US stocks posted their largest three-day gain since 2020 as investors flocked on companies that benefit from a strong economy. Many speculate that the Fed will try its best not to shake economic growth even while fighting inflation.

The S&P 500 closed higher on Wednesday, thanks to increases in energy producers and banks. The tech-heavy Nasdaq 100 rose as well amid strong gains from Alphabet and Advanced Micro Devices. Starbucks and PayPal, on the other hand, showed declines after their earnings fell short of estimates.

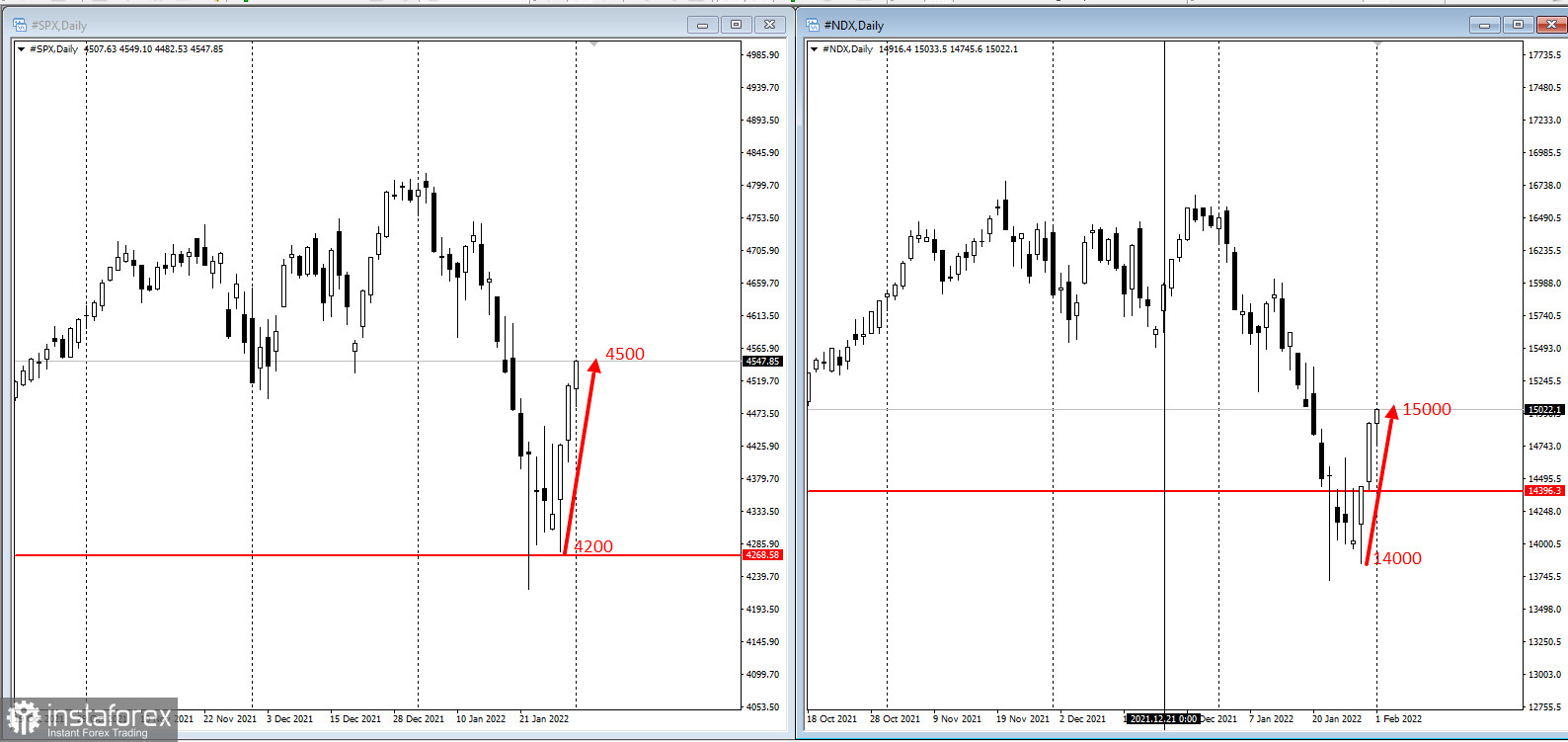

It appears that the S&P 500 is now in the middle of last month's peak-to-trough drop, which some analysts say indicates a potential full recovery. Treasury yields are also up, while dollar is weaker.

Stocks were struggling earlier because robust economic data brought back worries over the Fed's monetary policy. The recent employment and manufacturing reports showed a resilient economy, which the Fed is trying to cool down after inflation hit its highest level in four decades. However, officials have indicated they are aware of the threat to stifling growth.

"It feels like we are starting February with an uneasy truce between buyers and sellers, following the brutal correction we had last month," said Mike Bailey, director of research at FBB Capital Partners. "Looking ahead, my sense is investors see Jay Powell as having his foot a few inches away from the brakes. Will the market get a gentle tap? Or will the Fed slam on the brakes?," he added.

Volatility swept through the markets after Fed Chairman Jerome Powell signaled a faster monetary policy tightening. But regional Fed presidents Mary Daly and Esther George expressed caution about tightening it more quickly than necessary.

"Tightening needs to be done, but there was a suggestion that it would be better to run down the balance sheet more quickly rather than hiking rates rapidly," noted Fiona Cincotta, senior financial markets analyst at City Index. "That's pushing back on this idea of rapid increases in interest rates," she added.

Corporate earnings are also providing equities some support. For example, Exxon Mobil posted its highest earnings in eight years amid aggressive spending cuts. United Parcel Service also saw sales above expectations, while UBS stepped up its buyback program after a sharp drop in earnings.

"I don't think it's a coincidence that the market has started to stabilize as we start to get into earnings season," said Giorgio Caputo, senior fund manager of the JOHCM Global Income Builder fund. "You've had strong reports from companies like Microsoft and Apple, which are in many ways, bellwethers for the economy of the moment and the parts of the economy that are growing," he added.

22V Research founder Dennis DeBusschere also said that the "Fed tightening is still the path forward. But a short term rebound in equities will continue -- led by growth and cyclicals -- as investors focus on a narrative of 'peak tightening' ahead of what is likely to be a weak payroll report."

Other key events for this week are:

- earnings reports from Amazon, Ford Motor, Meta Platforms, Qualcomm, Sony and Spotify;

- OPEC meeting (Wednesday);

- Eurozone CPI (Wednesday);

- policy decision of the Bank of England and the European Central Bank (Thursday);

- Fed Board of Governors confirmation hearing (Thursday);

- US factory orders, initial jobless claims and orders for durable goods (Thursday);

- US payrolls report for January (Friday);

- start of Winter Olympic Games in China (Friday);

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română