To open long positions on GBP/USD, you need:

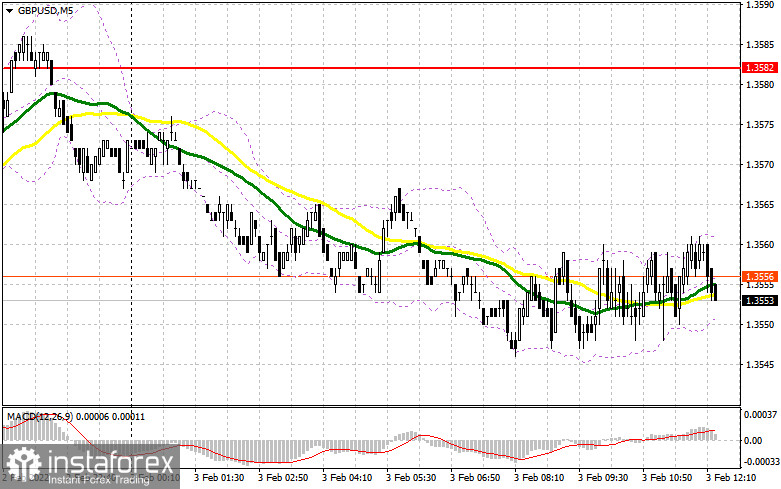

In my morning forecast, I paid attention to several levels of support and resistance. Let's look at the 5-minute chart and figure out what happened. Even though the data on activity in the UK services sector turned out to be slightly better than economists' forecasts, traders ignored the report, preferring to take a wait-and-see position before the publication of the results of the Bank of England meeting. As a result, intraday volatility was about 15 points. We did not reach the levels I indicated. From a technical point of view, nothing has changed. And what were the entry points for the euro this morning?

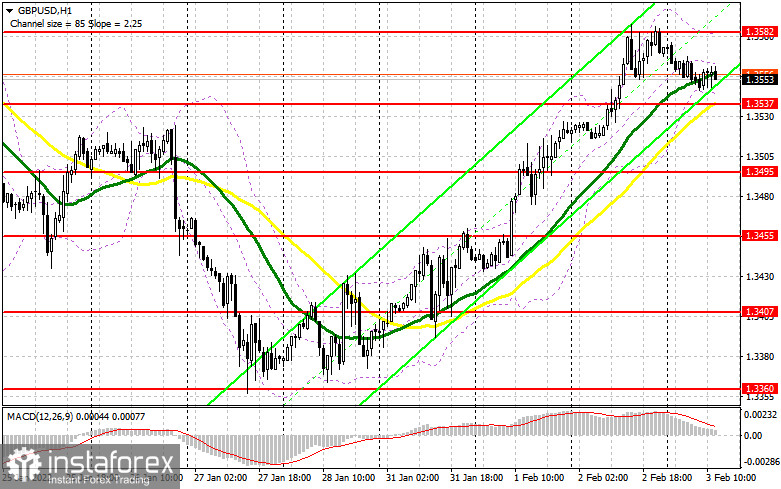

During the American session, we are waiting for data on the number of initial applications for unemployment benefits and the index of business activity in the service sector from ISM. Good indicators can help the US dollar, but the whole focus will shift to the decisions of the Bank of England on monetary policy. It should be understood that the planned increase has already been taken into account in the quotes, and if the regulator does not announce anything new in its summary, the pound may sink. Andrew Bailey must speak out more aggressively regarding further monetary policy – this will be a catalyst for the growth of the British pound. An important task for the bulls today will be to protect the support of 1.3537, where the moving averages are playing on their side. From this range, we can count on the continuation of the upward correction for the pair. It is important to form a false breakdown at 1.3537. Only this will form the first entry point into long positions, and weak data on the PMI index for the US services sector will return demand for the British pound. An equally important task will be the breakdown and test of 1.3582 from top to bottom, which will give an additional buy signal to return to 1.3622. A more difficult task is to update the 1.3656 area, but this will happen only in the case of aggressive changes in the Central Bank's policy after today's meeting. I recommend fixing profits there. In the scenario of a decline in GBP/USD during the US session, after weak strong fundamental data and lack of activity at 1.3537, it is better not to rush into buying risky assets. I advise you to wait for the test of the next major level - 1.3495. Only the formation of a false breakdown will give an entry point to long positions. You can buy the pound immediately for a rebound from 1.3455, or even lower - from this month's minimum of 1.3407, counting on a correction of 20-25 points within a day.

To open short positions on GBP/USD, you need:

The bears remain on the sidelines and will closely monitor the results of the Bank of England meeting. A lot will depend on the degree of hawkish policy, so no one will sell the pound even from the current highs yet. The primary task of sellers remains to protect the 1.3582 level, where the bullish momentum was stopped yesterday. The formation of a false breakdown in this range, together with the divergence that is being formed now on the MACD indicator, forms the first entry point into short positions, counting on the resumption of the bear market and the pair's decline to the intermediate support area of 1.3537, formed by the results of yesterday. A breakdown and a test of 1.3537 from the bottom up will give an additional entry point for the sale of the pound to fall to 1.3495 and 1.3455, where I recommend fixing the profits. If the pair grows during the US session after the Bank of England's decision to raise interest rates, as well as weak sellers' activity at 1.3582, it is best to postpone sales until the next major resistance at 1.3622. I also advise you to open short positions there only in case of a false breakdown. It is possible to sell GBP/USD immediately for a rebound from 1.3656, or even higher - from the maximum in the area of 1.3697, counting on the pair's rebound down by 20-25 points within a day.

The COT reports (Commitment of Traders) for January 25 recorded an increase in short positions and a sharp reduction in long ones. All this has led to a return of the market to the sellers' side, but this week the situation may change dramatically. No matter how the bears tried to continue the downward trend, it turned out pretty bad. The sellers were not helped by the statements of the Federal Reserve System after the monetary policy meeting that the regulator would start raising interest rates in the United States in March. The demand for the pound will gradually recover, as a meeting of the Bank of England committee will be held this Thursday, at which it will be decided to raise interest rates. However, the pressure on the pound will remain due to the observed fundamental picture, which creates several more serious moments limiting the upward potential. However, if you look at the overall picture, the prospects for the British pound look pretty good, and the observed downward correction makes it attractive. In any case, the Bank of England's decision to raise interest rates further this year will push the pound to new highs. The COT report for January 25 indicated that long non-commercial positions decreased from the level of 39,760 to the level of 36,666, while short non-commercial positions increased from the level of 40,007 to the level of 44,429. This led to a fall in the negative non-commercial net position from -247 to -7,763. The weekly closing price dropped from the level of 1.3647 to the level of 1.3488.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the continued growth of the pound.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower limit of the indicator around 1.3544 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română