Hi, dear traders!

Hi, dear traders!

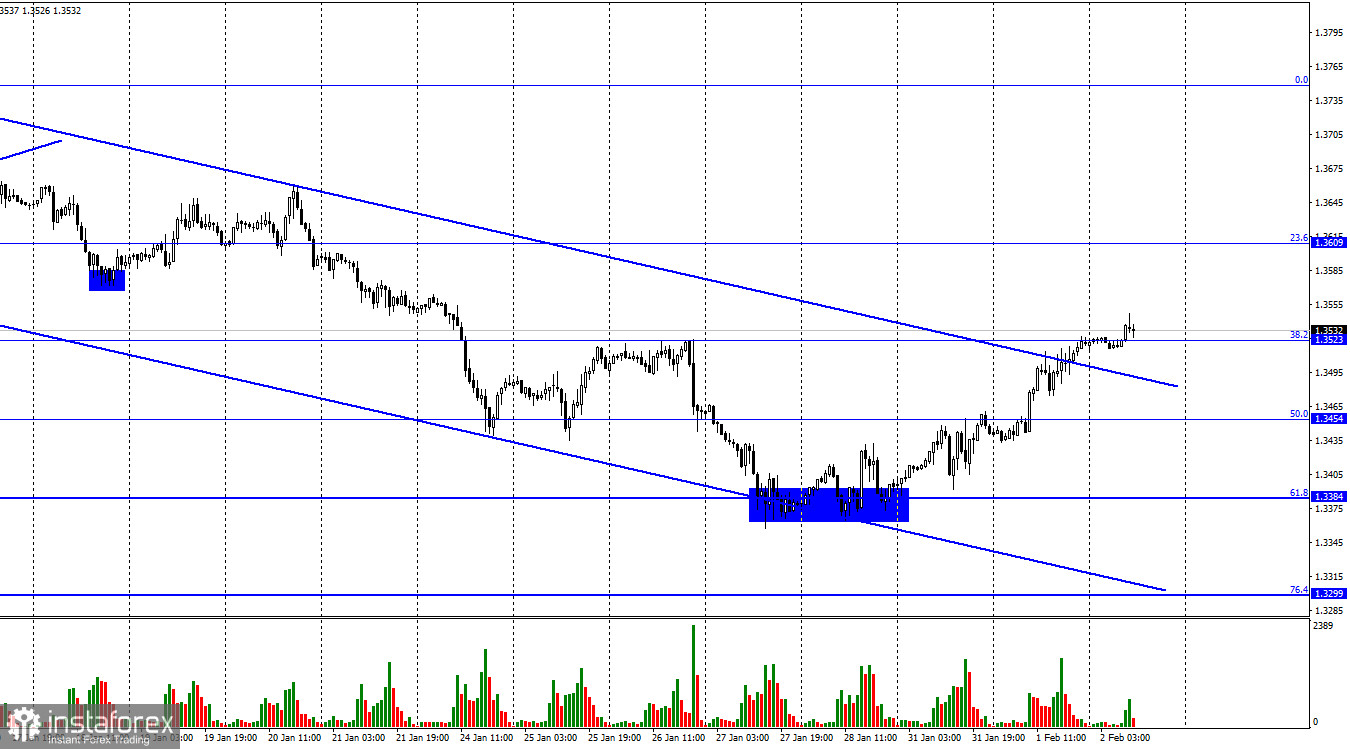

According to the H1 chart, GBP/USD closed above the descending trend channel on Tuesday and settled above the retracement level of 38.2% (1.3523) on Wednesday. The trader sentiment is now bullish, and the pair could continue to rise towards the next Fibonacci level of 23.6% (1.3609). If GBP/USD closes below the retracement level of 38.2%, it could decline slightly. This week's most important economic events are on Thursday and Friday. There are no significant data releases in the UK today comparable to EU CPI data. Similar to the euro, the pound sterling is on the increase in the run-up to the regulator's meeting. However, the Bank of England and the ECB are expected to make different policy decisions.

The ECB is likely not to tighten its monetary policy or even make any hawkish statements. The Bank of England, on the other hand, is expected to raise the interest rate again, this time by 0.25%. This would put the UK's interest rate above the rate in the US, which is quite rare, and could push GBP up. The pound sterling's upward movement could also be brief - GBP has been on the rise for the past 3 days. However, the price dynamics of EUR and GBP are very similar right now. This suggests that market players do not see any particular difference between expected results of both regulator meetings. Alternatively, traders could be focused on trading USD at the moment. Both GBP and USD could move in any direction tomorrow.

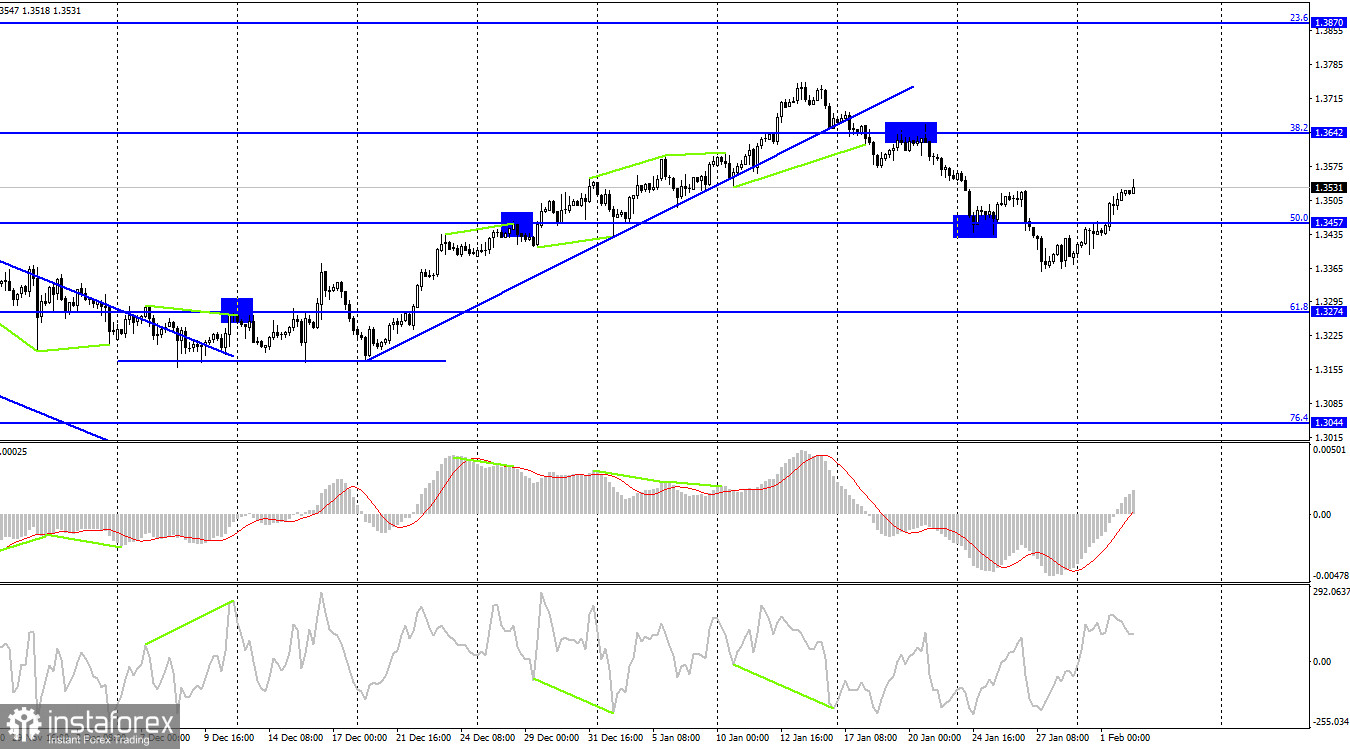

According to the H4 chart, the pair closed above the retracement level of 50.0% (1.3457). From there, GBP/USD could climb towards the next Fibonacci level of 38.2% (1.3642). If the quote closes below the retracement level of 50.0%, it could resume its fall towards the Fibonacci level of 61.8% (1.3274).

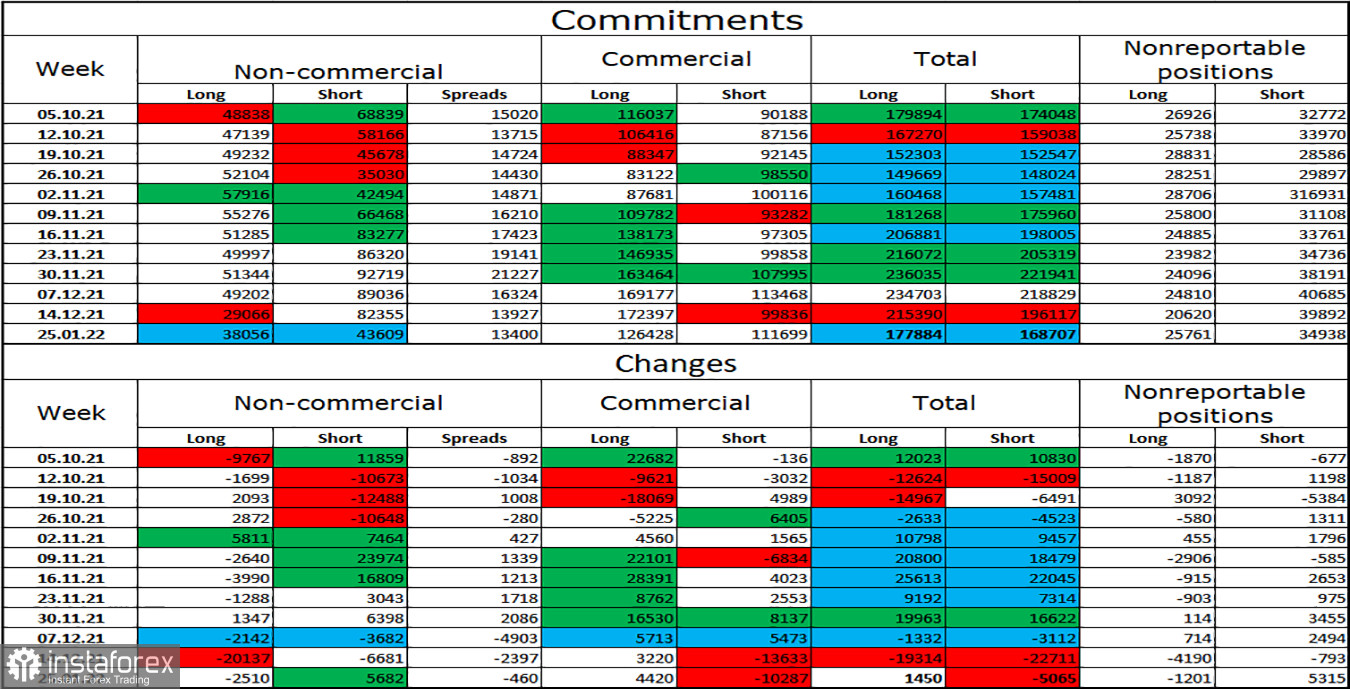

Commitments of Traders (COT) report:

The sentiment of Non-commercial traders is largely neutral at the moment. The number of opened Short positions slightly exceeds the number of Long positions, suggesting the pound sterling could go down. However, the COT report does not include trades made after the meeting of the Federal Reserve. The Bank of England's meeting this week could also strongly affect traders.

US and UK economic calendar

US - ADP employment change report (13-15 UTC)

There are no events in the UK, and the ADP payrolls data are unlikely to influence traders significantly.

Outlook for GBP/USD:

Short positions could be opened if the pair closes below 1.3523 on the H1 chart, with 1.3454 and 1.3384 being the targets. Previously, traders were recommended to open long positions if the pair closes above the descending channel on the H1 chart targeting 1.3609 - these positions can be kept open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română