The EUR/USD currency pair rose by more than 100 points on Thursday. That's all you need to know about yesterday. As soon as the ECB announced the results of its meeting, which did not surprise anyone at all, the European currency began to grow and continued it during a press conference with Christine Lagarde. Someone might think that the ECB has raised the key rate or Christine Lagarde said that in 2022, the regulator will tighten monetary policy a couple of times, but no. Nothing like that sounded. Thus, the European currency just rose out of the blue, for no reason at all. However, this week such behavior of the European currency should not surprise at all. The euro has been growing since Monday when the fourth-quarter GDP report was published in the Eurozone, which turned out to be weaker than even the weakest forecasts. Therefore, in total, the European currency managed to rise in price by almost 300 points this week, although the fundamental background should have provoked an equally strong fall in the euro. What is the result? According to the results, the upward trend remains, which again formed this week. The fact that the current growth of the euro currency is illogical does not negate the fact of this growth. Of course, as early as next week or even today, an equally strong drop in the pair may begin. But the strong growth of the European currency cannot be canceled. And now we have an upward trend and a very strong upward movement. Moreover, if the illogicality of this movement is not won back (the pair does not fall back to the 11th level, where it is more reason for it), then we will assume that in the global and long-term the mood of traders has changed to "bullish" and now we can say that the downward trend of 2021 is over, and a new long-term upward trend awaits us.

It makes no sense for the ECB to raise the rate, and it is not going to do so.

What can I say about the ECB meeting itself and its results? By and large, there is nothing to say, because all the results were known even before they were announced. The credit, deposit, and key rates remained unchanged. The PEPP program will continue to function as planned and in the first quarter, the ECB will buy bonds at a slower pace than in the fourth quarter. The PEPP program will be fully completed in March 2022, as previously planned. Reinvestments from redeemed bonds under the PEPP program will continue until the end of 2024. In 2022, the APP program (also an incentive program) will continue to operate, which will be expanded in the second quarter to 40 billion euros per month. In the third quarter, it will be reduced to 30 billion euros per month, and in autumn or winter - to 20 billion euros per month. In general, nothing unexpected, market participants have known all this for a long time. The European regulator fully met the expectations of traders, but at the same time, the euro market is still up. Why this happened is quite difficult to say. Maybe the market somehow interpreted Christine Lagarde's words at a press conference in a peculiar way? But Lagarde did not say anything ambiguous or ambiguous. Her rhetoric was also fully expected. Thus, we believe that the European currency has grown undeservedly and should start falling in the near future. If not, then we will assume that the global trend has changed to an upward one. One way or another, we need to wait for the end of this crazy week. After all, the most important Nonfarm Payrolls report will be published in the USA today, and I don't even want to try to predict what the market's reaction to it may be. Just as I don't want to talk about what the value of this indicator may be, although the last two reports were worse than forecasts. Today, the markets can continue to work out the results of the ECB meeting in the first half of the day, and in the second - the American statistics. Therefore, the movements can also be extremely volatile, therefore, you need to wait again until the market calms down and returns to normal to calmly assess the technical picture and draw conclusions.

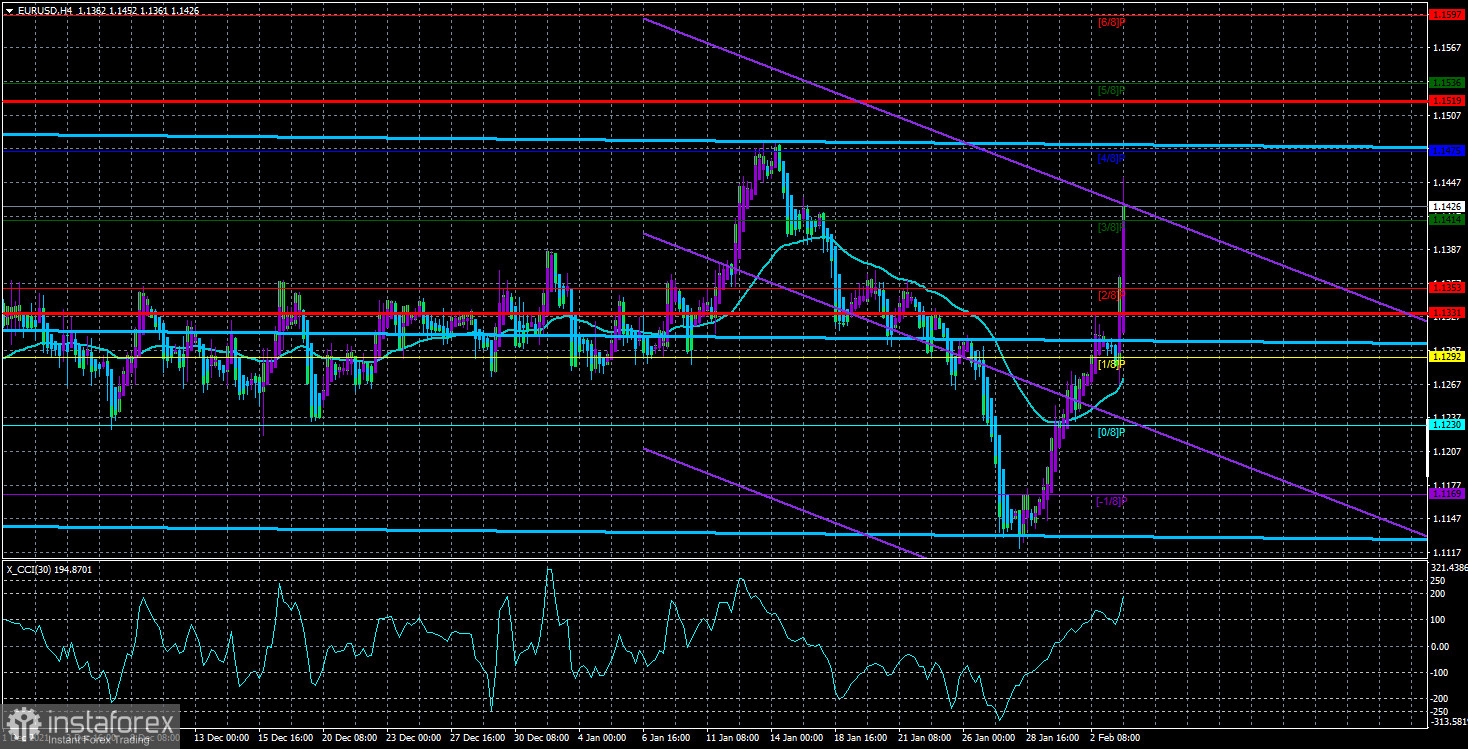

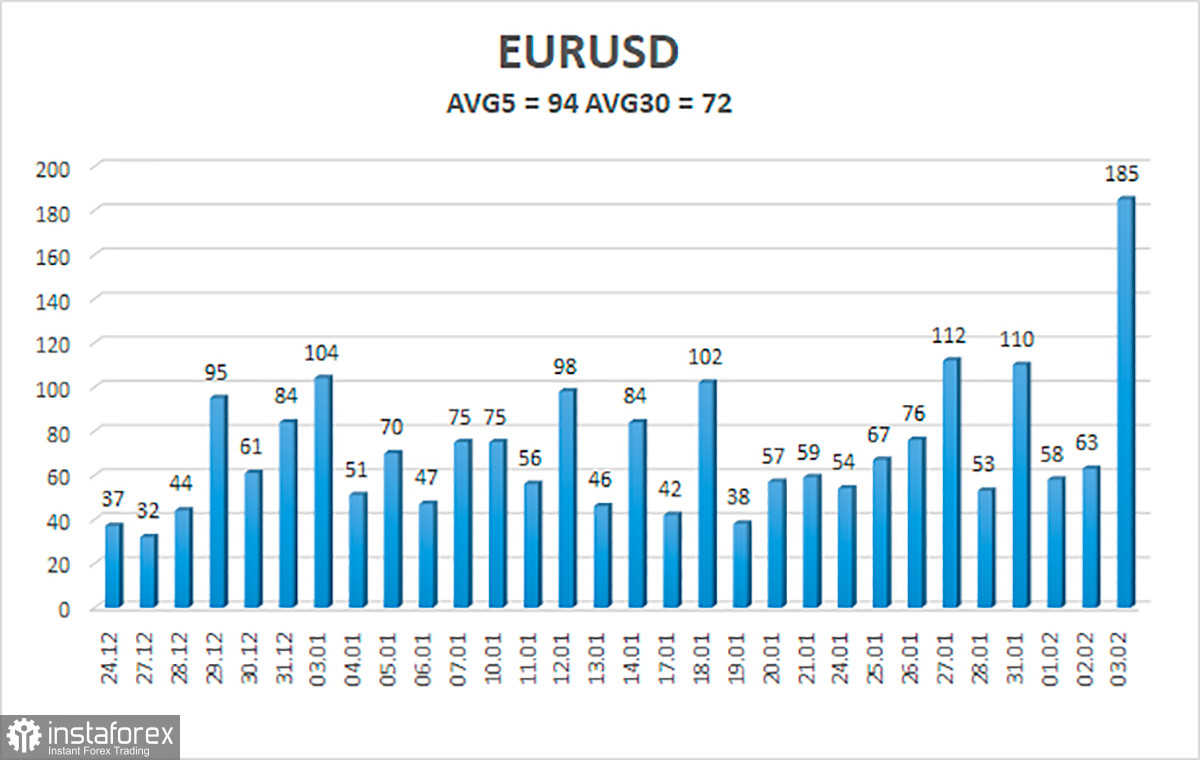

The volatility of the euro/dollar currency pair as of February 4 is 94 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1331 and 1.1519. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading recommendations:

The EUR/USD pair continues to be located above the moving average line. Thus, now you should stay in long positions with targets of 1.1475 and 1.1536 until the Heiken Ashi indicator turns down. Short positions should be opened no earlier than the price-fixing below the moving average line with targets of 1.1230 and 1.1169.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română