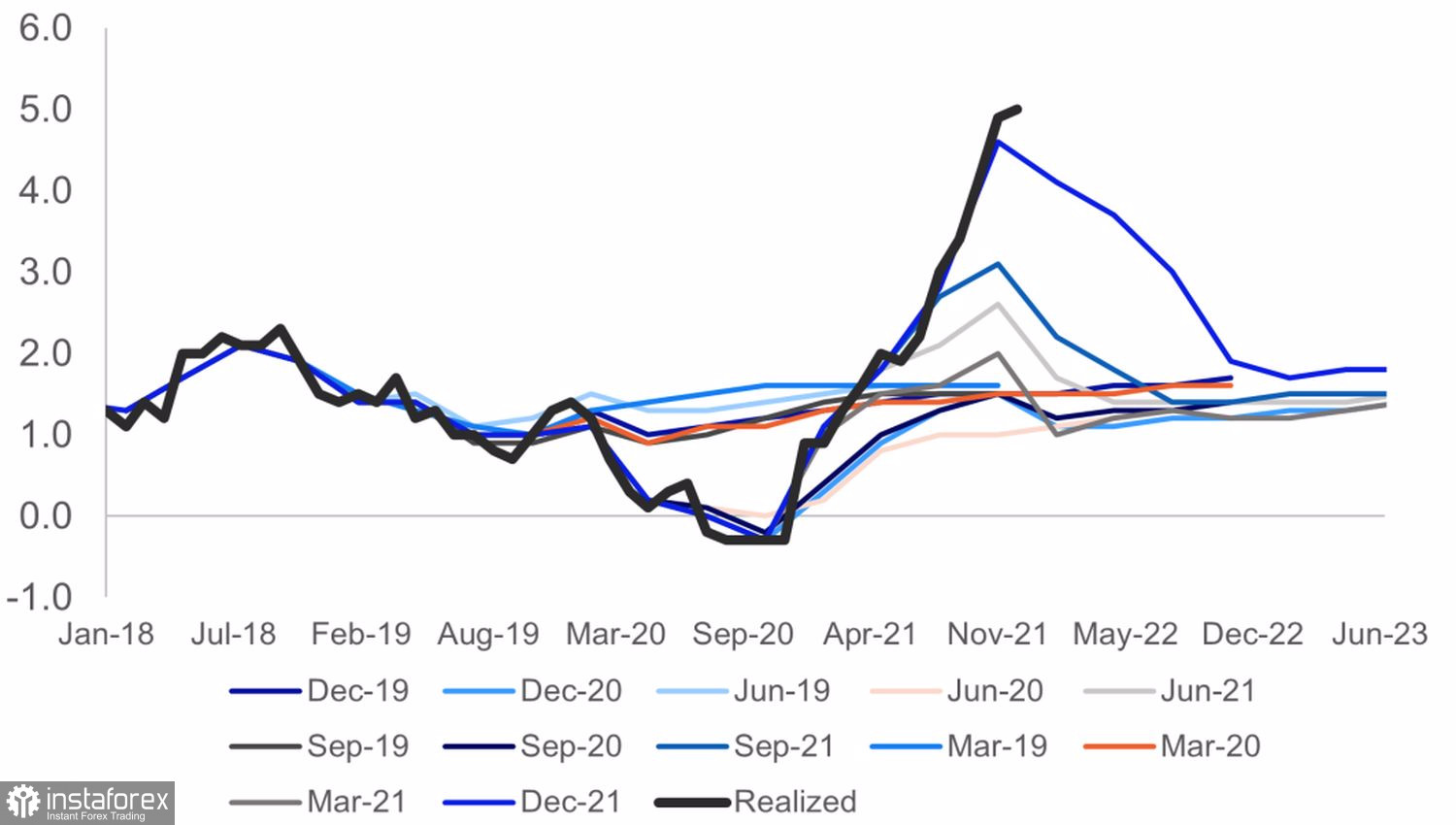

Dynamics of ECB inflation forecasts

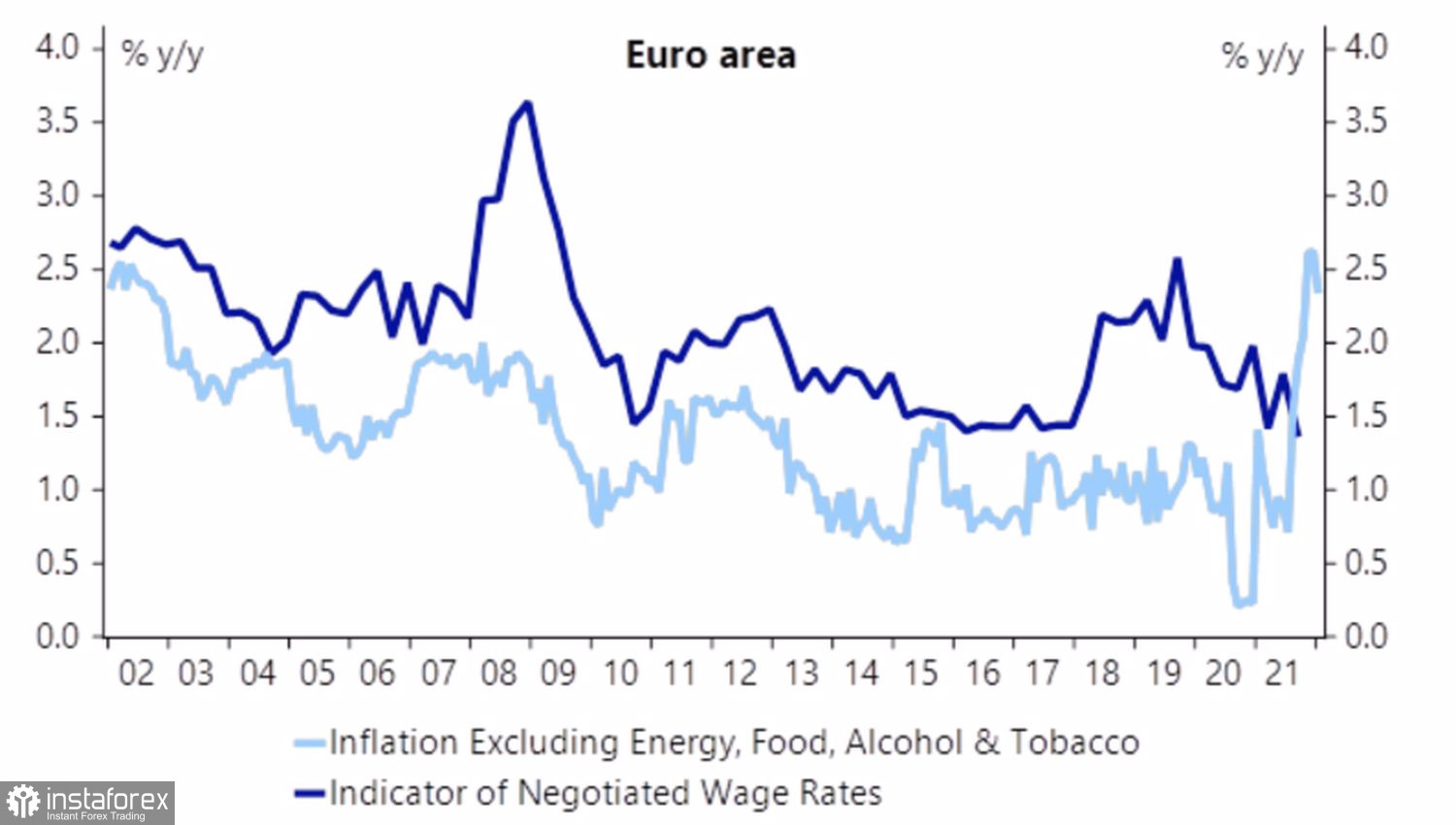

At the same time, there will be a test of the three criteria that Lagarde referred to earlier when justifying the ECB's reluctance to raise rates in 2022. From her point of view, the European Central Bank has fewer reasons for concern than the Fed, because due to large-scale fiscal stimulus, demand in the United States increased by 30% of the pre-pandemic level. Indeed, wages in the currency bloc are not rising as fast as in the U.S., which still leaves hope for a slowdown in CPI this year.

Dynamics of Core Inflation and Wages in the Eurozone

If the ECB had remained dovish, it would have lost control of inflationary expectations, which would have led to a further rise in consumer prices. The transition to hawkish rhetoric is a necessary measure, and the markets reacted quite violently to this. They are counting on an increase in the deposit rate by as much as 45 basis points in 2022 and by 100 basis points over the next 12 months. Investors haven't been this aggressive since 2018.

What's next? If U.S. inflation slows down, the Fed will tighten monetary policy not five times, but a smaller number of times, which will negatively affect the dollar. If the CPI continues to accelerate, the Fed will act aggressively, but such a strategy would result in the ECB quickly withdrawing stimulus. And in this scenario, the "bears" on EURUSD will have a hard time.

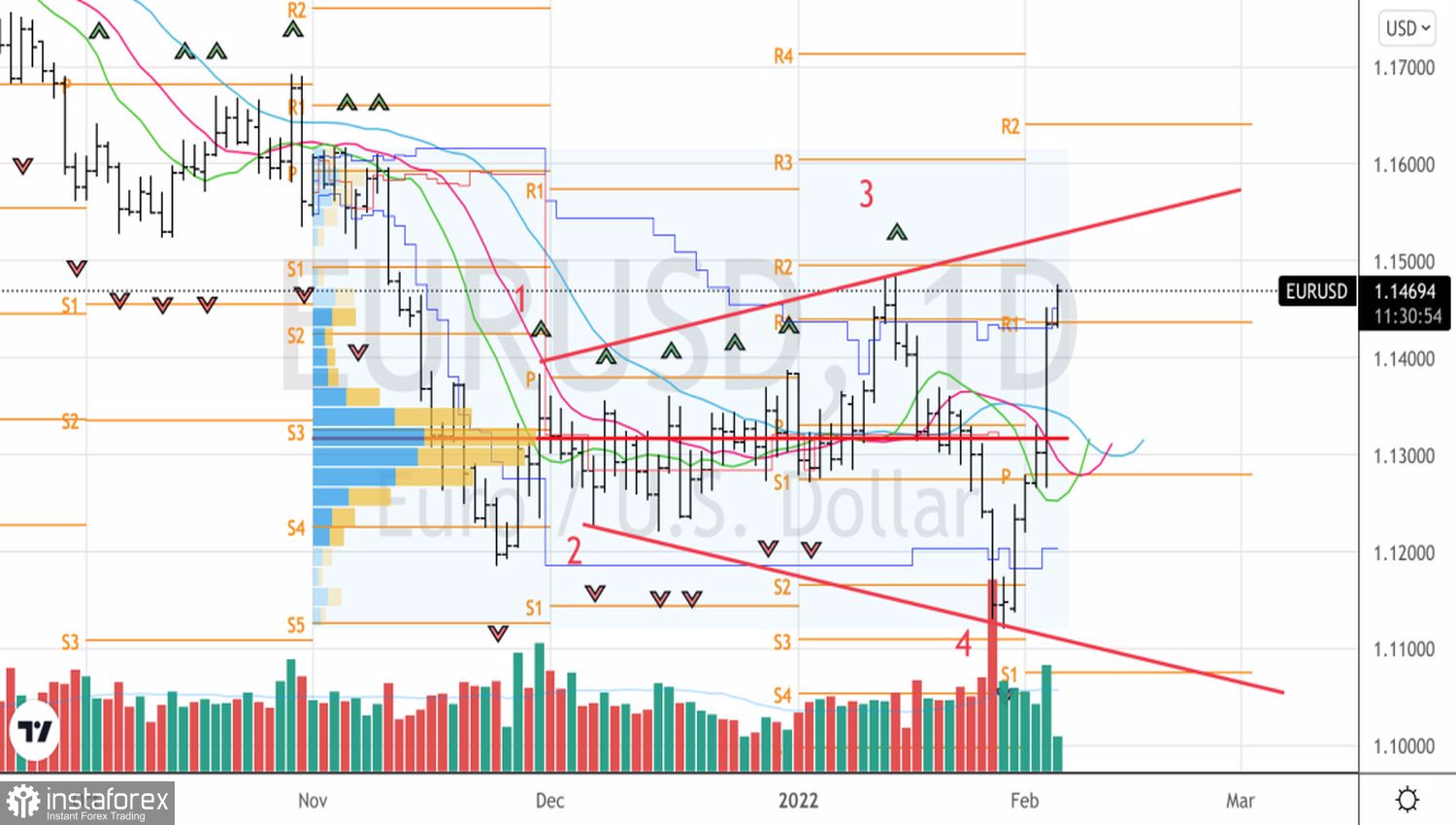

Most likely, the downward trend is broken and the pair should be bought on dips. At the same time, the week by February 11 may give a reason to do this. Its key event is the release of U.S. inflation data for January.

Technically, the return of EURUSD quotes above the fair value of 1.132 is a signal of a reversal of the bearish trend. In order to make sure of this, the pair needs to grow above 1.15. In this case, the "Rising Wedge" pattern will be activated, followed by a pullback in the direction of 23.6%, 38.2%, and 50% Fibonacci levels from waves 4-5. It should be used to buy the euro towards the pivot levels at $1.16 and $1.172.

EURUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română