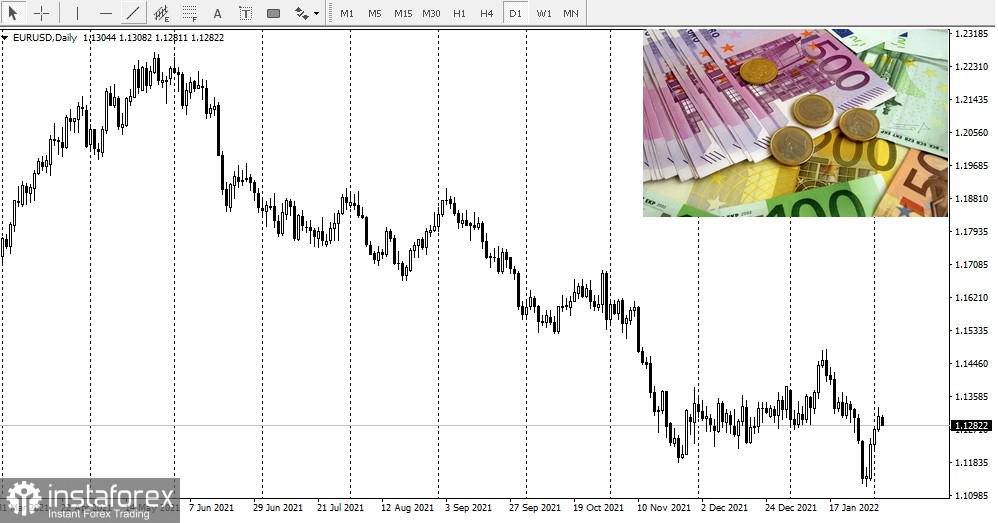

Today, The European Central Bank will announce its decision on the measures to tackle inflation. The data released on Wednesday, as the two-day meeting of the Governing Council began, showed that consumer prices rose by 5.1% unexpectedly in January. This is more than double the 2% inflation target, which exceeded analysts' expectations in the past two decades.

The central bank is unlikely to react to this news with immediate actions, but many experts are wondering whether ECB President Christine Lagarde will follow suit of Federal Reserve Chairman Jerome Powell.

So far, Christine Lagarde has insisted that the regulator was not planning to raise the rate this year. At the same time, the Fed is preparing for several rate hikes, while the Bank of England is set to increase the rate for the second time in three months.

The ECB was expected to raise the rate by 10 basis points by September but this date was moved to July. By the end of the year, the regulator may raise the rate by a total of 25 basis points.

Today, investors' attention will be focused on Lagarde's speech. The press conference will take place 45 minutes after the decision of the ECB.

So far, the ECB is the only regulator that keeps rates at a minimum level despite a record-breaking inflation rate. The Federal Reserve and the Bank of England have chosen a different path.

Officials will also discuss the broader economic outlook. Attention will be given to supply disruptions which kept economic growth in the eurozone at just 0.3% in the last quarter of 2021.

As announced at the last meeting, the ECB's €1.85 trillion ($2.1 trillion) emergency bond purchases will end in March as scheduled, while regular purchases will be extended by six months to smooth out the transition.

Further rate hikes would shift this schedule in line with current guidance.

According to Commerzbank economist Christoph Weil, Lagarde may not repeat her line that a rate hike is unlikely in 2022.

Despite monetary tightening in other Western economies that has left the ECB something of an exception, The ECB President says Europe is in a different position than the US where inflation and recovery are moving faster.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română