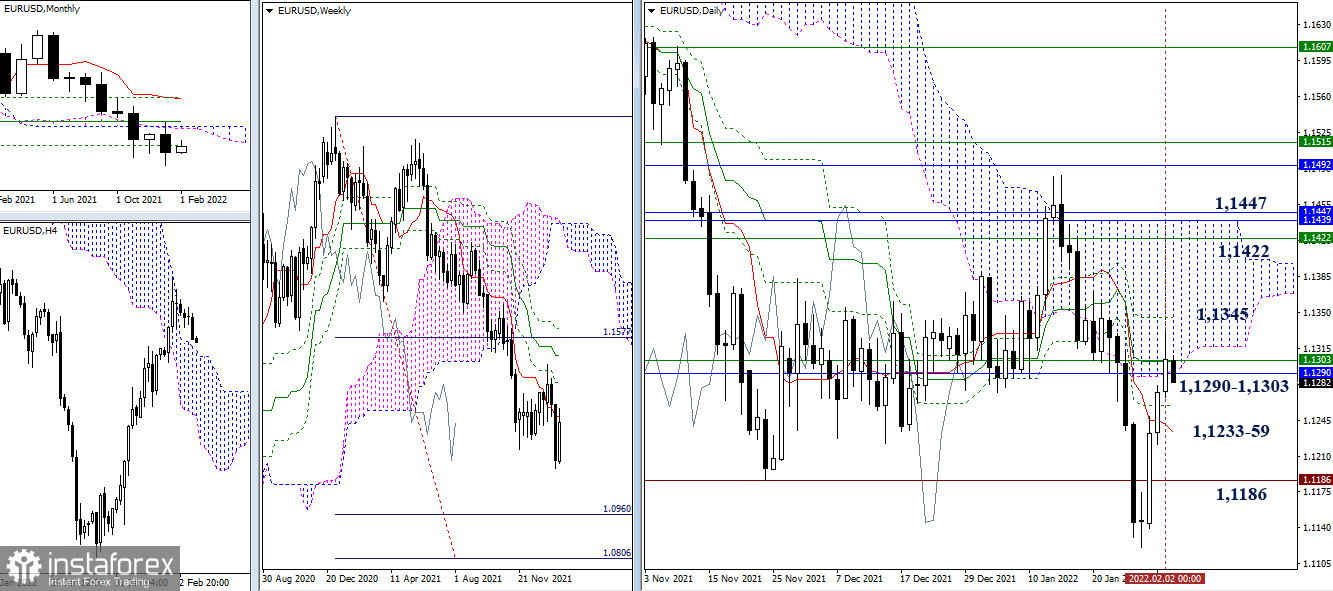

EUR/USD

The bulls managed to almost completely neutralize all the gains of the opponent obtained last week. As a result, the pair returned to the accumulation of strong levels at 1.1290 - 1.1303 (monthly Fibo Kijun + weekly short-term trend). The breakdown of this border will enhance the advantages and opportunities of one side or another. The nearest targets for the bulls are at 1.1345 - 1.1422 - 1.1447, while for the bears, the levels of 1.1259 - 1.1233 - 1.1186 can be considered.

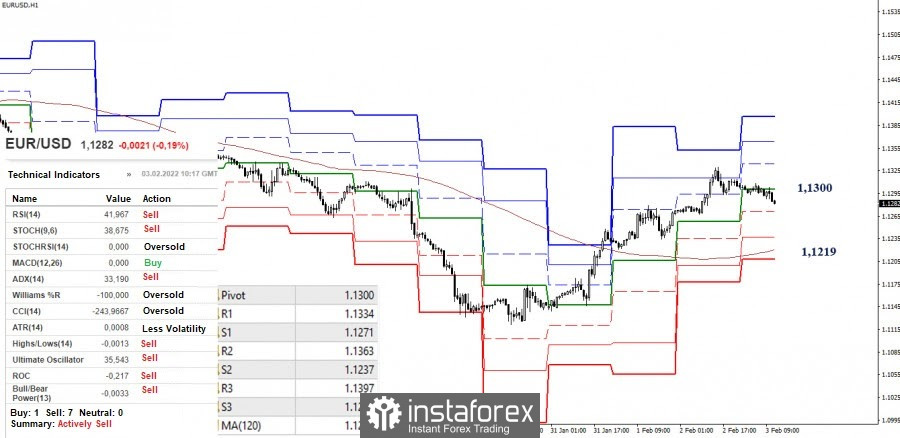

The main advantage in the smaller timeframes currently belongs to the bulls, but the pair on the hourly chart is in the downward correction zone. Sellers managed to consolidate below the first important level - the central pivot level (1.1300). The next key target for correction that could affect the distribution of the balance of power is now set at 1.1219 (a weekly long-term trend). The closest supports can be noted at 1.1271 and 1.1237 (classic pivot levels). Once the correction ends, the relevance will return to upward pivot points, namely the resistance of the classic pivot levels (1.1334 - 1.1363 - 1.1397).

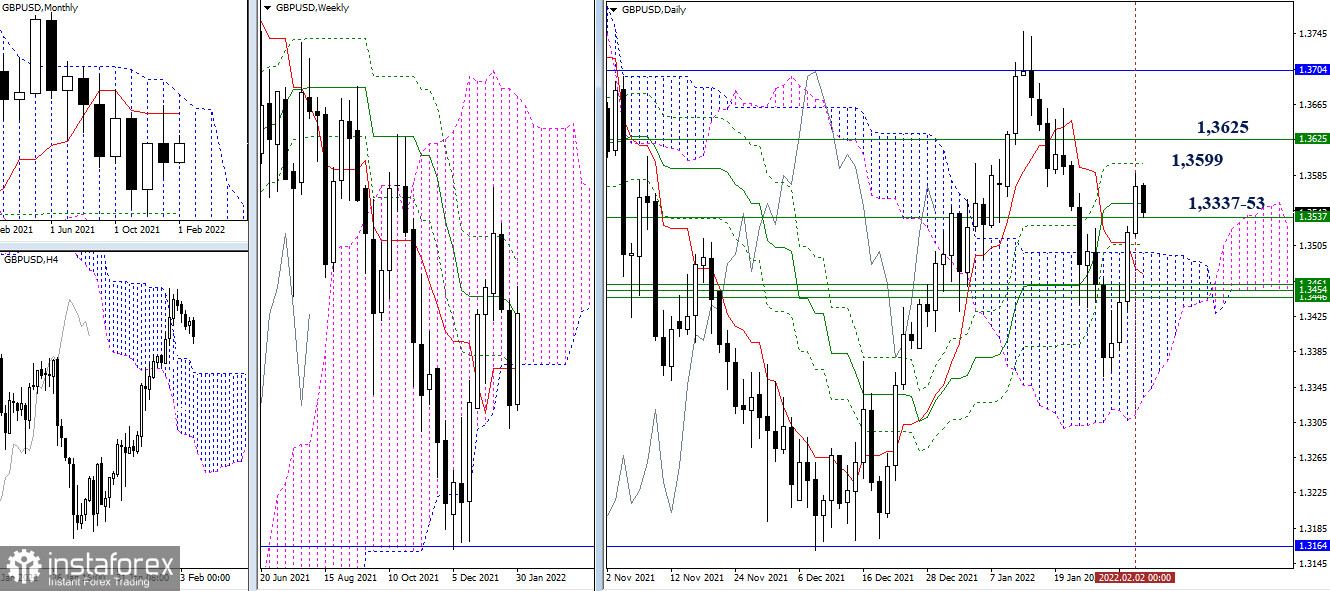

GBP/USD

The bulls rapidly regained important weekly levels and almost completely blocked the bearish gains from the past week. Now, their main task is to consistently break through Ichimoku crosses, first on the daily timeframe (1.3599) and then on the weekly one (1.3625). If the tasks are completed, new prospects to intensify the bullish mood will be considered. It should be noted that medium-term trends – daily (1.3553) and weekly (1.3537) are attracting and influencing. A consolidation below them can serve as the beginning for the formation of a rebound from the met resistance.

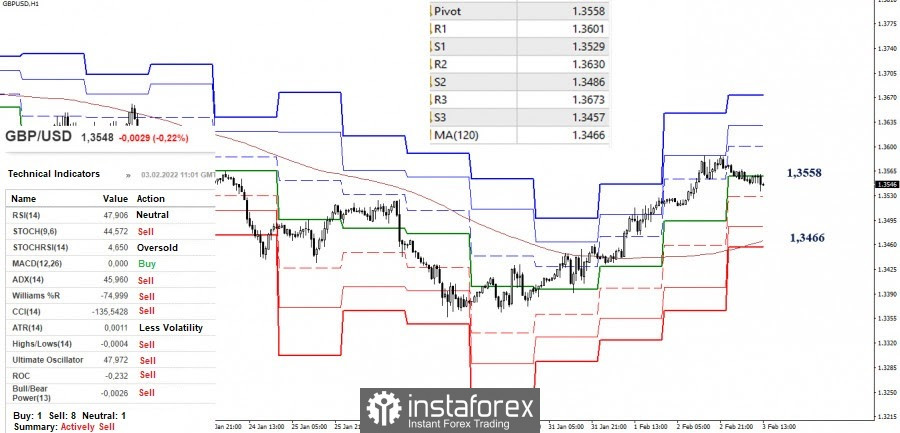

The downward correction has allowed the bears to gain the support of the analyzed indicators. Now, they are fighting to break through the central pivot level (1.3558). Trading below this level gives preference to the development of a downward correction. Its next important downward pivot point is the weekly long-term trend (1.3466). The nearest supports can be noted at 1.3529 (S1) and 1.3486 (S2). On the contrary, leaving the correction zone will direct the pair to new upward pivot points – resistances of classic pivot levels (1.3601 - 1.3630 - 1.3673).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română