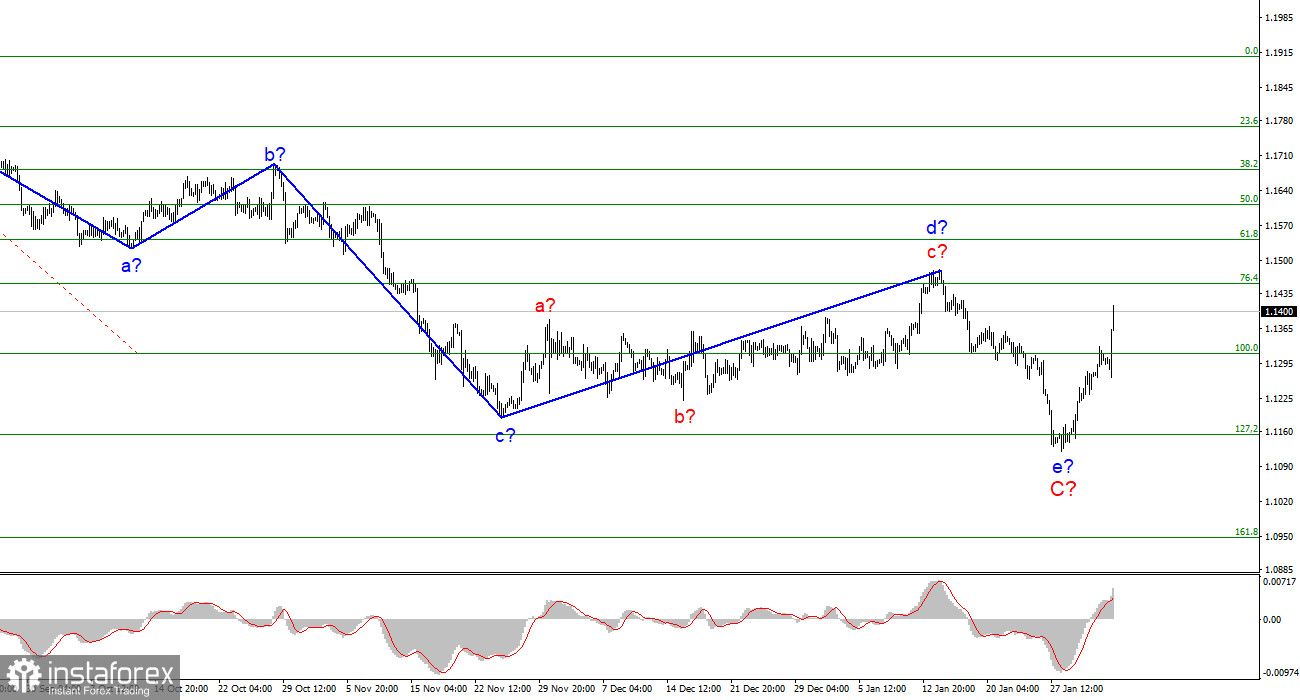

The wave pattern of the 4-hour chart for the EUR/USD pair is unquestionable. The quotes' continue to grow dramatically during the last few days. This rise might be an internal correction wave as part of e in C, or it might be the first wave of wave D or a new ascending trend section. The price increase resembles the first wave of wave D as it is too strong. In this case, the downward c wave has been formed and its internal e wave was shortened. It is just an assumption as the outcome of the ECB meeting was quite dovish and the decline in the European currency may resume. However, in this case wave d may become a three-wave pattern with the inner waves of the same size. It is not possible to make more precise conclusions due to the downtrend correction as it might transform into a five-wave trend but still be corrective.

Euro continues its best week in 2022

The EUR/USD instrument gained another 100 basis points on Thursday. Therefore, the market continues to increase demand for the European currency or reduce demand for the US dollar. On Thursday, the European Central Bank announced the results of its first meeting of 2022, and they were not a surprise to the market. However, the market reacted as if it did not expect the ECB to take no action. The ECB did not raise the interest rate and did not announce it was ready to start raising it. Besides, it was not going to stop stimulating the economy using the PEPP and APP programs. Therefore, it is difficult to say what was the reason for the markets' reaction to buy the European currency yesterday. I can only make one assumption.

The market activity has increased due to this major event. However, the wave pattern is extremely significant. Therefore, currently either wave d or the first wave of the new uptrend section has been forming. In both cases, the instrument's quotations may go beyond the peak of the anticipated wave c in d in C. Thus, it will be very difficult to draw a conclusion as to which wave the instrument is within in the coming days and weeks. In fact, it might even be inside the C wave, which will become more complicated and lengthened. However, it is the least likely scenario. Christine Lagarde said at a press conference that the latest wave of the coronavirus pandemic has had less negative impact on the EU economy than previous waves. The ECB president also expects economic conditions to improve in 2022 and a slowdown in inflation, but continues to maintain dovish monetary policy.

Overall conclusions

Based on the analysis, I conclude that the ascending wave C has been completed. If this assumption is correct, then the formation of a corrective downward b wave in D, or 2 in 1 a new uptrend section may start in the near future. Therefore, I recommend not to hurry to buy the instrument. It is better to await the formation of the corrective downward wave and then to buy according to the signals of the MACD indicator with the upper target.

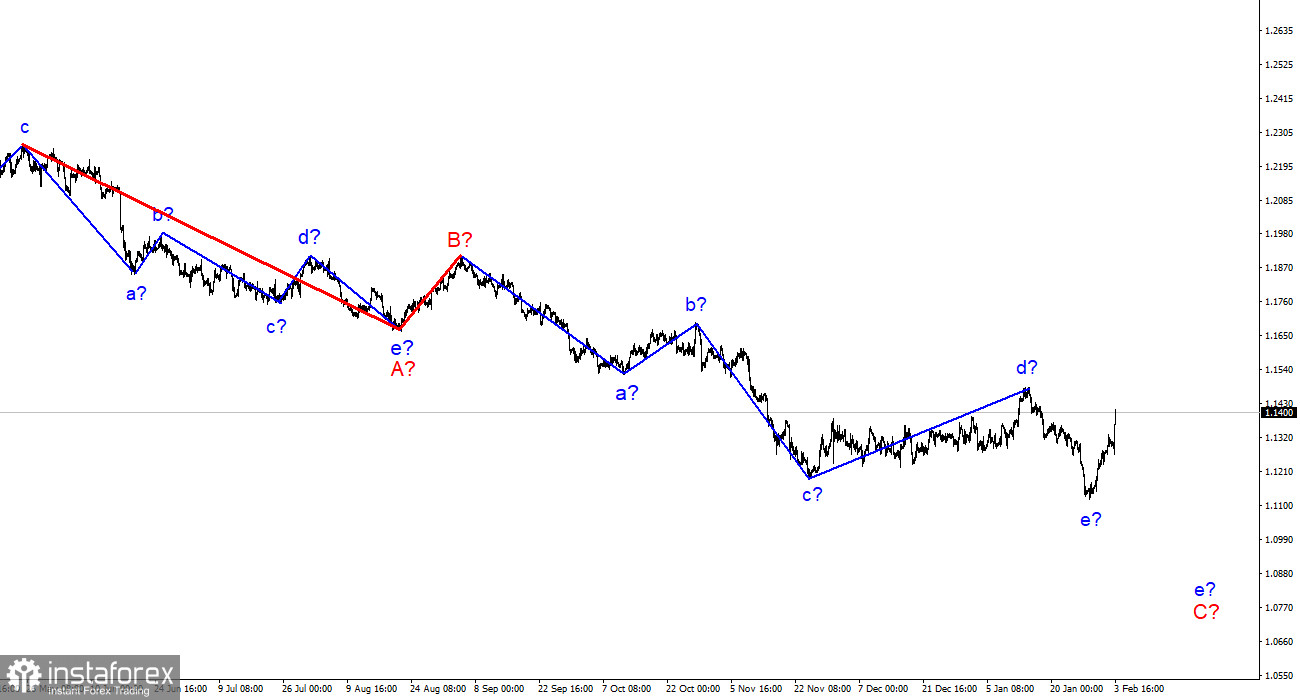

On a larger scale it is shown that the formation of the presumed wave e in C is going on. This wave may have a five-wave pattern or it may be a short wave. The previous waves were not too large and were approximately the same size. Therefore, the current wave is expected to have the same features. I believe that it is more likely that this wave has been completed than will build three more waves as part of the C wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română