To open long positions on EURUSD, you need:

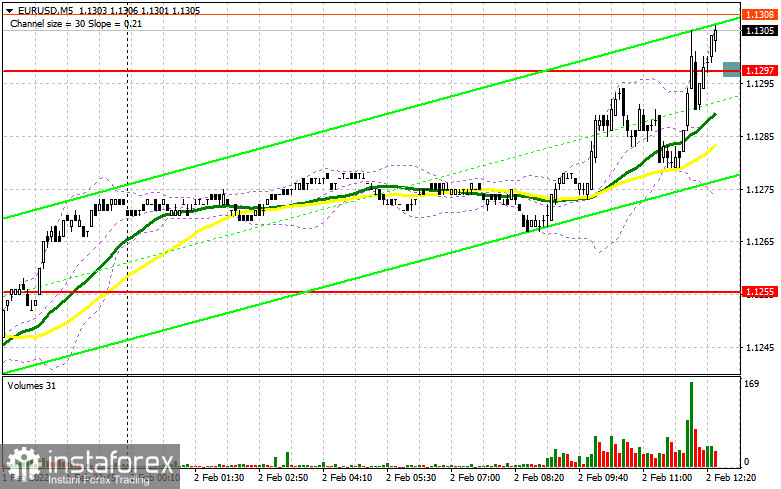

In my morning forecast, I drew attention to the importance of eurozone inflation and the 1.1297 level, and also recommended that it make decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The sharp inflationary jump in the eurozone in January this year to 5.1% per annum surprised many economists who expected it to decrease to 4.4%. Against this background, the bulls achieved a breakthrough of resistance, but it never reached the reverse test of this level from top to bottom. As a result, there were no signals to enter the market in the first half of the day. And what were the entry points for the pound this morning?

During the US session, we are waiting for data on the US labor market, which may put even more pressure on the US dollar, as a sharp slowdown in the growth of new jobs in the private sector is expected in January this year compared to December last year.

The main task of buyers is to protect 1.1294, which was formed following the results of the first half of the day. Given that a meeting of the European Central Bank will be held tomorrow, demand for the euro may only increase, especially after today's inflation data. The formation of a false breakout at 1.1294 will give a good entry point into long positions in the continuation of the bull market in the afternoon. An equally important task will be to return the resistance of 1.1328 under control. A breakdown and a reverse test from the top-down of this range, together with weak data on the number of employed from ADP, will lead to an additional buy signal and open the possibility of recovery to the area: 1.1358. The level of 1.1390 will be a more distant target, but it is possible to count on updating this range only tomorrow, after the decisions of the European regulator.

If the pair declines during the American session and there is no bull activity at 1.1294, most likely the pressure on the euro will return, as traders will take profits. In this case, it is best to postpone purchases to the next minimum of 1.1258, where the moving averages are playing on the buyers' side. However, I advise you to open long positions there when forming a false breakdown. You can buy the euro immediately for a rebound from the 1.1223 level with the aim of an upward correction of 20-25 points within the day.

To open short positions on EURUSD, you need:

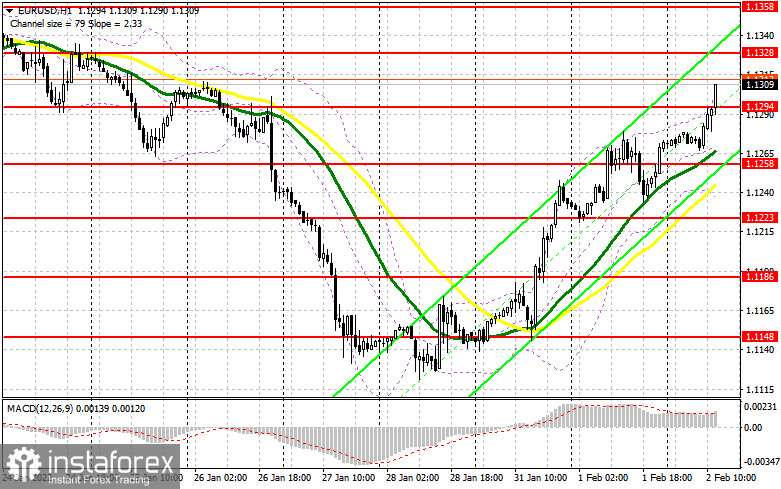

Sellers continue to wait for something and are not particularly active, especially after the sharp inflationary pressure, which no one expected at the beginning of this year in the eurozone. Now many traders are counting on a more aggressive policy of the European Central Bank, which is confirmed by the growth of EUR/USD observed in the first half of the day.

Sellers need to try very hard not to miss the initiative in the afternoon. An important task is to protect the resistance of 1.1328, which buyers are now targeting. In the case of strong data on the US labor market, it will be difficult for bulls to offer anything above this range. Therefore, the formation of a false breakout at 1.1328 will return pressure on the pair and form the first entry point into short positions to reduce EUR/USD to the area of 1.1294.

A breakdown and a test from the bottom up of this range will give an additional signal to open short positions already with the prospect of falling to a large minimum of 1.1258, where the moving averages are playing on the side of the bulls. The 1.1223 area will be a more distant target, but it will be available only in the case of very strong data on the American economy. I recommend fixing profits there.

In the case of the growth of the euro and the absence of bears at 1.1328, it is best not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1358. You can sell EUR/USD immediately on a rebound from 1.1390, or even higher - around 1.1419 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for January 25 recorded an increase in long positions and a reduction in short ones, which led to a further increase in the positive delta. The demand for risky assets will continue to persist, because even after the results of the Federal Reserve meeting, where there were clear hints of an increase in interest rates in March 2022, the market did not react with a serious drop in risky assets, and the changing balance of power speaks for itself. This week, everyone is waiting for the results of the meeting of the European Central Bank, at which a decision on monetary policy will be made. Some traders expect that the central bank may resort to more aggressive statements aimed at policy changes in the near future and abandon measures to support the economy due to the threat of high inflation. However, most analysts do not expect changes from the European regulator. A lot will depend on whether the ECB agrees to fully complete its emergency bond purchase program as early as March this year, or not. If so, the demand for the euro will only increase, since such actions will sooner or later lead to an increase in interest rates in the eurozone. The COT report indicates that long non-profit positions have increased from the level of 211,901 to the level of 213,408, while short non-profit positions have fallen from the level of 187,317 to the level of 181,848. This suggests that traders continue to build up long positions in the euro with the expectation of building an upward trend. At the end of the week, the total non-commercial net position remained positive and amounted to 31,569 against 24,584. But the weekly closing price decreased and amounted to 1.1323 against 1.1410 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates an attempt by buyers to continue the growth of the euro in the short term.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the average border of the indicator around 1.1270 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română