A good option is to await the outcome of the situation

Hello, dear traders!

Today, the GBP/USD pair has the first of the two most important trading days of the week. Notably, today the British Central Bank will announce its decision on the key interest rate, will publish the minutes of its meeting, as well as will determine the size of its asset purchase program. Most experts predict that the Bank of England will continue to tighten its monetary policy and might increase the main interest rate from 0.25% to 0.50%, i.e. by 25 basis points. Therefore, the forecast of the second increase of the interest rate is very ambitious. However, will the Bank of England meet the market expectations? Moreover, the volatile and speculative British pound will have more options for changes. In case the interest rate is increased, the pound is likely to skyrocket. If the British Central Bank does not raise the key interest rate today, the pound could plummet. Therefore, today the Bank of England will likely exert pressure on the British pound. Besides, the decision of the British regulator will affect the pound's price dynamics. However, the technical factors are relevant. So, let's observe the charts of the GBP/USD pair.

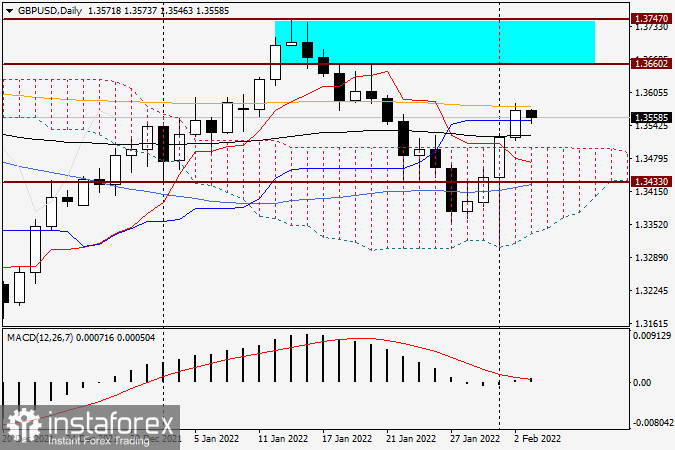

Daily

Yesterday, the pair showed growth, which continued for the fourth day in a row. Consequently, the blue Kijun line of the Ichimoku indicator was broken. However, bulls failed to overcome the orange 200 exponential moving average. The 200 EMA stopped yesterday's rise of the GBP/USD pair. Besides, Wednesday's trading closed at 1.3571. If after today's meeting the Bank of England decides to increase the basic interest rate by 25 basis points, the pair will continue its upward dynamic, and the nearest growth target will be the range of 1.3660-1.3747. Otherwise, in the best case scenario the GBP/USD pair may fall to the area of 1.3500-1.3460. In case of a more dramatic decline, the support level of 1.3433 with the low values of trading on February 1 will be broken.

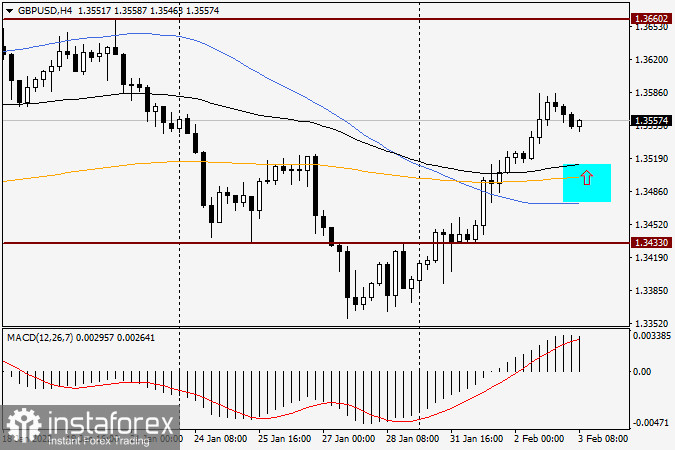

H4

On the 4-hour chart, it is shown that the pair has overcome all the three moving averages, and now it is about to pull back to them. It is common that the upward broken moving averages provide strong support to the price after the pullback. Moreover, after the pullback to the marked area of 1.3515-1.3475 it is possible to consider buying the pound. However, the Bank of England's rate decision is ahead, which will determine the movement of the British currency today. Besides, tomorrow's nonfarm payrolls should be taken into account as they may also have a significant impact on the price dynamics of all major currency pairs and the GBP/USD pair in particular. Today, the Bank of England's interest rate decision will definitely affect the GBP/USD pair. Therefore, this pair will be extremely volatile after this key event. Thus, I advise new traders to await the outcome of the situation, that is, stay out of the market.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română