Analysis of yesterday trades and tips on trading the pound sterling

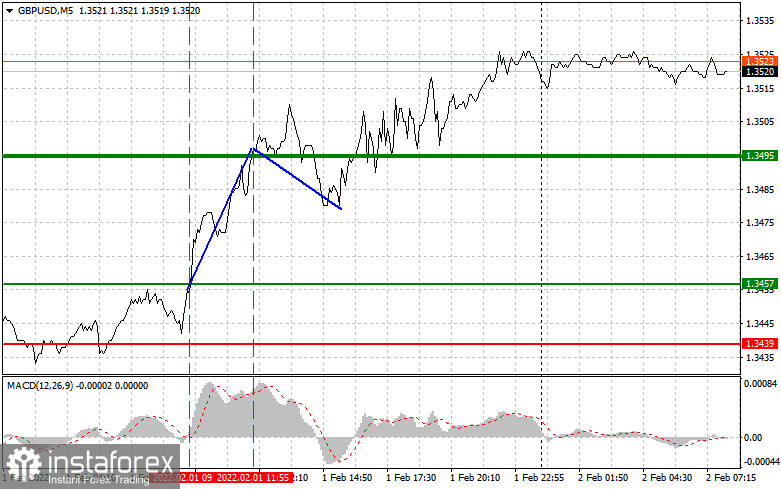

The pound/dollar pair tested the 1.3457 level in the first half of the day. At that time, the MACD indicator had just started to move up from the zero level, which was a confirmation of the correct entry point in long positions for the pound sterling. As a result, bulls pushed the pair to the target level of 1.3495. It gained about 40 pips. Short positions at the level of 1.3495 led to the correction of the pair by 15 pips. After that, demand for the pound sterling returned and the pair kept growing.

The UK PMI Manufacturing Index turned out to be better than economists' forecasts. It enabled bulls to send the pair above the large level of 1.1250. It triggered the formation of a powerful upward correction. The price approached new highs. The US ISM Manufacturing Index did not facilitate a rise of the US dollar against the pound sterling in the afternoon.

Today, the economic calendar for the UK is almost empty. The British Retail Consortium (BRC) Shop Price Index is on tap today. However, this data is unlikely to somehow influence the trajectory of the British currency. Tomorrow, the Bank of England will hold a meeting. Naturally, market participants will focus their attention on this event. The regulator is expected to announce its decision on monetary policy. I believe that there could be a drop in demand for the pound sterling until tomorrow. The pair may also move slightly down. In the afternoon, the US will unveil the ADP report for January of this year. The reading is expected to be modest in comparison with the December figure. It may undermine demand for the US dollar during the New Your session. However, as noted above, investors are now more focused on the Bank of England's meeting.

Entry points to open long positions

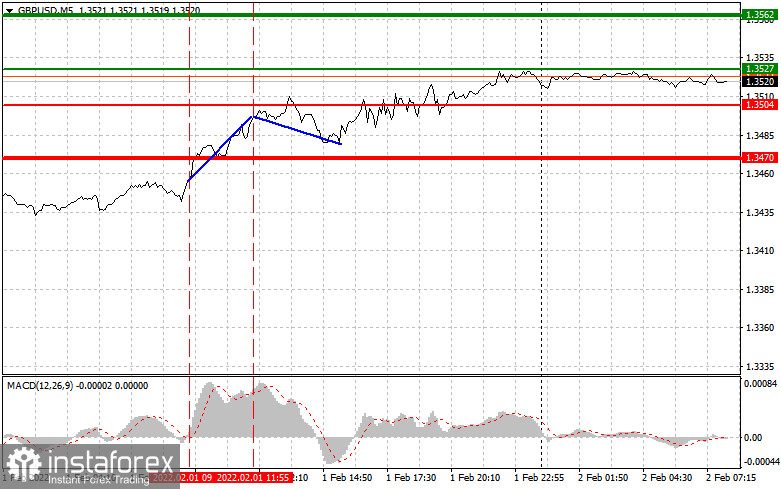

Scenario No.1: it is recommended to open long positions on the pound sterling today the price reaches the entry point of 1.3527 (green line on the chart). The target level will be 1.3562 (thicker green line on the chart). When the price hits 1.3562, it would be wise to close long positions and open short ones in the opposite direction. Bear in mind a 15-20 pips correction from the level. Today, the British currency will hardly add decent gains. Nevertheless, bulls may try to push the price to new highs. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to grow from it.

Scenario No.2: it is also possible to buy the pound sterling today if the price reaches 1.3504. At this moment, the MACD indicator should be in the oversold area, which will limit the pair's downward movement and lead to an upward reversal. It is expected to move to the opposite levels of 1.3527 and 1.3562.

Entry points to open short positions

Scenario No.1: it is recommended to open short positions on the pound sterling today only after the price hits the level of 1.3504 (the red line on the chart). It is likely to trigger a rapid decline of the pair. The target level will be 1.3470. I advise closing short positions near this level as well as immediately opening long ones in the opposite direction. Please, do not forget about a 15-20 pips correction from the level.

The pressure on the pound will increase as traders may lock in profits before tomorrow's meeting of the Bank of England. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price reaches 1.3527. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair and lead to a downward reversal. The price is likely to drop to the opposite levels of 1.3504 and 1.3470.

Description of the chart:

The thin green line is the entry point to open long positions.

The thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself as the pair is unlikely to rise above this level.

The thin red line is the entry point to open short positions.

The thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to the overbought and oversold zones.

Important. Novice traders need to make very careful decisions on entering the market. Before the release of important economic reports, it is best to stay out of the market to avoid losses due to sharp fluctuations. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous decision-making based on the current market situation is initially a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română