The employment data from ADP released yesterday was extremely disappointing, but it failed to have a significant negative impact on the US stock market, although it somewhat halted the upward pullback that began last Friday after the January correction.

According to the presented data, the US economy not only did not gain new jobs in January but also lost another 301,000. This picture was last observed at the beginning of 2020 during the start of the COVID-19 pandemic.

So why didn't the market react to this generally extremely bad news?

There are possible two reasons for this. One lies in the fact that investors already understand that the situation in the American economy is terrible amid high inflation, which is why the Fed actually made it clear that it would already start raising interest rates at the March meeting. This topic is already taken into account in market prices. Another likely reason is that the market has decided to focus on the official figures on the number of new jobs, which will be announced this Friday. Some kind of logical reaction can already be expected from here.

The result of the meetings of the ECB and the Bank of England on monetary policy is the most important event for today. It is expected that the European regulator will keep all monetary policy parameters unchanged, including the zero level for the main interest rate. Meanwhile, the BoE is expected to raise the cost of borrowing by 0.25% to 0.50%, but at the same time unchanged measures to support the economy at around 875 billion pounds.

What should be expected after the results of the meetings of these two largest world Central Banks?

We believe that the ECB's keeping the monetary policy unchanged will not surprise anyone. Investors will expect future plans from the regulator. They will expect the reaction of the ECB President, C. Lagarde, to the publication of inflation data in the region, which surged from 5.0% to 5.1% despite the consensus forecast of its deceleration to 4.4%. If she mentions the topic of the timing of interest rate hike at the press conference, this will provide significant support for the euro in the currency market. On the other hand, it may negatively affect the stock market, causing its possible correction. But if this topic is not discussed, the euro will clearly be under pressure primarily against the US dollar, and the European stock market will calmly receive support.

But again, it is worth noting that the likelihood of raising the topic of changing the monetary rate from soft to tighter is more relevant, so the probability of the continuation of the euro's growth and a weakening of demand for European shares may take place.

With regard to the reaction of the market to the Bank of England's rate hike, we note that this decision is expected and may already be taken into account in the pound's rate. What can be surprising is either an increase in the rate immediately by 0.50% or the decision not to do so will lead to a noticeable movement in the British currency. However, such a development of the situation is unlikely. Most likely, noticeable movements will be observed in the currency market, stock markets, and commodity markets tomorrow after the results of the publication of US employment data.

Forecast of the day:

The EUR/USD pair is trading above the level of 1.1280. Any signals about the probability of an earlier rate hike will support the pair. On this wave, it can further rise to the level of 1.1370.

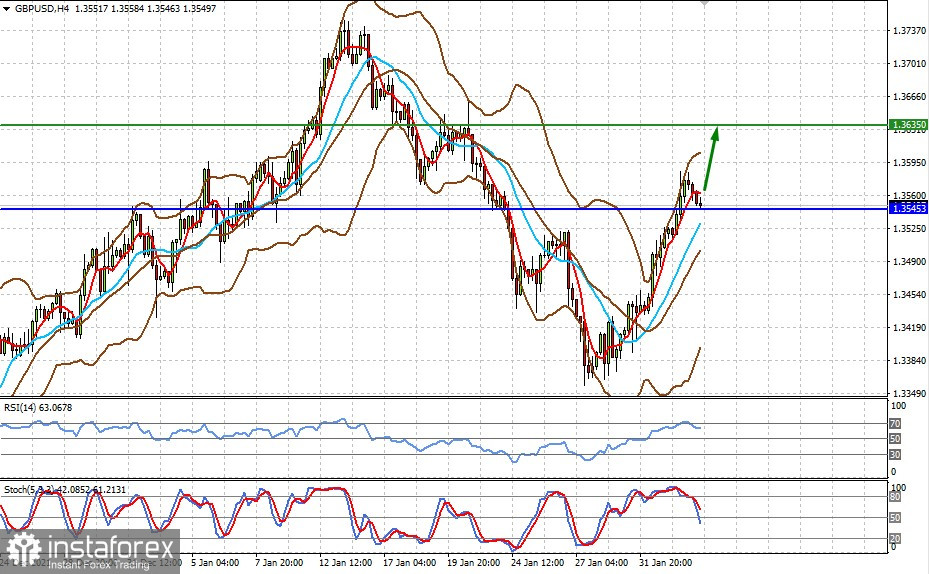

The GBP/USD pair is trading above the level of 1.3545. A rate hike by the Bank of England can only provide local support for the pair and contribute to its growth to 1.3635.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română